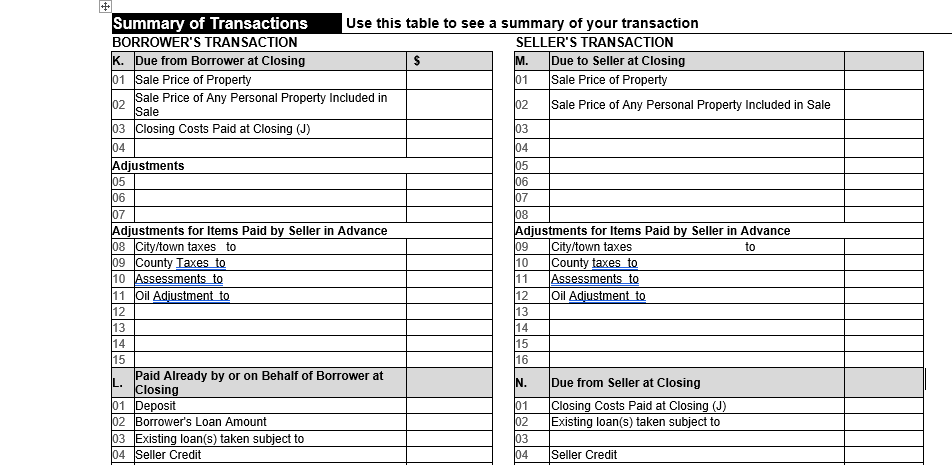

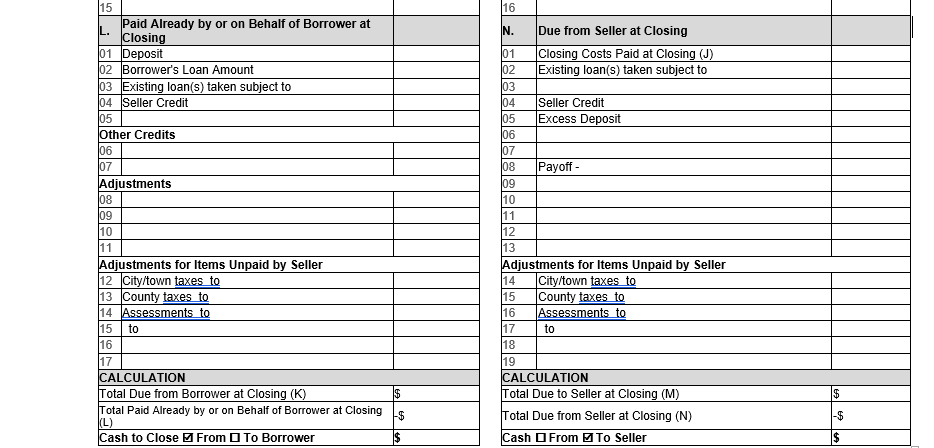

Question

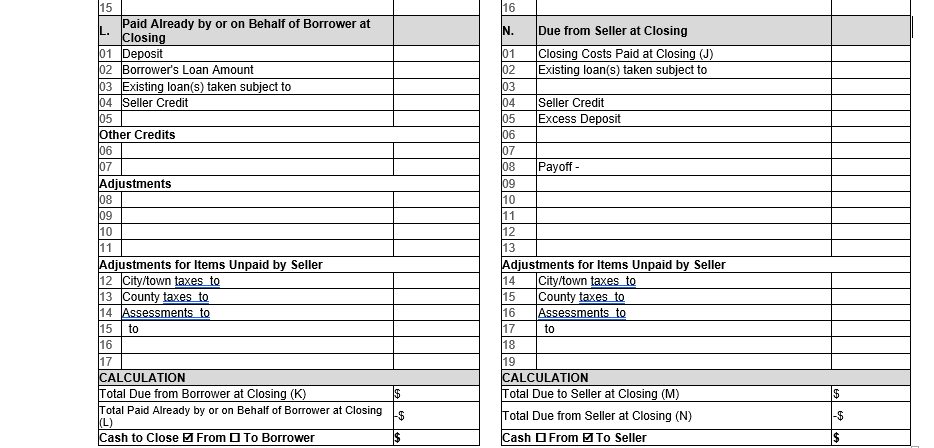

You are requested to study the case below and complete the Summary of Transaction of the Closing Disclosure form. The form is attached below as

You are requested to study the case below and complete the Summary of Transaction of the Closing Disclosure form. The form is attached below as well.

You are a paralegal coordinating the closing of Massachusetts property being sold by Evelyn and Frank (Sellers) to Grace and Hope (Buyers). Your firm represents the buyers and lender and will be acting as Settlement Agent. Details of the transaction are as follows:

- The property address is 200 Liberty Street, Soldasis, Massachusetts in Middlesex County.

- The purchase price is $500,000.00 and Buyers have already submitted a deposit of $25,000.00 being held by the listing agent in escrow.

- Buyers will be financing the purchase with a mortgage loan from Generic Mortgage in the amount of $450,000.00.

- The closing date will be September 1, 2021.

- Evelyn and Frank are married and hold title as tenants by the entirety. The presently occupy the property as their primary residence.

- Property taxes are $3650.00 for the year and have been paid in full through the first quarter of Fiscal Year 2021 by Sellers. Like most Massachusetts towns, the Soldasis bills taxes quarterly and the fiscal year starts on July 1. The quarterly bills are due in August, November, February and May.

- You have already calculated Sellers' total closing costs to be $27,999.00.

- You have already calculated Buyers' total closing costs to be $7,212.05.

- You have received a final water and sewer reading from the Town of Soldasis Water Department that shows $140.15 is due.

- The Purchase & Sale Agreement recites that the Sellers have agreed to credit the Buyers $1,500.00 toward repairs.

With the facts you have been given, please download and complete thesummary of Transactionsection of the CD as you are able: - below is the form

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started