Question

You are required to analyze the latest available financial statements of the company of your choice (2019/2020 whichever is available). Company Name: Jaguar mining. To

You are required to analyze the latest available financial statements of the company of your choice (2019/2020 whichever is available).

Company Name: Jaguar mining.

To be specific, you are advised to analyze (compute and interpret) the following ratios and techniques:

1. Liquidity Ratios

2. Solvency Ratios

3. Profitability Ratios

4. Efficiency Ratios

5. Coverage Ratios

6. Market Perspect Ratios

7. Trend Analysis

8. Common Size Analysis

9. Du-Pont Analysis

10. Overall analysis of the company based on different ratios and techniques.

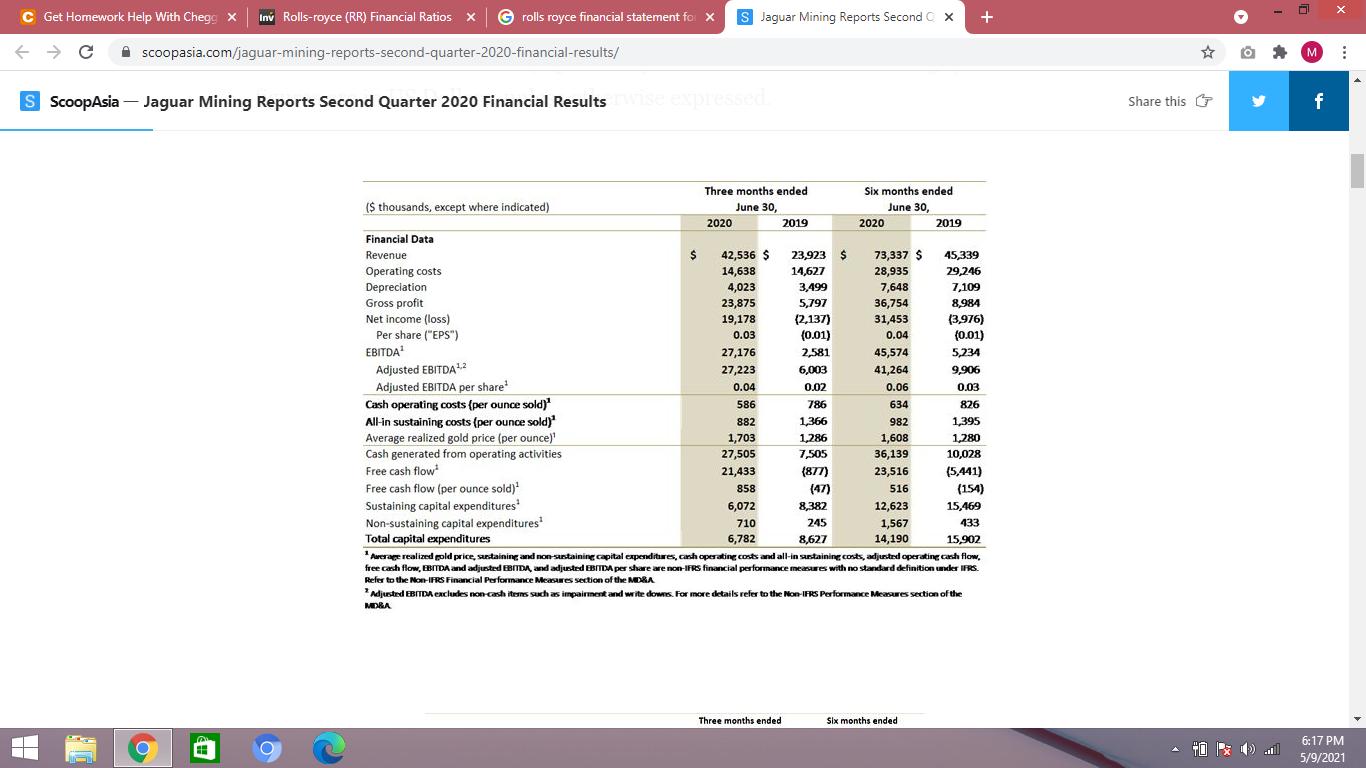

C Get Homework Help With Chegg x Inv Rolls-royce (RR) Financial Ratios x G rolls royce financial statement fo X S Jaguar Mining Reports Second C x A scoopasia.com/jaguar-mining-reports-second-quarter-2020-financial-results/ M S ScoopAsia Jaguar Mining Reports Second Quarter 2020 Financial Results e epressed Share this C f Six months ended June 30, Three months ended ($ thousands, except where indicated) June 30, 2020 2019 2020 2019 Financial Data 73,337 $ 28,935 45,339 29,246 7,109 8,984 Revenue 2$ 42,536 $ 23,923 $ Operating costs Depreciation Gross profit 14,638 14,627 4,023 23,875 19,178 3,499 5,797 (2,137) (0.01) 7,648 36,754 31,453 Net income (loss) Per share ("EPS") (3,976) (0.01) 0.03 0.04 EBITDA 27,176 2,581 45,574 5,234 Adjusted EBITDA12 Adjusted EBITDA per share Cash operating costs (per ounce sold) All-in sustaining costs (per ounce sold) Average realized gold price (per ounce) Cash generated from operating activities Free cash flow Free cash flow (per ounce sold) Sustaining capital expenditures Non-sustaining capital expenditures Total capital expenditures 27,223 6,003 41,264 9,906 0.04 0.02 0.06 0.03 586 786 634 826 882 1,366 982 1,395 1,703 27,505 1,286 1,608 1,280 7,505 36,139 10,028 21,433 (877) 23,516 (5,441) 858 (47) 516 (154) 6,072 8,382 12,623 15,469 710 245 1,567 14,190 433 6,782 8,627 15,902 *Aurerage realized gold price, sustaining and non-sustaining capital cxpenditures, cash operating costs and all-in sarstaining costs, adjusted operating cash flow, free cash flow, EBITDA and adjusted BEBITDA, and adjusted EBITDA per share are non-IFRS financial performance measures with no standard definition under IFRS Refer to the Non-IFRS Financial Performance Measures section of the MDRA *Adjusted EBITDA excludes non cash itesns such as impairment and write downs. For more details refer to the Non-IFRS Performance Measures section of the MDRA Three months ended Six months ended 6:17 PM 5/9/2021

Step by Step Solution

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

I have attached the answers for your questions Summary of the same is below for your quick reference ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started