Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are required to answer a number of questions about Credit Ratings and Credit Spreads and the factors that influence them and how they

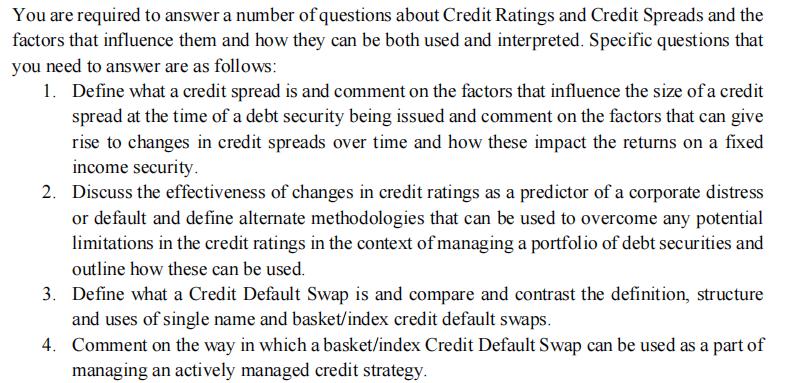

You are required to answer a number of questions about Credit Ratings and Credit Spreads and the factors that influence them and how they can be both used and interpreted. Specific questions that you need to answer are as follows: 1. Define what a credit spread is and comment on the factors that influence the size of a credit spread at the time of a debt security being issued and comment on the factors that can give rise to changes in credit spreads over time and how these impact the returns on a fixed income security. 2. Discuss the effectiveness of changes in credit ratings as a predictor of a corporate distress or default and define alternate methodologies that can be used to overcome any potential limitations in the credit ratings in the context of managing a portfolio of debt securities and outline how these can be used. 3. Define what a Credit Default Swap is and compare and contrast the definition, structure and uses of single name and basket/index credit default swaps. 4. Comment on the way in which a basket/index Credit Default Swap can be used as a part of managing an actively managed credit strategy.

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1A credit spread refers to the difference in yields between a fixed income security and a benchmark rate such as a Treasury bond with the same maturity It is the compensation that investors demand for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started