Question

You are required to create transactions for a sole trader for the month of April 2022. You must have the following dated transactions: Please note

You are required to create transactions for a sole trader for the month of April 2022.

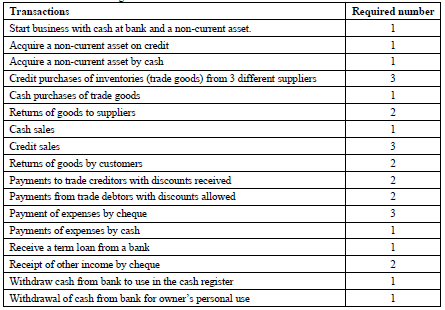

You must have the following dated transactions:

Please note that there should not be any beginning inventory since it is a new business. You will need to assume a suitable closing inventory in order to prepare your financial statements.

After creating the above transactions, you are to record them as follows: (a) Record the transactions into the relevant books of prime entry. Label clearly each book of prime entry and draw them in the proper format. (30 marks) (b) Post the entries in the books of prime entry to the T-accounts in the ledgers and balance off the accounts on 30 April 2022. (Clearly show which accounts are in the Purchases Ledger, the Sales Ledger or the General Ledger.) (20 marks) (c) Prepare the Unadjusted Trial Balance as at 30 April 2022. (10 marks) (d) Prepare the Statement of Profit or Loss for the month ended 30 April 2022. (10 marks) (e) Prepare the Statement of Financial Position as at 30 April 2022. (10 marks)

Required nunber 1 1 1 3 1 2 1 3 Transactions Start business with cash at bank and a non-curent asset. Acquire a non-curent asset on credit Acquire a non-curent asset by cash Credit purchases of inventories (trade goods) from 3 different suppliers Cash purchases of trade goods Returns of goods to suppliers Cash sales Credit sales Retuns of goods by customers Payments to trade creditors with discounts received Payments from trade debtors with discounts allowed Payment of expenses by cheque Payments of expenses by cash Receive a term loan from a bank Receipt of other income by cheque Withdraw cash from bank to use in the cash register Withdrawal of cash from bank for owner's personal use cicilan 2 2 2 2 3 1 1 2 1 1 Required nunber 1 1 1 3 1 2 1 3 Transactions Start business with cash at bank and a non-curent asset. Acquire a non-curent asset on credit Acquire a non-curent asset by cash Credit purchases of inventories (trade goods) from 3 different suppliers Cash purchases of trade goods Returns of goods to suppliers Cash sales Credit sales Retuns of goods by customers Payments to trade creditors with discounts received Payments from trade debtors with discounts allowed Payment of expenses by cheque Payments of expenses by cash Receive a term loan from a bank Receipt of other income by cheque Withdraw cash from bank to use in the cash register Withdrawal of cash from bank for owner's personal use cicilan 2 2 2 2 3 1 1 2 1 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started