Answered step by step

Verified Expert Solution

Question

1 Approved Answer

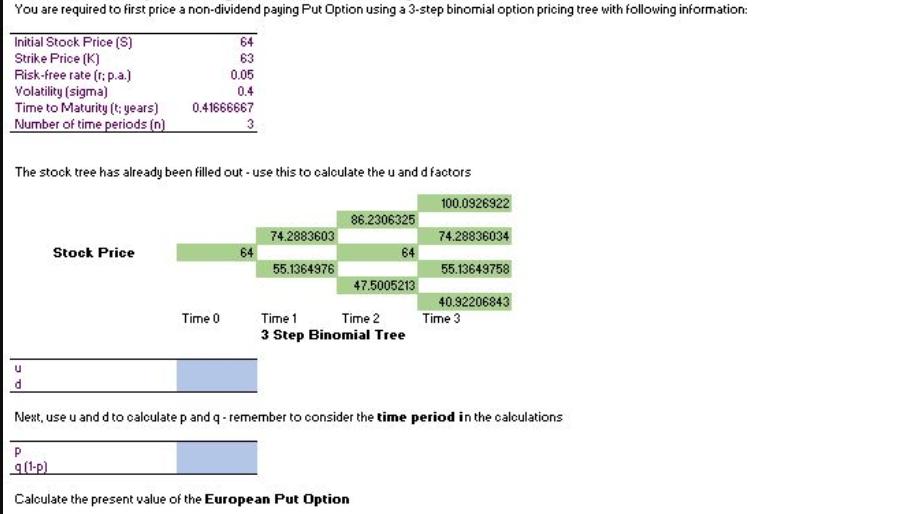

You are required to first price a non-dividend paying Put Option using a 3-step binomial option pricing tree with following information: Initial Stock Price

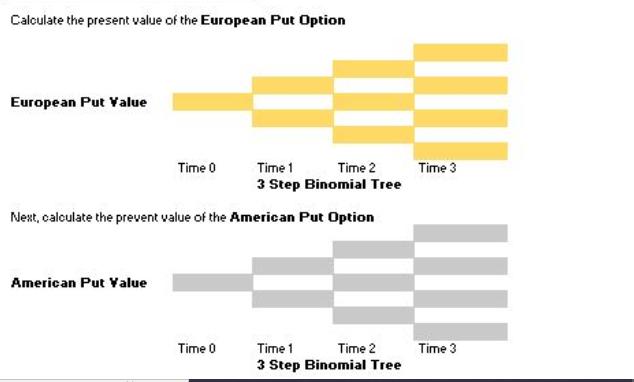

You are required to first price a non-dividend paying Put Option using a 3-step binomial option pricing tree with following information: Initial Stock Price (S) Strike Price (K) Risk-free rate (r: p.a.) Volatility (sigma) Time to Maturity (t: years) 64 63 0.05 0.4 0.41666667 3 Number of time periods (n) The stock tree has already been filled out - use this to calculate the u and d factors U d 100.0926922 86.2306325 74.2883603 74.28836034 Stock Price 64 64 55.1364976 55.13649758 47.5005213 40.92206843 Time 0 Time 1 Time 2 3 Step Binomial Tree Time 3 Next, use u and d to calculate p and q - remember to consider the time period in the calculations (1-p) Calculate the present value of the European Put Option Calculate the present value of the European Put Option European Put Value Time 0 Time 1 Time 2 Time 3 3 Step Binomial Tree Next, calculate the prevent value of the American Put Option American Put Value Time 0 Time 1 Time 2 Time 3 3 Step Binomial Tree

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started