Answered step by step

Verified Expert Solution

Question

1 Approved Answer

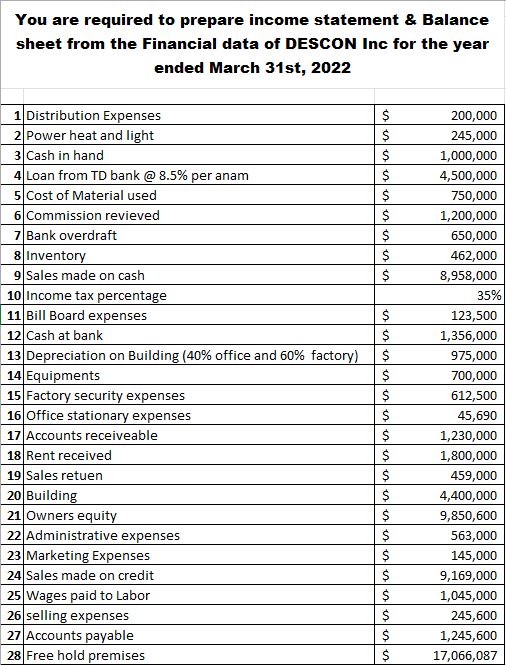

You are required to prepare income statement & Balance sheet from the Financial data of DESCON inc for the year ended March 3 1 st

You are required to prepare income statement & Balance sheet from the Financial data of DESCON inc for the year ended March st Distribution Expenses Power heat and light Cash in hand Loan from TD bank @ per anam Cost of Material used$ Commission revieved$ Bank overdraft$ Inventory Sales made on cash$ Income tax percentage Bill Board expenses$ Cash at bank Depreciation on Building office and factory$ Equipments$ Factory security expenses$ Office stationary expenses Accounts receiveable$ Rent received Sales retuen$ Building Owners equity Administrative expenses Marketing Expenses Sales made on credit Wages paid to Labor selling expenses Accounts payable Free hold premises$

You are required to prepare income statement & Balance sheet from the Financial data of DESCON Inc for the year ended March st

tableDistribution Expenses,$Power heat and light,$Cash in hand,$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started