Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are required to read the following case study and answer the questions given. 1. Critically evaluate the Banks approach to implementing the merger. (10

You are required to read the following case study and answer the questions given.

1. Critically evaluate the Banks approach to implementing the merger. (10 marks)

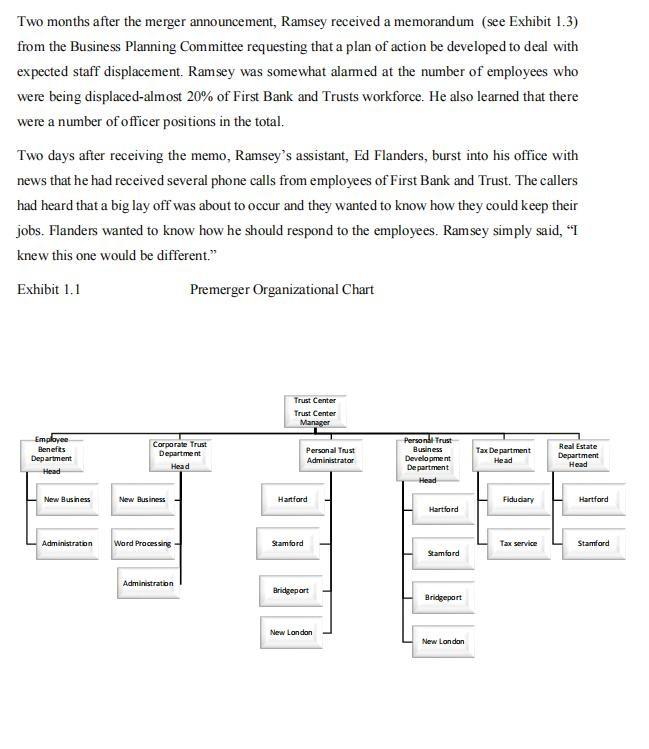

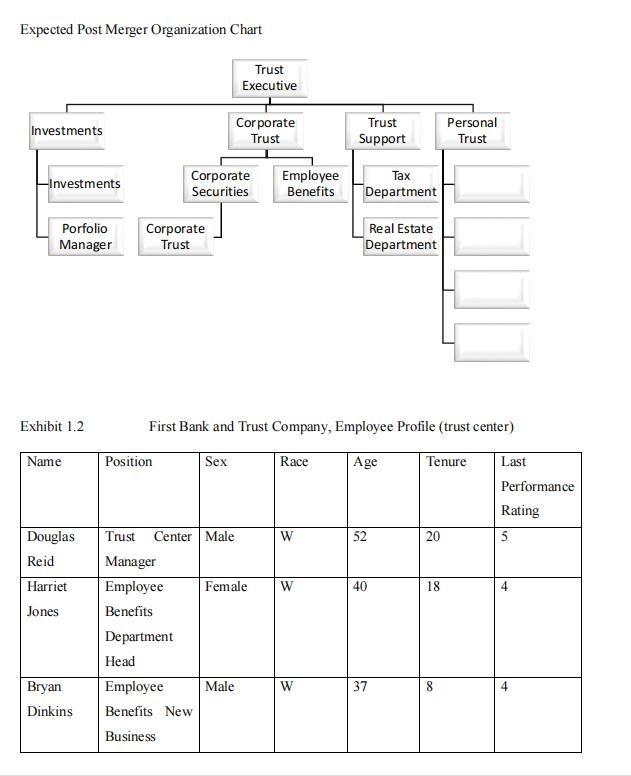

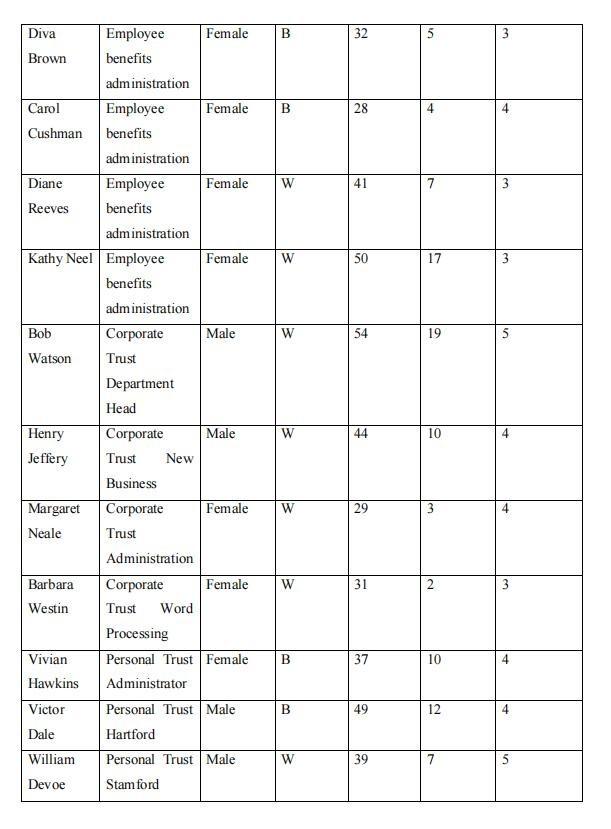

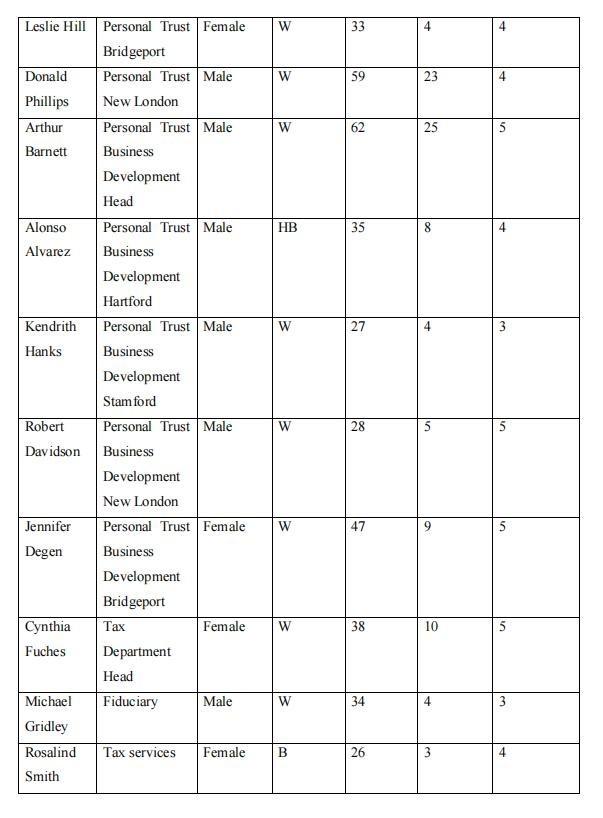

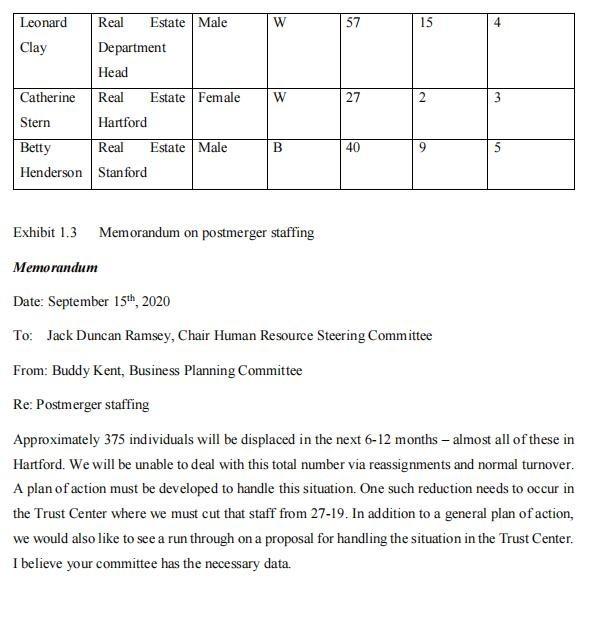

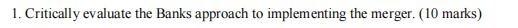

Students are required to read the following case study and answer the questions given. The Bank Merger Jack Duncan Ramsey, senior vice president of human resources at Northeastern Bank and Trust Company, reread the memo calling a meeting of top management to discuss the merger agreement signed with First Bank and Trust Company. First Bank and Trust Company was one of the largest commercial banks in Connecticut and this would be the largest mergers they had ever undertaken. First Bank and Trust enjoyed a strong market position throughout the state, and over the years had shown above average profitability. First Bank and Trust Company was a heavy personal and real estate lender. About 45% of its earning assets represented personal and real estate loan, while about 10% came from commercial and industrial loans. In contrast, Northeastem is a big commercial lender, offering a diversified range of financial services with about 35% of its earning assets in corporate loans. Although North Eastem Bank and Trust company had been basically put together through mergers, usually the mergers were through smaller banks, and most involved converting the acquired banks operational procedures for loans and deposits to their system. Most of the banks that were purchased did not have centralized operating or administrative functions. The major personnel actions involved putting employees of the acquired bank on the payroll and conducting a short orientation program to inform them about benefits and Bank policies and procedures. Typically, no employees lost their jobs because of the merger and any adjustments needed were handled through normal turnover and attrition. Ramsey felt that this merger would be quite different and require a more complex process to implement. First Banka and Trust Company was a state wide bank with over 80 branches in 38 cities and more than 1800 employees. As is often the case in banks of this size, First Bank and Trust Company had centralized support functions such as operations, personnel, auditing, and accounting. Ramsey knew that consolidating the support functions and in some cases the line functions would be a major challenge in this merger. The Planning Meeting Larry McDonald, chairman and CEO of North Eastern Bank and Trust Company, opened the meeting with the top officers, Jack Ramsey, Pat Stevenson (senior vice president of operations) and Thomas "Buddy" Kent (president). McDonald: our merger with First Bank and Trust Company is a natural fit. We are located in sister states with very similar social, cultural, political heritages. We already have a large corporate customer base in Connecticut and our advertising has covered many of its markets for years. I called this meeting today because we want this to be one of the smoothest mergers in our history, We need to come up with a plan to complete and implement the merger. I think we need to start now even though the merger is still pending board and shareholder approval. Ramsey: Larry, from the personal side, I can already anticipate some concern from First Bank and Trust about protecting their employees. There are probably all kinds of rumors circulating and a lot of anxiety about what this merger is going to mean in terms of job security for their employees. We may have very few changes in personnel on the line side of the bank but some problems may crop up if there are major changes on the staff side. Stevenson: I also think we're going to have to make some decisions about consolidating computer systems and getting their people up to speed on using our equipment and technology. The economies of scale here are a real plus and we should definitely keep that in the forefront of our thinking and planning. Kent: We also probably need to come up with a combined business plan which should help us in getting First Bank and Trust Company management committed to our goals. We need to capitalize on our geographical proximity and similar cultures in developing a business plan. McDonald: We must remain true to our own corporate philosophy. We have recognized for years that our customers will be treated well if our employees are treated well. This strategy has worked for us and we want to carry it over to all our bank employees. We can't guarantee them a job because we are going to take advantage of the economies of scale and consolidate many positions, but we should at least try to do everything possible to absorb and maintain as many good people as possible. Ramsey: I agree with you, Larry. I think our hardest task is going to be managing the people side of this merger, especially the communication part. We've done the operations part many times before and have had good results. I really believe a successful merger is 10% planning and 90% communication. The Steering Committees Shortly after the meeting, three steering committees were found to guide the merger process over the next 12 to 18 months. The Business Planning Committee consisted of the President of NorthEastem Bank and Trust Company, the President of First Bank and Trust Company, and the top managers from the operations, Human Resources and line functions of each bank. The committee compared bank products, made pricing decisions, decided how to handle the transition period, and how to phase in the merger. The committee developed a one year profit plan and a three year business plan for the combined banks. The business plan spelled out the banks objectives for each of its major activities as well as an overall market strategy. The planned strategy was around the theme Your Southern New England Bank. A major outcome of this planning was a decision to consolidate most of the banks support functions at the headquarters of Northeastem Bank in Boston. These and other projected consolidations would save between $ 16 and $ 18 million a year. Once the overall business plans were formulated, the post-merger organizational structure was developed for each major division of First Bank and Trust to reflect which jobs would remain. For example, the pre- and postmerger organization chart developed for the Connecticut Trust Center is shown in Exhibit 1.1. A profile of the employees in that division is given in Exhibit 1.2. The Operations Committee developed detailed work plans to operationally merge the banks. These plans included procedures for the conversion of loans, deposits, check processing, and other operational activities. The committee included managers from every major unit in the Operations Group of each bank, as well as managers from support functions throughout both banks. The Human Resource Steering Committee, headed by Jack Ramsey, consisted of human resource staff from both banks. The committee was charged with developing a strategy for implementing human resource policies, practices, and procedures for placing employees whose jobs might be eliminated in other positions. During initial meetings, differences in philosophy emerged. First Bank and Trust Company traditionally had taken a more conservative, by the book approach to applying human resource policies. North Eastern Bank tendered to be more flexible and would often consider the particular employees circumstances and situations before making personnel decisions. At the time of the merger, First Bank and Trust Company did not have fomal job descriptions and because of its smaller size, did not have the same level of employee benefits as North Eastem. The tumover rate at First Bank and Trust was around 10% annually, somewhat higher than North Easterns. One of the first things done by the committee was to draw up a list of major Human Resource issues to be managed over the year or so: 1. Staff reductions and transfers 2. Maintaining employee productivity during the merger transition period 3. Communication flow to employees to minimize unwarranted rumours 4. Socializing employees to North Esaterns "culture and philosophy." 5. Designing appropriate training programs 6. Balancing EEO/affirmative action goals Two months after the merger announcement, Ramsey received a memorandum (see Exhibit 1.3) from the Business Planning Committee requesting that a plan of action be developed to deal with expected staff displacement. Ramsey was somewhat alammed at the number of employees who were being displaced-almost 20% of First Bank and Trusts workforce. He also learned that there were a number of officer positions in the total. Two days after receiving the memo, Ramsey's assistant, Ed Flanders, burst into his office with news that he had received several phone calls from employees of First Bank and Trust. The callers had heard that a big lay off was about to occur and they wanted to know how they could keep their jobs. Flanders wanted to know how he should respond to the employees. Ramsey simply said, I knew this one would be different." Exhibit 1.1 Premerger Organizational Chart Trust Center Trust Center Manager Employee Benefits Department Head Corporate Trust Department Head Personal Trust Administrator Personal Trust Business Development Department Head Tax Department Head Real Estate Department Head New Business New Business Hartford Fidudary Hartford Hartford Administration Word Processing Stamford 1 Tax Service Stamford Stamford Administration Bridgeport - Bridgeport New London New London Expected Post Merger Organization Chart Trust Executive Investments Corporate Trust Trust Support Personal Trust Investments Corporate Securities Employee Benefits Tax Department Porfolio Manager Corporate Trust Real Estate Department Exhibit 1.2 First Bank and Trust Company, Employee Profile (trust center) Name Position Sex Race Age Tenure Last Performance Rating 5 W 52 20 Douglas Reid Harriet Jones W 40 18 4 Trust Center Male Manager Employee Female Benefits Department Head Employee Male Benefits New Business w 37 8 Bryan Dinkins Female B 32 5 3 B Female B 28 Female W 41 7 en Diva Employee Brown benefits administration Carol Employee Cushman benefits administration Diane Employee Reeves benefits administration Kathy Neel Employee benefits administration Bob Corporate Watson Trust Department Female W 50 17 3 Male W 54 19 va Head W 44 10 4 Henry Jeffery W 29 Margaret Neale W 31 2 Barbara Westin Corporate Male Trust New Business Corporate Female Trust Administration Corporate Female Trust Word Processing Personal Trust Female Administrator Personal Trust Male Hartford Personal Trust Male Stamford B 37 10 4 Vivian Hawkins Victor B 49 12 4 Dale William W 39 7 5 Devoe W 33 4 4 4 W 59 23 W 62 25 5 HB 35 8 W 27 4 Leslie Hill Personal Trust Female Bridgeport Donald Personal Trust Male Phillips New London Arthur Personal Trust Male Barnett Business Development Head Alonso Personal Trust Male Alvarez Business Development Hartford Kendrith Personal Trust Male Hanks Business Development Stamford Robert Personal Trust Male Davidson Business Development New London Jennifer Personal Trust Female Degen Business Development Bridgeport Cynthia Tax Female Fuches Department Head Michael Fiduciary Male Gridley Rosalind Tax services Female Smith W 28 5 W 47 9 5 W 38 10 5 W 34 4 3 B 26 3 4 W 57 15 4 Leonard Real Estate Male Clay Department Head Catherine Real Estate Female Stern Hartford Betty Real Estate Male Henderson Stanford W 27 2 3 B 40 9 5 Exhibit 1.3 Memorandum on postmerger staffing Memorandum Date: September 15th, 2020 To: Jack Duncan Ramsey, Chair Human Resource Steering Committee From: Buddy Kent, Business Planning Committee Re: Postmerger staffing Approximately 375 individuals will be displaced in the next 6-12 months - almost all of these in Hartford. We will be unable to deal with this total number via reassignments and normal turnover. A plan of action must be developed to handle this situation. One such reduction needs to occur in the Trust Center where we must cut that staff from 27-19. In addition to a general plan of action, we would also like to see a run through on a proposal for handling the situation in the Trust Center. I believe your committee has the necessary data. 1. Critically evaluate the Banks approach to implementing the merger. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started