Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are required to select the correct statement regarding the medical aid scheme and medical scheme contributions? Select one: a. Medical aid scheme contributions are

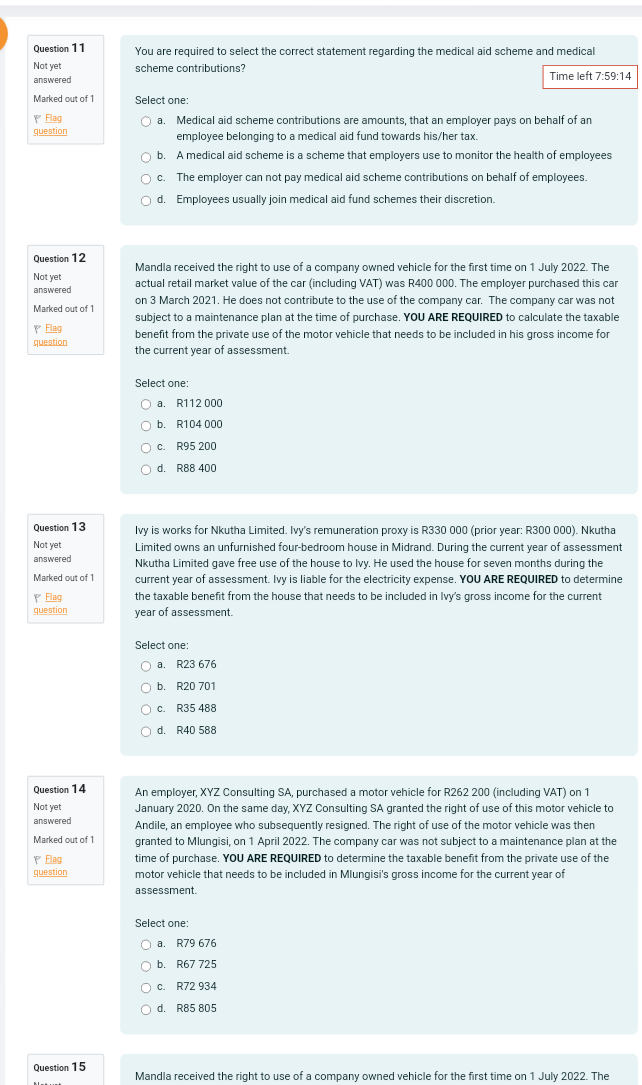

You are required to select the correct statement regarding the medical aid scheme and medical scheme contributions? Select one: a. Medical aid scheme contributions are amounts, that an employer pays on behalf of an employee belonging to a medical aid fund towards his/her tax. b. A medical aid scheme is a scheme that employers use to monitor the health of employees c. The employer can not pay medical aid scheme contributions on behalf of employees. d. Employees usually join medical aid fund schemes their discretion. Mandla received the right to use of a company owned vehicle for the first time on 1 July 2022. The actual retail market value of the car (including VAT) was R400 000. The employer purchased this car on 3 March 2021. He does not contribute to the use of the company car. The company car was not subject to a maintenance plan at the time of purchase. YOU ARE REQUIRED to calculate the taxable benefit from the private use of the motor vehicle that needs to be included in his gross income for the current year of assessment. Select one: a. R112000 b. R104000 c. R95 200 d. R88 400 Ivy is works for Nkutha Limited. Ivy's remuneration proxy is R330 000 (prior year: R300 000). Nkutha Limited owns an unfurnished four-bedroom house in Midrand. During the current year of assessment Nkutha Limited gave free use of the house to Ivy. He used the house for seven months during the current year of assessment. Ivy is liable for the electricity expense. YOU ARE REQUIRED to determine the taxable benefit from the house that needs to be included in Ivy's gross income for the current year of assessment. Select one: a. R23 676 b. R20 701 C. R35 488 d. R40 588 An employer, XYZ Consulting SA, purchased a motor vehicle for R262 200 (including VAT) on 1 January 2020. On the same day, XYZ Consulting SA granted the right of use of this motor vehicle to Andile, an employee who subsequently resigned. The right of use of the motor vehicle was then granted to Mlungisi, on 1 April 2022. The company car was not subject to a maintenance plan at the time of purchase. YOU ARE REQUIRED to determine the taxable benefit from the private use of the motor vehicle that needs to be included in Mlungisi's gross income for the current year of assessment. Select one: a. R79 676 b. R67 725 c. R72 934 d. R85 805 Mandla received the right to use of a company owned vehicle for the first time on 1 July 2022 . The

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started