Answered step by step

Verified Expert Solution

Question

1 Approved Answer

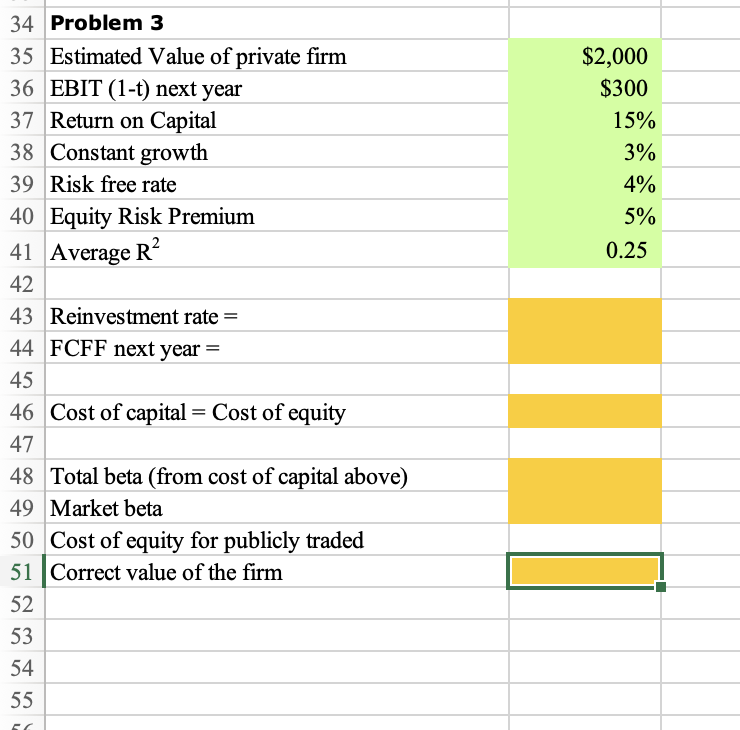

You are reviewing the valuation of Vulcan Enterprises, a private business. The analyst has estimated a value of $ 2.0 million for the company, which

- You are reviewing the valuation of Vulcan Enterprises, a private business. The analyst has estimated a value of $ 2.0 million for the company, which is in stable growth and expected to grow 3% a year in perpetuity. The firm has no debt outstanding and is expected to generate an after-tax operating income of $300,000 next year; the return on capital is anticipated to be 15%. The analyst valued the company for a private-to-private transaction, and the cost of equity he estimated is correct, given that setting. (He used atotal beta to estimate the cost of equity, a risk-free rate of 4%, and an equity risk premium of 5%).

However, the buyer is a publicly-traded firm with diversified investors. The average Rsquared across publicly traded companies in this business is 25%. Estimate the correct value of Vulcan Enterprises for sale to a public buyer.

34 Problem 3 \begin{tabular}{|l|l|} \hline 35 & Estimated Value of p \\ 36 & EBIT (1-t) next year \\ 37 & Return on Capital \\ 38 & Constant growth \\ 39 & Risk free rate \\ 40 & Equity Risk Premium \\ 41 & Average R2 \\ \hline 42 & \\ \hline 43 & Reinvestment rate = \end{tabular} 44 FCFF next year = 45 46 Cost of capital = Cost of equity 47 48 Total beta (from cost of capital above) 49 Market beta 50 Cost of equity for publicly traded 51 Correct value of the firm 52 53 54 55 34 Problem 3 \begin{tabular}{|l|l|} \hline 35 & Estimated Value of p \\ 36 & EBIT (1-t) next year \\ 37 & Return on Capital \\ 38 & Constant growth \\ 39 & Risk free rate \\ 40 & Equity Risk Premium \\ 41 & Average R2 \\ \hline 42 & \\ \hline 43 & Reinvestment rate = \end{tabular} 44 FCFF next year = 45 46 Cost of capital = Cost of equity 47 48 Total beta (from cost of capital above) 49 Market beta 50 Cost of equity for publicly traded 51 Correct value of the firm 52 53 54 55Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started