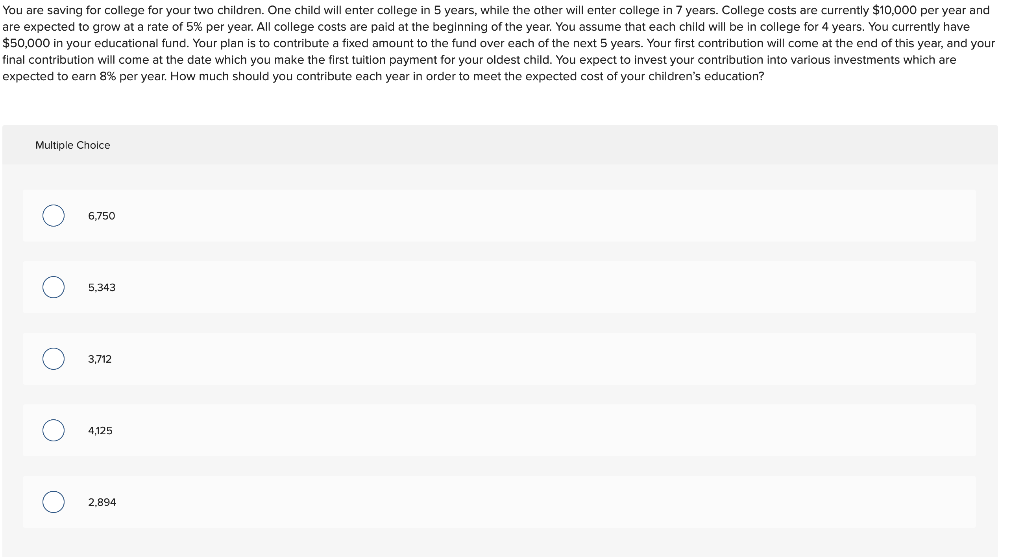

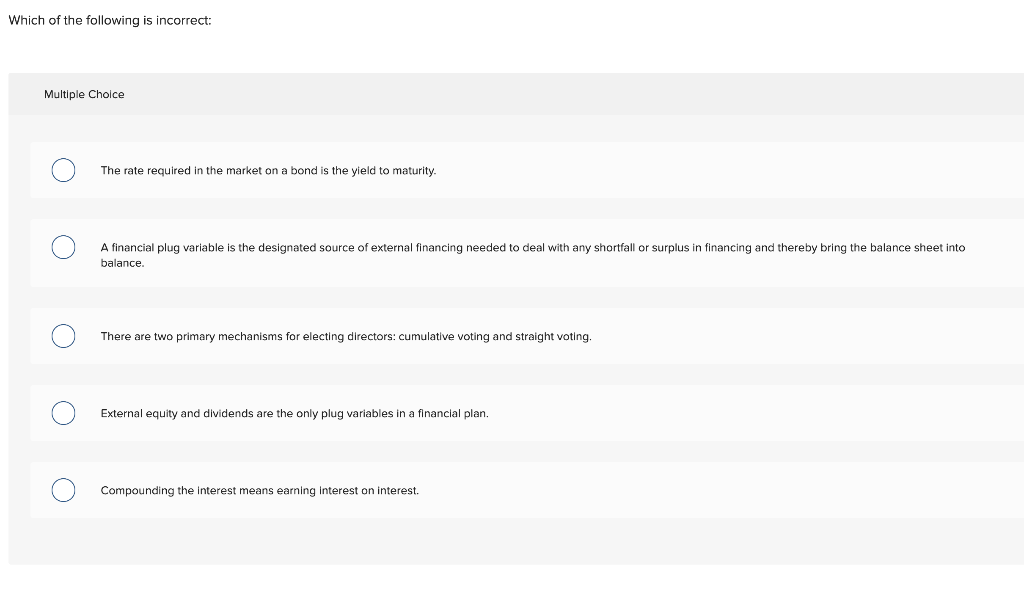

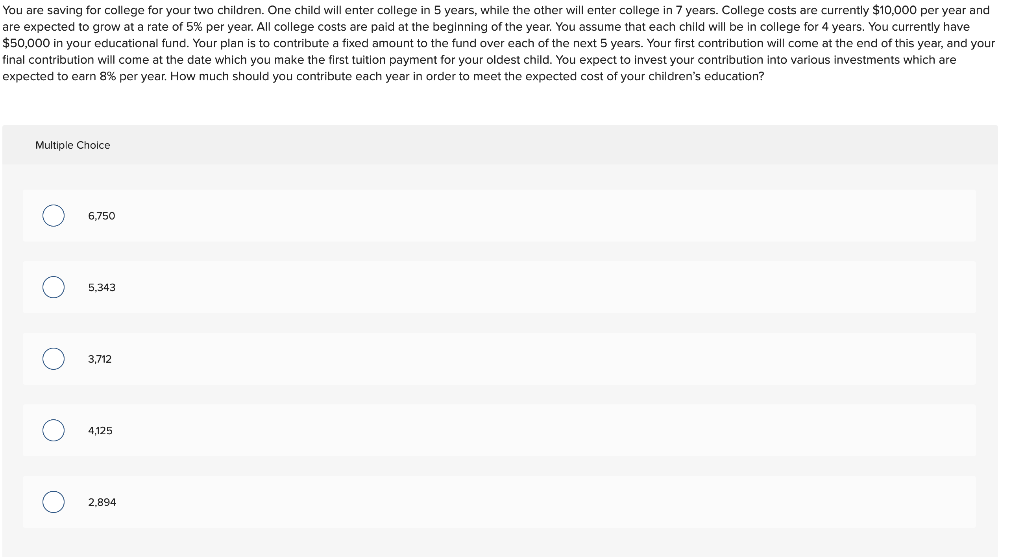

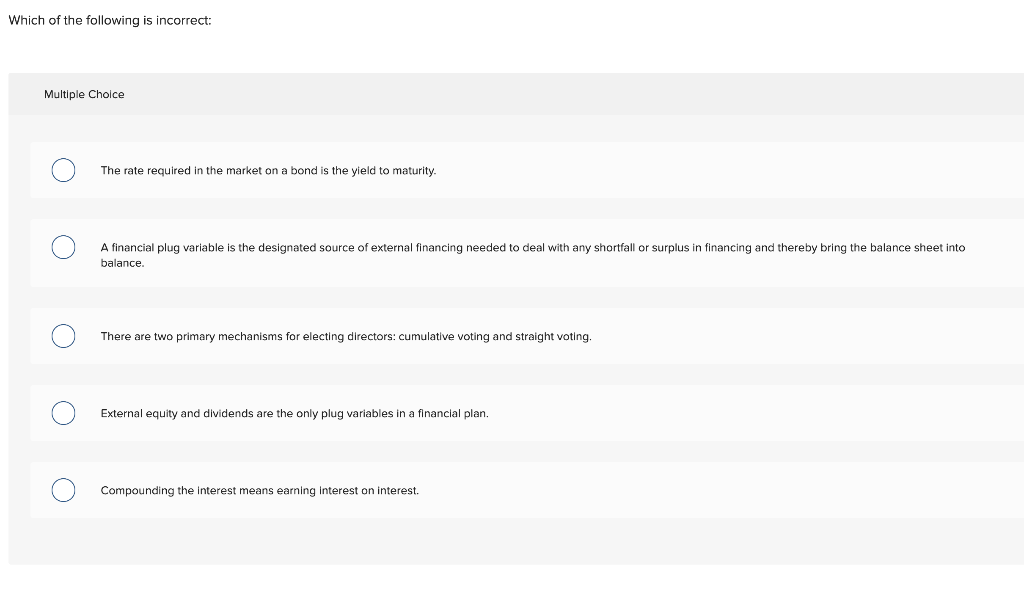

You are saving for college for your two children. One child will enter college in 5 years, while the other will enter college in 7 years. College costs are currently $10,000 per year and are expected to grow at a rate of 5% per year. All college costs are paid at the beginning of the year. You assume that each child will be in college for 4 years. You currently have $50,000 in your educational fund. Your plan is to contribute a fixed amount to the fund over each of the next 5 years. Your first contribution will come at the end of this year, and your final contribution will come at the date which you make the first tuition payment for your oldest child. You expect to invest your contribution into various investments which are expected to earn 8% per year. How much should you contribute each year in order to meet the expected cost of your children's education? Multiple Choice O 6.750 O 5.343 3,712 O O 4,125 O 2.894 Which of the following is incorrect: Multiple Choice The rate required in the market on a bond is the yield to maturity. A financial plug variable is the designated source of external financing needed to deal with any shortfall or surplus in financing and thereby bring the balance sheet into balance. There are two primary mechanisms for electing directors: cumulative voting and straight voting, O External equity and dividends are the only plug variables in a financial plan. Compounding the interest means earning interest on interest. You are saving for college for your two children. One child will enter college in 5 years, while the other will enter college in 7 years. College costs are currently $10,000 per year and are expected to grow at a rate of 5% per year. All college costs are paid at the beginning of the year. You assume that each child will be in college for 4 years. You currently have $50,000 in your educational fund. Your plan is to contribute a fixed amount to the fund over each of the next 5 years. Your first contribution will come at the end of this year, and your final contribution will come at the date which you make the first tuition payment for your oldest child. You expect to invest your contribution into various investments which are expected to earn 8% per year. How much should you contribute each year in order to meet the expected cost of your children's education? Multiple Choice O 6.750 O 5.343 3,712 O O 4,125 O 2.894 Which of the following is incorrect: Multiple Choice The rate required in the market on a bond is the yield to maturity. A financial plug variable is the designated source of external financing needed to deal with any shortfall or surplus in financing and thereby bring the balance sheet into balance. There are two primary mechanisms for electing directors: cumulative voting and straight voting, O External equity and dividends are the only plug variables in a financial plan. Compounding the interest means earning interest on interest