Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are seeking to combine two risky securities, A and B, and the risk-free asset in an efficient way. The characteristics of A and B

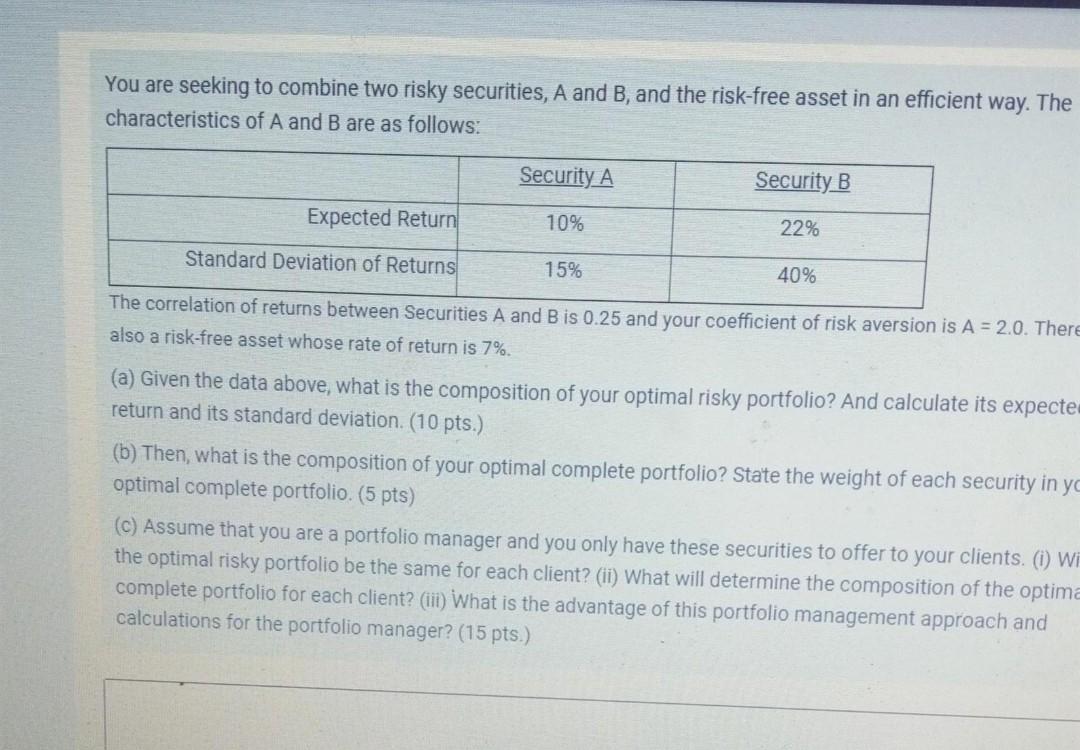

You are seeking to combine two risky securities, A and B, and the risk-free asset in an efficient way. The characteristics of A and B are as follows: Security A Security B Expected Return 10% 22% Standard Deviation of Returns 15% 40% The correlation of returns between Securities A and B is 0.25 and your coefficient of risk aversion is A = 2.0. There also a risk-free asset whose rate of return is 7%. (a) Given the data above, what is the composition of your optimal risky portfolio? And calculate its expecte return and its standard deviation. (10 pts.) (b) Then, what is the composition of your optimal complete portfolio? State the weight of each security in yo optimal complete portfolio. (5 pts) (c) Assume that you are a portfolio manager and you only have these securities to offer to your clients. (1) Wi the optimal risky portfolio be the same for each client? (ii) What will determine the composition of the optima complete portfolio for each client? (iii) What is the advantage of this portfolio management approach and calculations for the portfolio manager? (15 pts.) You are seeking to combine two risky securities, A and B, and the risk-free asset in an efficient way. The characteristics of A and B are as follows: Security A Security B Expected Return 10% 22% Standard Deviation of Returns 15% 40% The correlation of returns between Securities A and B is 0.25 and your coefficient of risk aversion is A = 2.0. There also a risk-free asset whose rate of return is 7%. (a) Given the data above, what is the composition of your optimal risky portfolio? And calculate its expecte return and its standard deviation. (10 pts.) (b) Then, what is the composition of your optimal complete portfolio? State the weight of each security in yo optimal complete portfolio. (5 pts) (c) Assume that you are a portfolio manager and you only have these securities to offer to your clients. (1) Wi the optimal risky portfolio be the same for each client? (ii) What will determine the composition of the optima complete portfolio for each client? (iii) What is the advantage of this portfolio management approach and calculations for the portfolio manager? (15 pts.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started