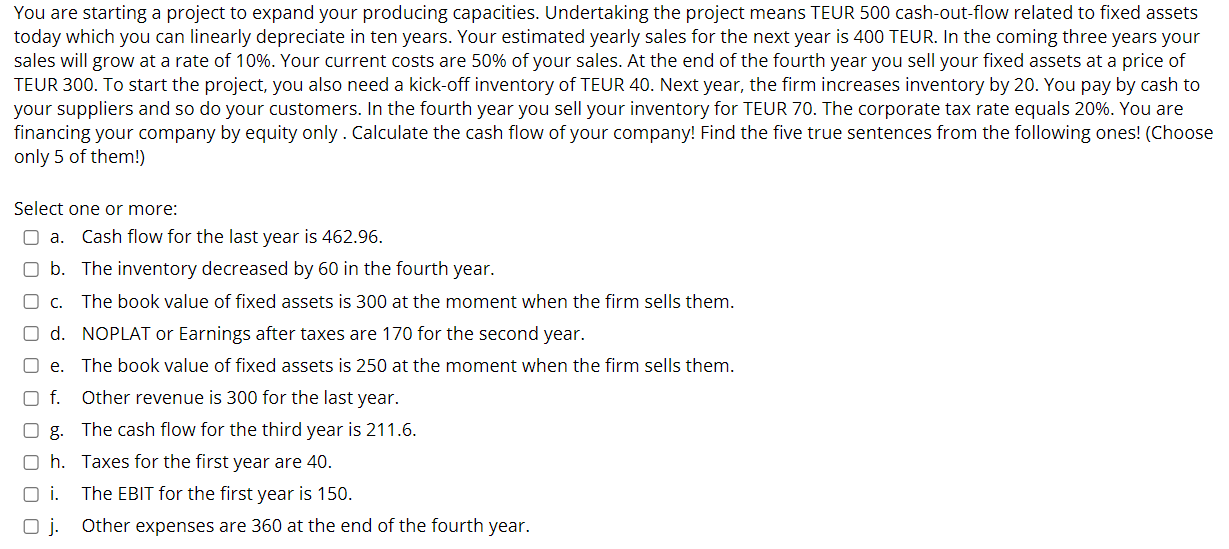

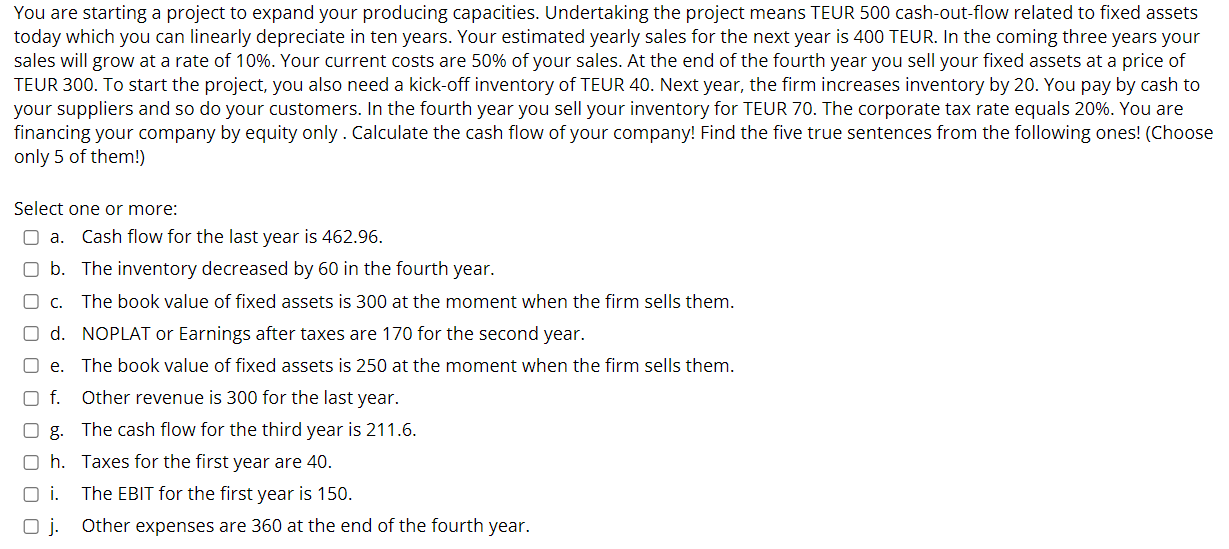

You are starting a project to expand your producing capacities. Undertaking the project means TEUR 500 cash-out-flow related to fixed assets today which you can linearly depreciate in ten years. Your estimated yearly sales for the next year is 400 TEUR. In the coming three years your sales will grow at a rate of 10%. Your current costs are 50% of your sales. At the end of the fourth year you sell your fixed assets at a price of TEUR 300. To start the project, you also need a kick-off inventory of TEUR 40. Next year, the firm increases inventory by 20. You pay by cash to your suppliers and so do your customers. In the fourth year you sell your inventory for TEUR 70. The corporate tax rate equals 20%. You are financing your company by equity only. Calculate the cash flow of your company! Find the five true sentences from the following ones! (Choose only 5 of them!) O a. Select one or more: Cash flow for the last year is 462.96. ob. The inventory decreased by 60 in the fourth year. O c. The book value of fixed assets is 300 at the moment when the firm sells them. O d. NOPLAT or Earnings after taxes are 170 for the second year. O e. The book value of fixed assets is 250 at the moment when the firm sells them. O f. Other revenue is 300 for the last year. Og. The cash flow for the third year is 211.6. h. Taxes for the first year are 40. O i. The EBIT for the first year is 150. oj. Other expenses are 360 at the end of the fourth year. You are starting a project to expand your producing capacities. Undertaking the project means TEUR 500 cash-out-flow related to fixed assets today which you can linearly depreciate in ten years. Your estimated yearly sales for the next year is 400 TEUR. In the coming three years your sales will grow at a rate of 10%. Your current costs are 50% of your sales. At the end of the fourth year you sell your fixed assets at a price of TEUR 300. To start the project, you also need a kick-off inventory of TEUR 40. Next year, the firm increases inventory by 20. You pay by cash to your suppliers and so do your customers. In the fourth year you sell your inventory for TEUR 70. The corporate tax rate equals 20%. You are financing your company by equity only. Calculate the cash flow of your company! Find the five true sentences from the following ones! (Choose only 5 of them!) O a. Select one or more: Cash flow for the last year is 462.96. ob. The inventory decreased by 60 in the fourth year. O c. The book value of fixed assets is 300 at the moment when the firm sells them. O d. NOPLAT or Earnings after taxes are 170 for the second year. O e. The book value of fixed assets is 250 at the moment when the firm sells them. O f. Other revenue is 300 for the last year. Og. The cash flow for the third year is 211.6. h. Taxes for the first year are 40. O i. The EBIT for the first year is 150. oj. Other expenses are 360 at the end of the fourth year