Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are starting to plan for your eventual retirement, and you've decided you would like to retire in 32 years. Your goal is to

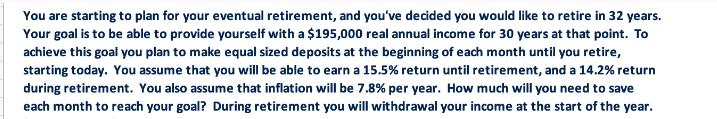

You are starting to plan for your eventual retirement, and you've decided you would like to retire in 32 years. Your goal is to be able to provide yourself with a $195,000 real annual income for 30 years at that point. To achieve this goal you plan to make equal sized deposits at the beginning of each month until you retire, starting today. You assume that you will be able to earn a 15.5% return until retirement, and a 14.2% return during retirement. You also assume that inflation will be 7.8% per year. How much will you need to save each month to reach your goal? During retirement you will withdrawal your income at the start of the year.

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the monthly deposit you need to make to reach your retirement goal we can use the future value of an annuity formula The formula is given ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started