Question

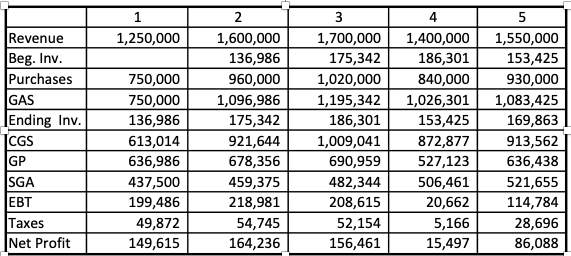

You are starting your own business with an equity investment of $500,000. ?You have prepared ?prof-forma income statements for the first five years shown below.

You are starting your own business with an equity investment of $500,000. ?You have prepared ?prof-forma income statements for the first five years shown below.

You plan to distribute 100% of firms profits to yourself each year. Based upon the assumptions listed below will you be able to distribute all the firm?s profits?

Average Collection Period of 75 days based upon revenue.

Average Inventory days of 67 days based upon purchases

Average Payable Period of 27 days based upon purchases.

1. ?Determine the cash in and the cash out each year.

2. ?What is the net cash flow for each year

Revenue Beg. Inv. Purchases GAS Ending Inv. CGS GP SGA EBT Taxes Net Profit 1 1,250,000 750,000 750,000 136,986 613,014 636,986 437,500 199,486 49,872 149,615 2 1,600,000 136,986 960,000 1,096,986 175,342 921,644 678,356 459,375 218,981 54,745 164,236 3 4 1,700,000 1,400,000 175,342 186,301 1,020,000 840,000 1,195,342 1,026,301 1,083,425 186,301 153,425 169,863 872,877 913,562 527,123 636,438 1,009,041 690,959 482,344 506,461 208,615 20,662 52,154 156,461 5,166 15,497 5 1,550,000 153,425 930,000 521,655 114,784 28,696 86,088

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started