Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are tasked with picking an appropriate investment portfolio for a new client. You will need to prepare three different portfolio options for them

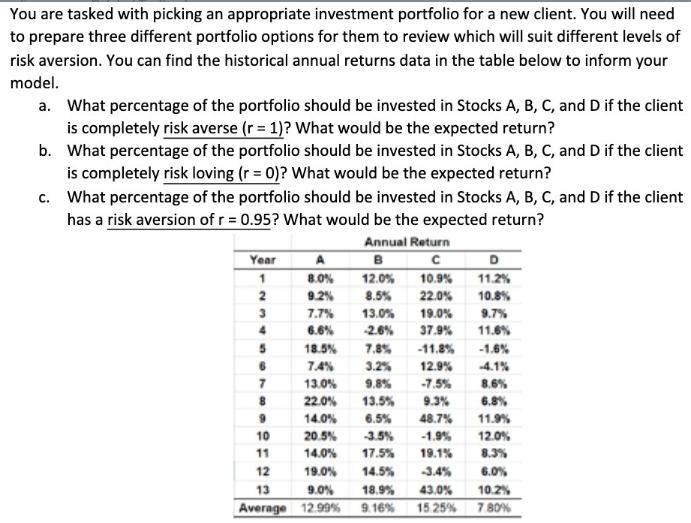

You are tasked with picking an appropriate investment portfolio for a new client. You will need to prepare three different portfolio options for them to review which will suit different levels of risk aversion. You can find the historical annual returns data in the table below to inform your model. a. What percentage of the portfolio should be invested in Stocks A, B, C, and D if the client is completely risk averse (r = 1)? What would be the expected return? b. What percentage of the portfolio should be invested in Stocks A, B, C, and D if the client is completely risk loving (r = 0)? What would be the expected return? c. What percentage of the portfolio should be invested in Stocks A, B, C, and D if the client has a risk aversion of r = 0.95? What would be the expected return? Annual Return C B 12.0% 10.9% 8.5% 22.0% Year 1 2 3 4 5 6 7 A 8.0% 9.2% 7.7% 13.0% 6.6% -2.6% 18.5% 7.8% 7.4% 3.2% 9.8% 13.0% 22.0% 14.0% 20.5% 14.0% 19.0% 19.0% 37.9% -11.8% 12.9% -7.5% 13.5% 9.3% 6.5% 48.7% 8 9 10 -3.5% 11 17.5% 12 14.5% 13 9.0% 18.9% Average 12.99% 9.16% D 11.2% 10.8% 9.7% 11.6% -4.1% 8.6% 6.8% 11.9% -1.9% 12.0% 19.1% 8.3% -3.4% 6.0% 43.0% 10.2% 15.25% 7.80%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the portfolio options we need to calculate the expected returns and standard deviations for each stock and then use these values to determi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started