Answered step by step

Verified Expert Solution

Question

1 Approved Answer

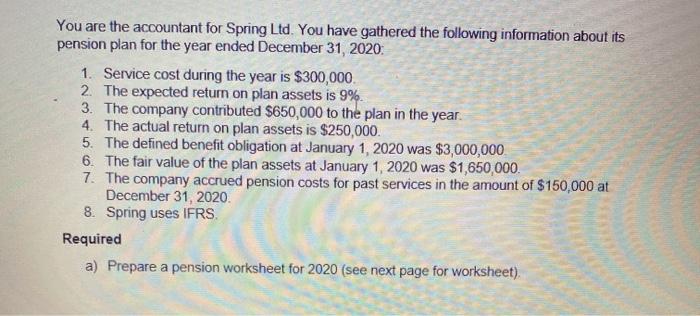

You are the accountant for Spring Ltd. You have gathered the following information about its pension plan for the year ended December 31, 2020:

You are the accountant for Spring Ltd. You have gathered the following information about its pension plan for the year ended December 31, 2020: 1. Service cost during the year is $300,000. 2. The expected return on plan assets is 9%. 3. The company contributed $650,000 to the plan in the year. 4. The actual return on plan assets is $250,000. 5. The defined benefit obligation at January 1, 2020 was $3,000,000. 6. The fair value of the plan assets at January 1, 2020 was $1,650,000. 7. The company accrued pension costs for past services in the amount of $150,000 at December 31, 2020. 8. Spring uses IFRS. Required a) Prepare a pension worksheet for 2020 (see next page for worksheet). Financial Statement Entries Annual Pension Memo Record Net Defined Benefit Asset / (Liability) Items Re-measurement (Gain) Loss (OCI) Cash Defined Benefit Plan Assets Expense Obligation Beg Balance January 1, 2020 Expense Entry Contribution Entry Ending Balance

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

IFRS Year 2020 1 Pension Expense 42150000 2 Journal entry Account title Explaination 2020 Debit Cred...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started