Question

You are the accountant for the KK2 Homeowners' Association. You receive a message that a late notice for homeowner association dues was sent to Bill

You are the accountant for the KK2 Homeowners' Association. You receive a message that a late notice for homeowner association dues was sent to Bill Morris by the KK2 Homeowners' Association Treasurer, Mrs. Betty Yugo.

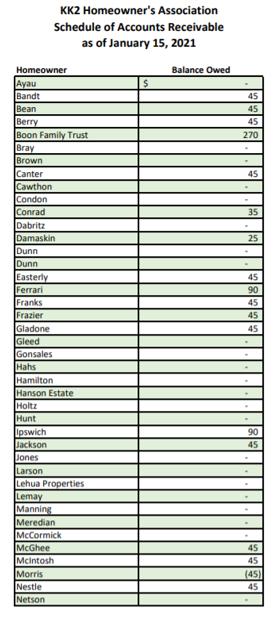

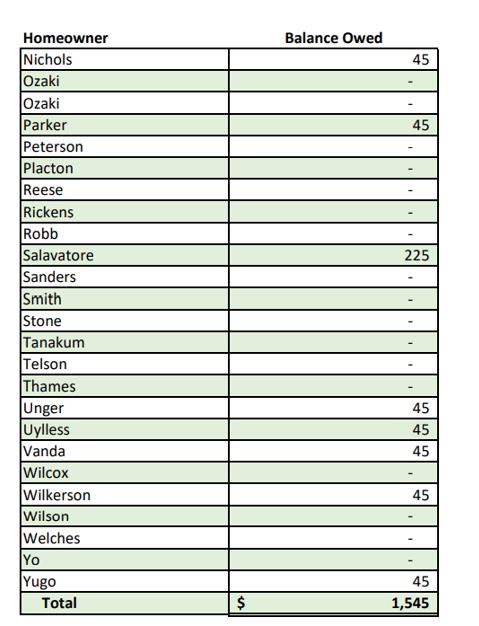

Mrs. Yugo uses an Accounts Receivable Report that you prepare as a basis for sending past-due notices:

The last date to pay dues without a late fee was January 15, at the KK2 Homeowners' Association's Annual Meeting.

The past-due notice sent to Mr. Morris contained a REQUEST for IMMEDIATE PAYMENT OF $55, the annual homeowner's association dues of $45, plus a $10 late fee.

When you checked the accounting records, you discovered that Mr. Morris paid $90 in annual homeowner dues on December 30, the previous month, which is before the due date. The payment resulted in his account having a credit balance of $45 since he paid dues for the current year plus next year.

You have verified that the accounting records are correct. The Accounts Receivable Report you gave to Mrs. Yugo at the January 15 annual meeting (the report is attached) notes the correct ending balances.

- Write a memorandum to Mrs. Betty Yugo covering the following:

- 1) Make her aware of the error that was made?

- 2) Explain the meaning of the schedule to help her better understand the report and what the numbers mean?

Homeowner Ayau Bandt Bean Berry Boon Family Trust Bray Brown Canter Cawthon Condon Conrad Dabritz Damaskin Dunn Dunn Easterly Ferrari Franks KK2 Homeowner's Association Schedule of Accounts Receivable as of January 15, 2021 Frazier Gladone Gleed Gonsales Hahs Hamilton Hanson Estate Holtz Hunt Ipswich Jackson Jones Larson Lehua Properties Lemay Manning Meredian McCormick McGhee Mcintosh Morris Nestle Netson $ Balance Owed 45 45 45 270 45 35 25 45 90 45 45 45 90 45 45 45 (45) 45

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started