Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the accountant for Wacky Wednesdays Ltd. The following information is made available for the year ended 30 June 2021: 1. On 1

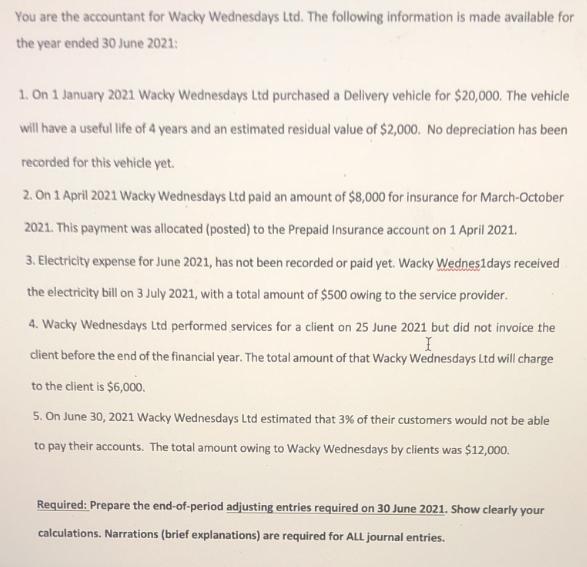

You are the accountant for Wacky Wednesdays Ltd. The following information is made available for the year ended 30 June 2021: 1. On 1 January 2021 Wacky Wednesdays Ltd purchased a Delivery vehicle for $20,000. The vehicle will have a useful life of 4 years and an estimated residual value of $2,000. No depreciation has been recorded for this vehicle yet. 2. On 1 April 2021 Wacky Wednesdays Ltd paid an amount of $8,000 for insurance for March-October 2021. This payment was allocated (posted) to the Prepaid Insurance account on 1 April 2021. 3. Electricity expense for June 2021, has not been recorded or paid yet. Wacky Wednes1days received the electricity bill on 3 July 2021, with a total amount of $500 owing to the service provider. 4. Wacky Wednesdays Ltd performed services for a client on 25 June 2021 but did not invoice the I client before the end of the financial year. The total amount of that Wacky Wednesdays Ltd will charge to the client is $6,000. 5. On June 30, 2021 Wacky Wednesdays Ltd estimated that 3% of their customers would not be able to pay their accounts. The total amount owing to Wacky Wednesdays by clients was $12,000. Required: Prepare the end-of-period adjusting entries required on 30 June 2021. Show clearly your calculations. Narrations (brief explanations) are required for ALL journal entries.

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Depreciation Adjustment The Company purchased a car on January 1 2021 worth 20000 with a useful life of 4 years and an estimated residue value of 2000 The depreciation expense for the car needs to be ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started