Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the accountant of MrClean Ltd, a manufacturer of cleaning detergents in the south of Johannesburg. As part of the finalisation of the

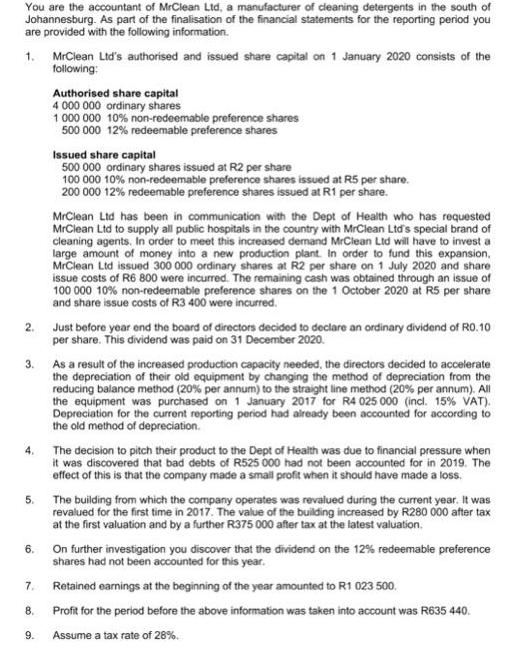

You are the accountant of MrClean Ltd, a manufacturer of cleaning detergents in the south of Johannesburg. As part of the finalisation of the financial statements for the reporting period you are provided with the following information. 1. MrClean Ltd's authorised and issued share capital on 1 January 2020 consists of the following: 2. 3. 5. 6. 7. 8. 9. Authorised share capital 4 000 000 ordinary shares 1 000 000 10% non-redeemable preference shares 500 000 12% redeemable preference shares Issued share capital 500 000 ordinary shares issued at R2 per share 100 000 10% non-redeemable preference shares issued at R5 per share. 200 000 12% redeemable preference shares issued at R1 per share. MrClean Ltd has been in communication with the Dept of Health who has requested MrClean Ltd to supply all public hospitals in the country with MrClean Ltd's special brand of cleaning agents. In order to meet this increased demand MrClean Ltd will have to invest a large amount of money into a new production plant. In order to fund this expansion, MrClean Ltd issued 300 000 ordinary shares at R2 per share on 1 July 2020 and share issue costs of R6 800 were incurred. The remaining cash was obtained through an issue of 100 000 10% non-redeemable preference shares on the 1 October 2020 at R5 per share and share issue costs of R3 400 were incurred. Just before year end the board of directors decided to declare an ordinary dividend of R0.10 per share. This dividend was paid on 31 December 2020. As a result of the increased production capacity needed, the directors decided to accelerate the depreciation of their old equipment by changing the method of depreciation from the reducing balance method (20% per annum) to the straight line method (20% per annum). All the equipment was purchased on 1 January 2017 for R4 025 000 (incl. 15% VAT). Depreciation for the current reporting period had already been accounted for according to the old method of depreciation. The decision to pitch their product to the Dept of Health was due to financial pressure when it was discovered that bad debts of R525 000 had not been accounted for in 2019. The effect of this is that the company made a small profit when it should have made a loss. The building from which the company operates was revalued during the current year. It was revalued for the first time in 2017. The value of the building increased by R280 000 after tax at the first valuation and by a further R375 000 after tax at the latest valuation. On further investigation you discover that the dividend on the 12% redeemable preference shares had not been accounted for this year. Retained earnings at the beginning of the year amounted to R1 023 500. Profit for the period before the above information was taken into account was R635 440. Assume a tax rate of 28%. QUESTION 1 (CONTINUED) REQUIRED: a) Prepare the Statement of Changes in Equity for MrClean Ltd for the reporting period ended 31 December 2020. b) Disclose the following notes to the financial statements of MrClean Ltd for the reporting period ended 31 December 2020. Change in accounting estimate Prior period error (25) (4) (6) (35)

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Introduction MrClean Ltd a manufacturer of cleaning detergents faces various changes and events during the reporting period impacting its financial statements These include share issuances a dividend ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started