Answered step by step

Verified Expert Solution

Question

1 Approved Answer

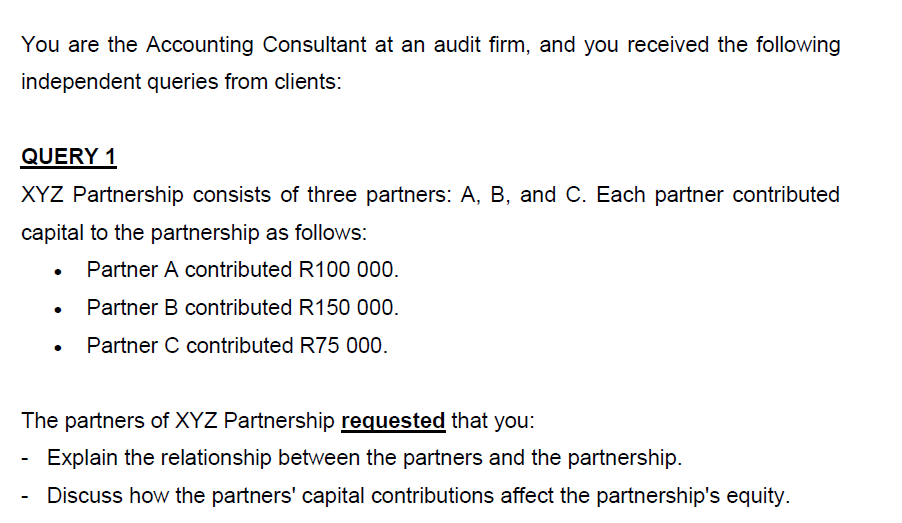

You are the Accounting Consultant at an audit firm, and you received the following independent queries from clients: QUERY 1 XYZ Partnership consists of three

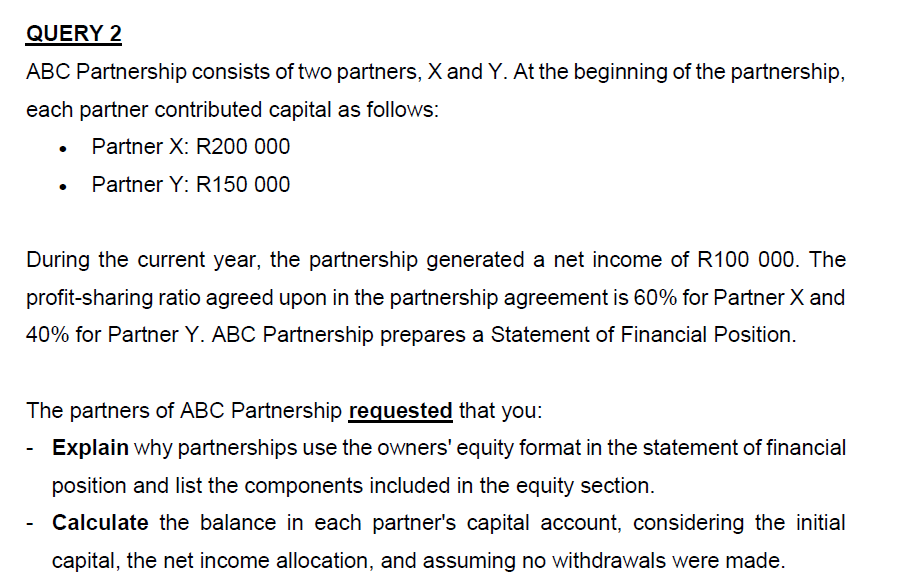

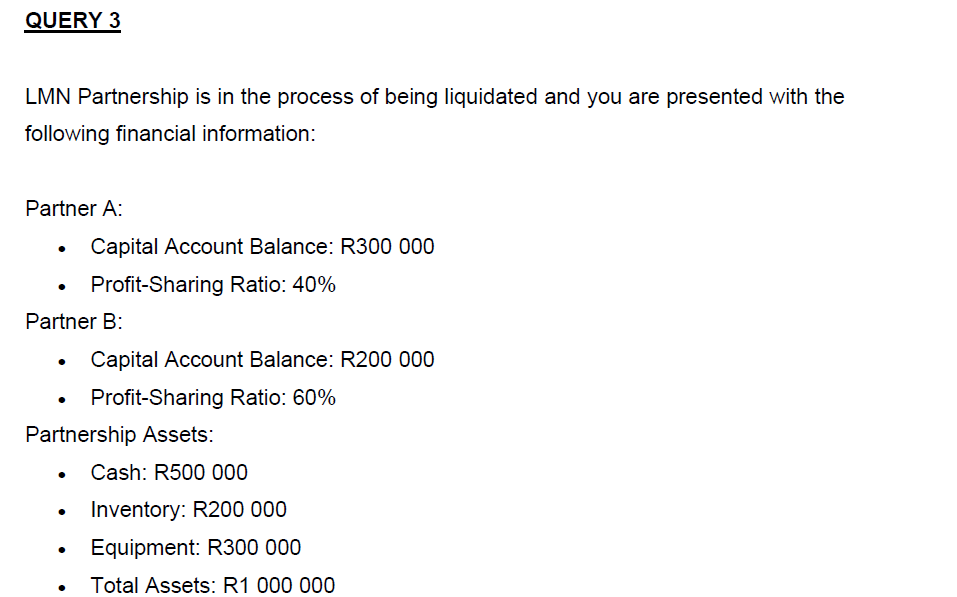

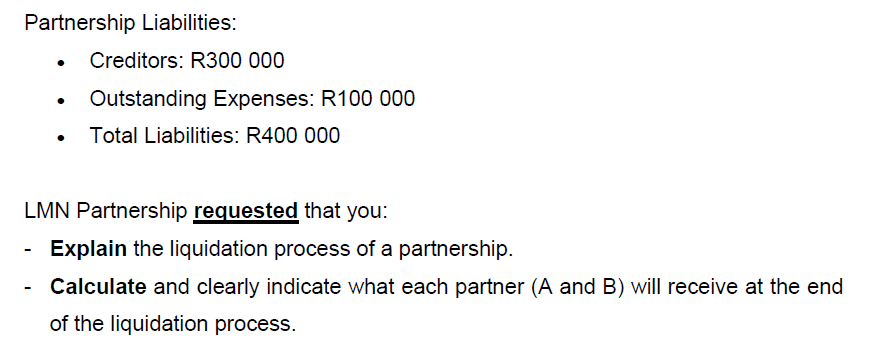

You are the Accounting Consultant at an audit firm, and you received the following independent queries from clients: QUERY 1 XYZ Partnership consists of three partners: A, B, and C. Each partner contributed capital to the partnership as follows: - Partner A contributed R100 000. - Partner B contributed R150 000. - Partner C contributed R75 000. The partners of XYZ Partnership requested that you: - Explain the relationship between the partners and the partnership. - Discuss how the partners' capital contributions affect the partnership's equity. QUERY 2 ABC Partnership consists of two partners, X and Y. At the beginning of the partnership, each partner contributed capital as follows: - Partner X: R200 000 - Partner Y: R150 000 During the current year, the partnership generated a net income of R100 000. The profit-sharing ratio agreed upon in the partnership agreement is 60% for Partner X and 40% for Partner Y. ABC Partnership prepares a Statement of Financial Position. The partners of ABC Partnership requested that you: - Explain why partnerships use the owners' equity format in the statement of financial position and list the components included in the equity section. - Calculate the balance in each partner's capital account, considering the initial capital, the net income allocation, and assuming no withdrawals were made. LMN Partnership is in the process of being liquidated and you are presented with the following financial information: Partner A: - Capital Account Balance: R300 000 - Profit-Sharing Ratio: 40% Partner B: - Capital Account Balance: R200 000 - Profit-Sharing Ratio: 60% Partnership Assets: - Cash: R500 000 - Inventory: R200 000 - Equipment: R300 000 Partnership Liabilities: - Creditors: R300 000 - Outstanding Expenses: R100 000 - Total Liabilities: R400 000 LMN Partnership requested that you: - Explain the liquidation process of a partnership. - Calculate and clearly indicate what each partner (A and B) will receive at the end of the liquidation process. REQUIRED: You are required to draft a response to the client, for each query, to answer their requests

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started