Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the audit senior for a longstanding client, Chattel Ltd. Chattel produces good quality living room and bedroom furniture. The company then sells

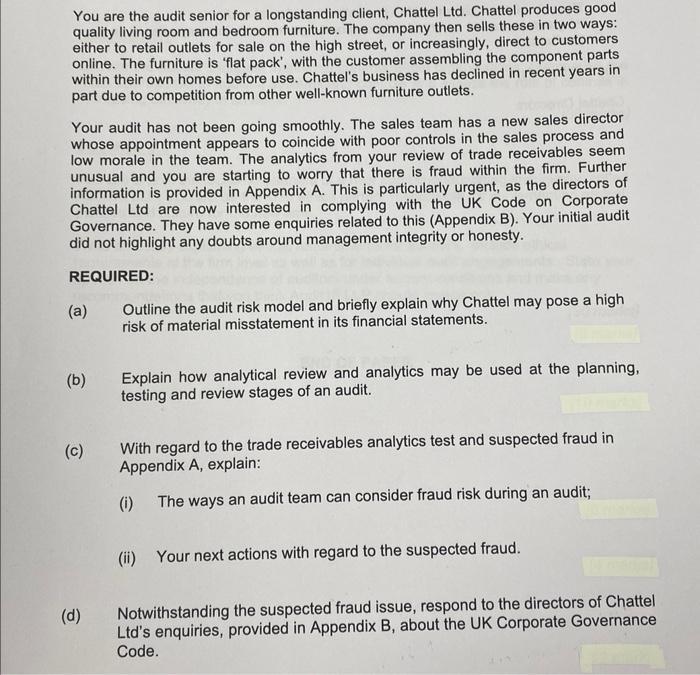

You are the audit senior for a longstanding client, Chattel Ltd. Chattel produces good quality living room and bedroom furniture. The company then sells these in two ways: either to retail outlets for sale on the high street, or increasingly, direct to customers online. The furniture is 'flat pack', with the customer assembling the component parts within their own homes before use. Chattel's business has declined in recent years in part due to competition from other well-known furniture outlets. Your audit has not been going smoothly. The sales team has a new sales director whose appointment appears to coincide with poor controls in the sales process and low morale in the team. The analytics from your review of trade receivables seem unusual and you are starting to worry that there is fraud within the firm. Further information is provided in Appendix A. This is particularly urgent, as the directors of Chattel Ltd are now interested in complying with the UK Code on Corporate Governance. They have some enquiries related to this (Appendix B). Your initial audit did not highlight any doubts around management integrity or honesty. REQUIRED: (a) (b) (c) (d) Outline the audit risk model and briefly explain why Chattel may pose a high risk of material misstatement in its financial statements. Explain how analytical review and analytics may be used at the planning, testing and review stages of an audit.. With regard to the trade receivables analytics test and suspected fraud in Appendix A, explain: (i) The ways an audit team can consider fraud risk during an audit; (ii) Your next actions with regard to the suspected fraud. Notwithstanding the suspected fraud issue, respond to the directors of Chattel Ltd's enquiries, provided in Appendix B, about the UK Corporate Governance Code.

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a The audit risk model is the process used to assess the risk of material misstatement in the financial statements This assessment is based on the auditors understanding of the clients business the cl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started