Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the auditor of Carla Vista Inc., the Canadian subsidiary of a public multinational engineering company that offers a defined benefit pension plan

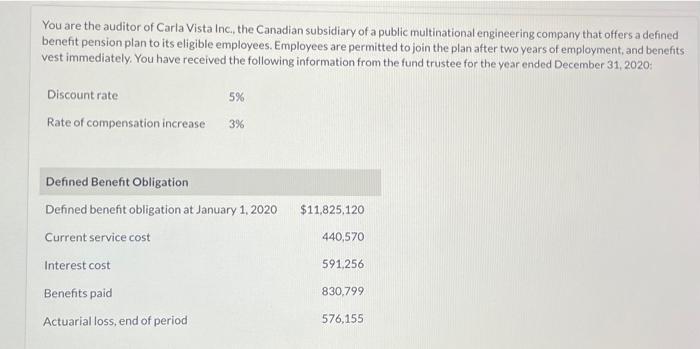

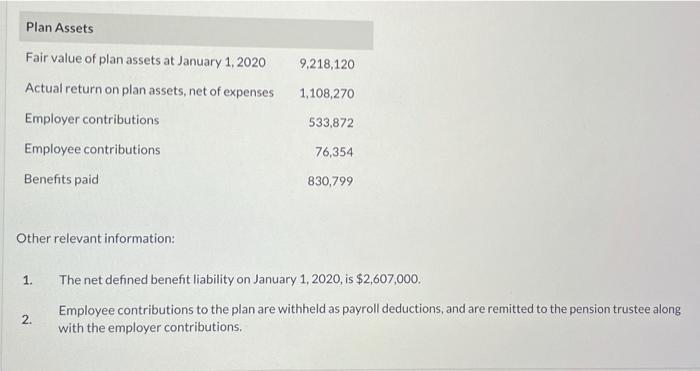

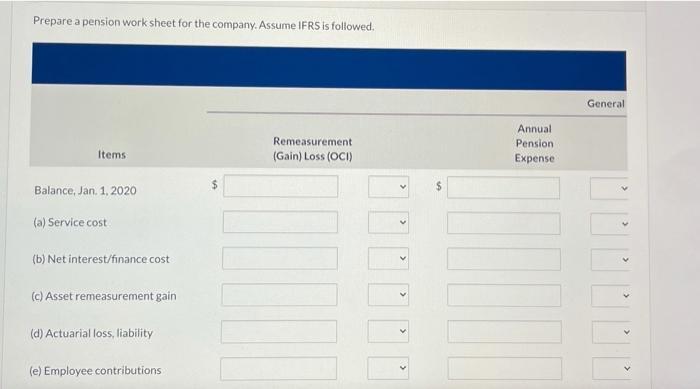

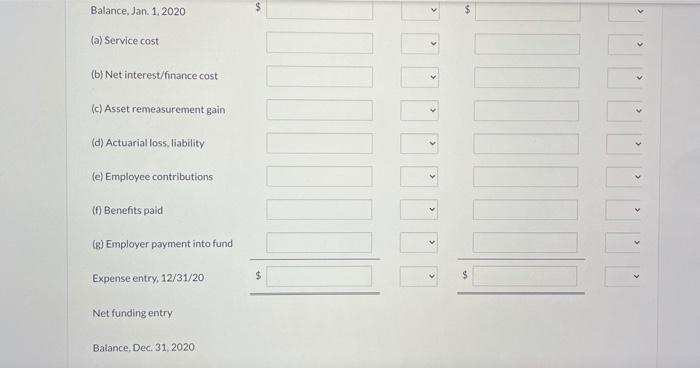

You are the auditor of Carla Vista Inc., the Canadian subsidiary of a public multinational engineering company that offers a defined benefit pension plan to its eligible employees. Employees are permitted to join the plan after two years of employment, and benefits vest immediately. You have received the following information from the fund trustee for the year ended December 31, 2020: Discount rate Rate of compensation increase 5% Interest cost Benefits paid Actuarial loss, end of period 3% Defined Benefit Obligation Defined benefit obligation at January 1, 2020 Current service cost $11,825,120 440,570 591,256 830,799 576,155 Plan Assets Fair value of plan assets at January 1, 2020 Actual return on plan assets, net of expenses Employer contributions Employee contributions Benefits paid Other relevant information: 1. 2. 9,218,120 1,108,270 533,872 76,354 830,799 The net defined benefit liability on January 1, 2020, is $2,607,000. Employee contributions to the plan are withheld as payroll deductions, and are remitted to the pension trustee along with the employer contributions. Prepare a pension work sheet for the company. Assume IFRS is followed. Items Balance, Jan. 1, 2020 (a) Service cost (b) Net interest/finance cost (c) Asset remeasurement gain (d) Actuarial loss, liability (e) Employee contributions Remeasurement (Gain) Loss (OCI) 111 > > Annual Pension Expense 11 General > Balance, Jan. 1, 2020 (a) Service cost (b) Net interest/finance cost (c) Asset remeasurement gain (d) Actuarial loss, liability (e) Employee contributions (f) Benefits paid (g) Employer payment into fund Expense entry, 12/31/20 Net funding entry Balance, Dec. 31, 2020- $ > > >

Step by Step Solution

★★★★★

3.50 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

IFRS 1 Pension Expense 2 Journal entry Annual pension expense OCIPrior Service Cost OCIGainLoss Cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started