Question

You are the CEO of a major conglomerate in 2016, and are thinking of acquiring a tech company. You are wondering what price would be

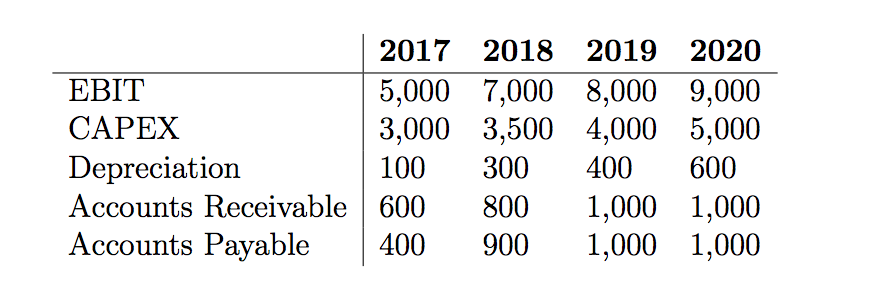

You are the CEO of a major conglomerate in 2016, and are thinking of acquiring a tech company. You are wondering what price would be appropriate to offer. You take a look at the companys financial statements, and see that they expect the following accounting numbers for the next 5 years (in thousands of dollars):

The current corporate tax rate is 35%. The market return is 10%, and the current risk-free interest rate is 4%. The company says that it will be able to sustain its cash flows at the 2020 level indefinitely after 2020.

(a) What are the free cash flows of the tech company from 2017 to 2020? (Note: you can assume that net working capital in 2016 is 0)

(b) You see that the tech company operates with no debt, and is therefore all-equity financed. You look at the correlation between the market and the companys stock returns, and calculate that its stock beta is 0.9. What is the appropriate discount rate with which to discount the companys cash flows by?

(c) What is the terminal value of the company as of 2020? What is the present value of this terminal value?

(d) What is the total enterprise value of the company in 2016?

2017 2018 2019 2020 EBIT 5,000 7,000 8,000 9,000 CAPEX 3,000 3,500 4,000 5,000 Depreciation 100 300 400 600 Accounts Receivable 600 800 1,000 1,000 Accounts Payable 400 900 1,000 1,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started