Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the CEO of Acquifix, a company that wants to acquire a controlling interest (that is, over 50 per cent of the stock)

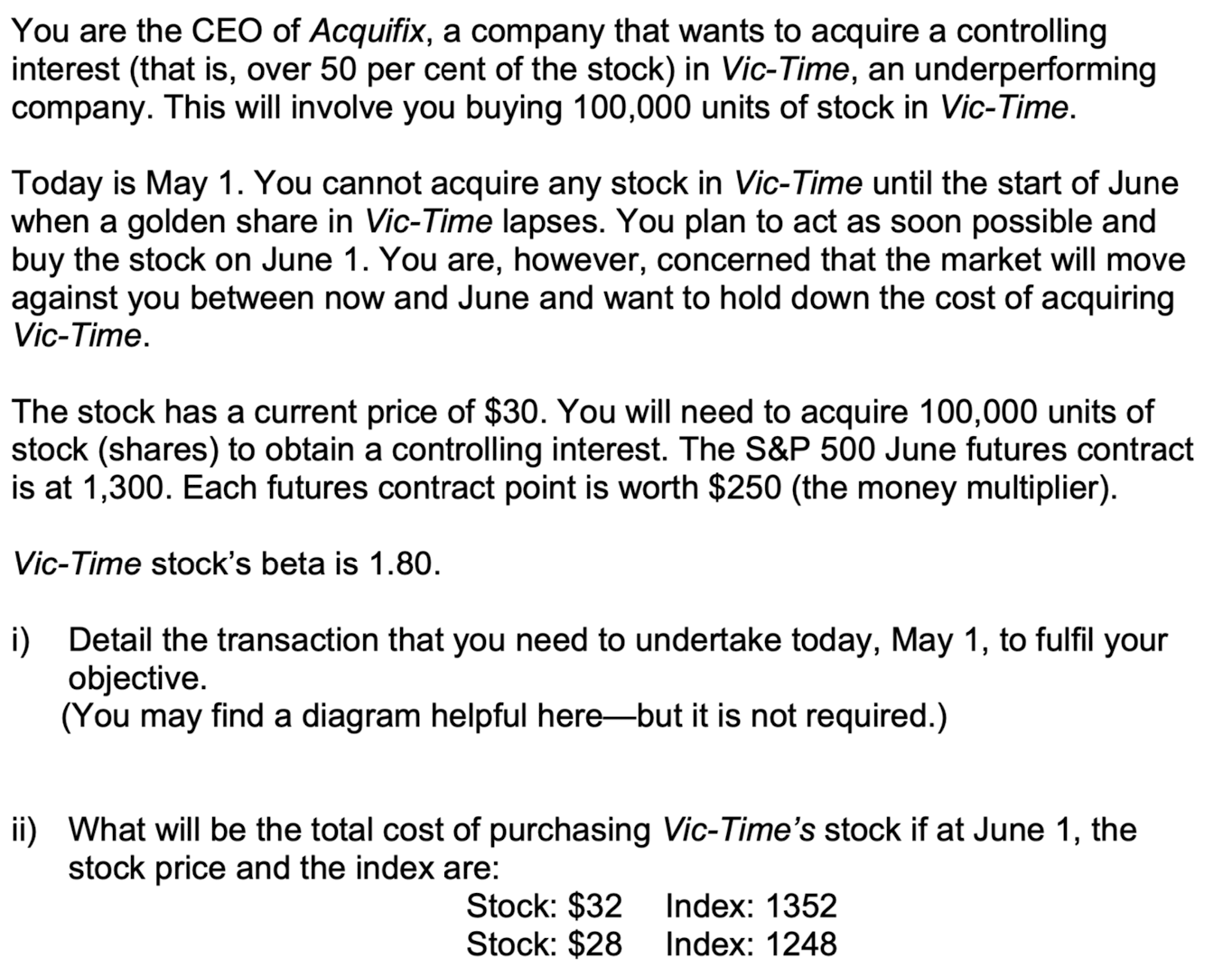

You are the CEO of Acquifix, a company that wants to acquire a controlling interest (that is, over 50 per cent of the stock) in Vic-Time, an underperforming company. This will involve you buying 100,000 units of stock in Vic-Time. Today is May 1. You cannot acquire any stock in Vic-Time until the start of June when a golden share in Vic-Time lapses. You plan to act as soon possible and buy the stock on June 1. You are, however, concerned that the market will move against you between now and June and want to hold down the cost of acquiring Vic-Time. The stock has a current price of $30. You will need to acquire 100,000 units of stock (shares) to obtain a controlling interest. The S&P 500 June futures contract is at 1,300. Each futures contract point is worth $250 (the money multiplier). Vic-Time stock's beta is 1.80. i) Detail the transaction that you need to undertake today, May 1, to fulfil your objective. (You may find a diagram helpful here-but it is not required.) ii) What will be the total cost of purchasing Vic-Time's stock if at June 1, the stock price and the index are: Stock: $32 Stock: $28 Index: 1352 Index: 1248

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER i To hedge against potential market movements and hold down the cost of acquiring VicTime you ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started