Answered step by step

Verified Expert Solution

Question

1 Approved Answer

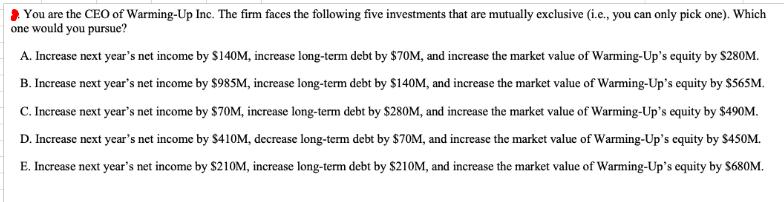

You are the CEO of Warming-Up Inc. The firm faces the following five investments that are mutually exclusive (i.e., you can only pick one).

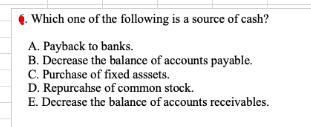

You are the CEO of Warming-Up Inc. The firm faces the following five investments that are mutually exclusive (i.e., you can only pick one). Which one would you pursue? A. Increase next year's net income by $140M, increase long-term debt by $70M, and increase the market value of Warming-Up's equity by $280M. B. Increase next year's net income by $985M, increase long-term debt by $140M, and increase the market value of Warming-Up's equity by $565M. C. Increase next year's net income by $70M, increase long-term debt by $280M, and increase the market value of Warming-Up's equity by $490M. D. Increase next year's net income by $410M, decrease long-term debt by $70M, and increase the market value of Warming-Up's equity by $450M. E. Increase next year's net income by $210M, increase long-term debt by $210M, and increase the market value of Warming-Up's equity by S680M. . Which one of the following is a source of cash? A. Payback to banks. B. Decrease the balance of accounts payable. C. Purchase of fixed asssets. D. Repurcahse of common stock. E. Decrease the balance of accounts receivables.

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

As the CEO of WarmingUp Inc I would pursue Investment B Investment B has the largest increase in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started