Answered step by step

Verified Expert Solution

Question

1 Approved Answer

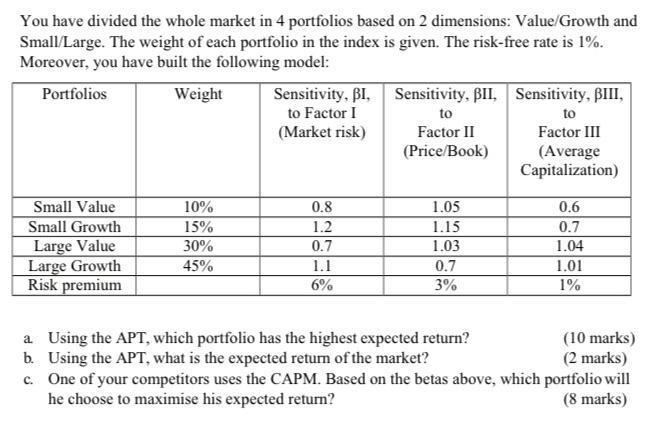

You have divided the whole market in 4 portfolios based on 2 dimensions: Value/Growth and Small/Large. The weight of each portfolio in the index

You have divided the whole market in 4 portfolios based on 2 dimensions: Value/Growth and Small/Large. The weight of each portfolio in the index is given. The risk-free rate is 1%. Moreover, you have built the following model: Portfolios Weight Small Value Small Growth Large Value Large Growth Risk premium 10% 15% 30% 45% Sensitivity, BI. to Factor I (Market risk) 0.8 1.2 0.7 1.1 6% Sensitivity, BII, Sensitivity, BIII, to to Factor II Factor III (Price/Book) (Average Capitalization) 1.05 1.15 1.03 0.7 3% 0.6 0.7 1.04 1.01 1% a. Using the APT, which portfolio has the highest expected return? (10 marks) (2 marks) b. Using the APT, what is the expected return of the market? c. One of your competitors uses the CAPM. Based on the betas above, which portfolio will he choose to maximise his expected return? (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The APT formula for expected return is Expected Return RiskFree Rate Sensitivity to Factor I Risk ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started