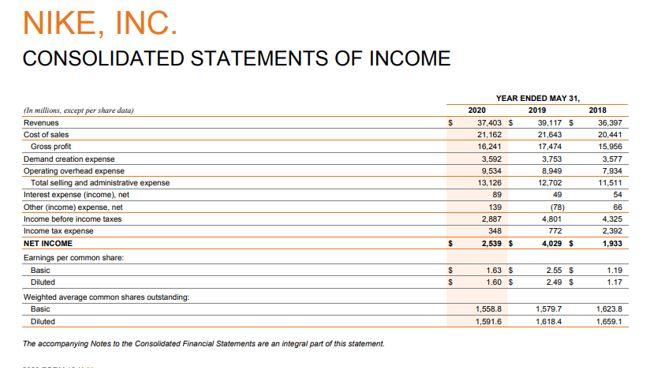

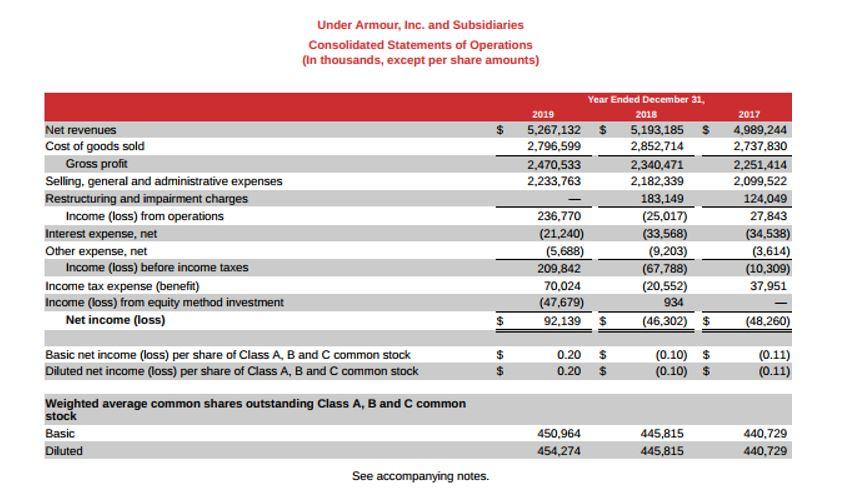

You are the CFO of an athletic apparel company). One hour before the board of directors meeting and you just received the following message from one of the directors: After reviewing our recent operating results, it seems Nike is beating us in relation to almost every financial metric related to profitability and efficiency. Please share your thoughts with the entire board when we meet later today.

Required: Please develop talking points and an overall conclusion related to the board members viewpoint for your use during the discussion with the entire board. Following is the ONLY information for you company and Nike you have available to complete the assessment. Remember, you do not have a lot of time so focus on what you think are the key metrics that should be addressed and commented on.

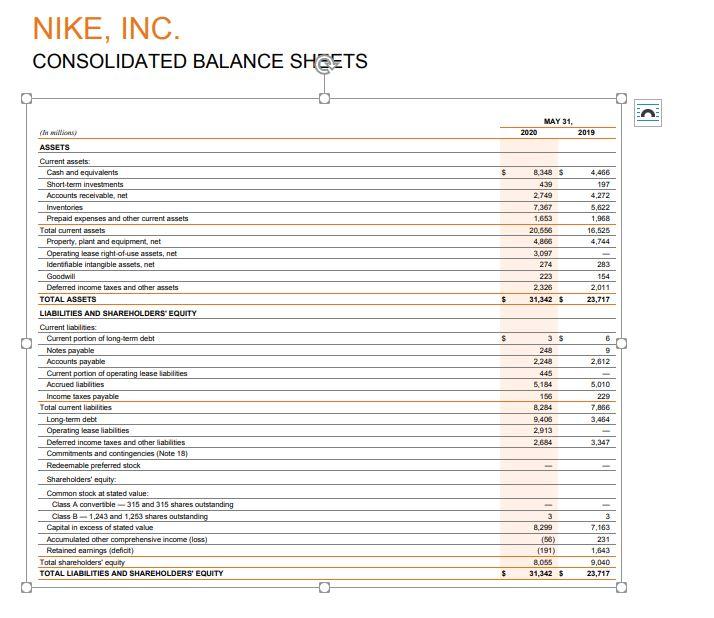

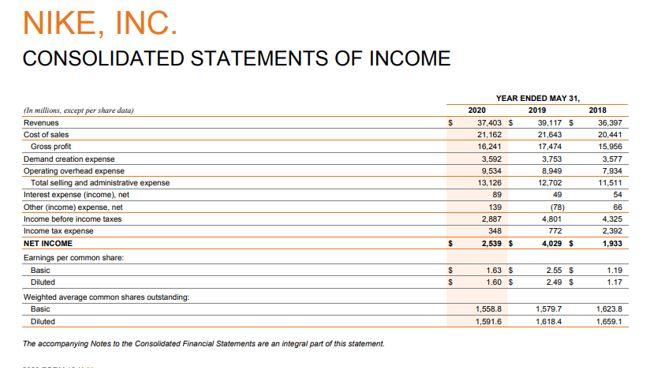

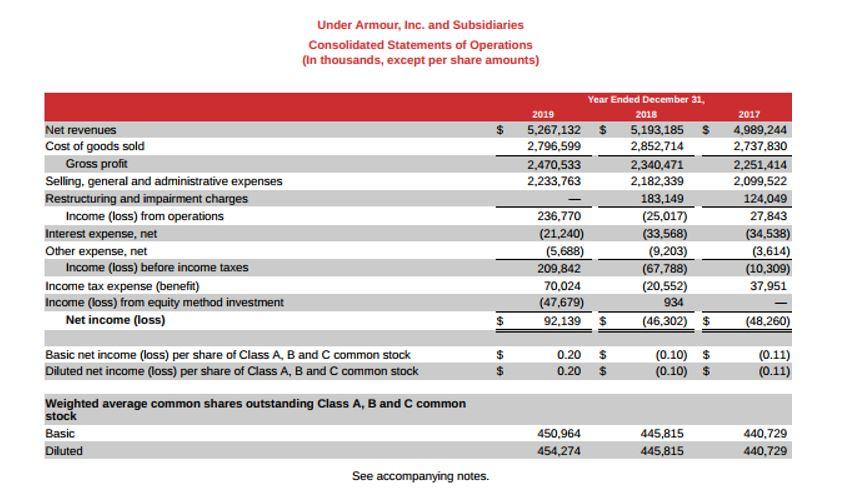

NIKE, INC. CONSOLIDATED BALANCE SHEETS MAY 31, 2020 2019 $ 8.348 439 2.749 7.367 1,653 20.556 4.805 3,097 274 223 2.328 31,342 6 4,466 197 4,272 5,622 1,968 16,525 4,744 283 154 2,011 23,717 $ $ ASSETS Current assets Cash and equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Property, plant and equipment, net Operating lease right of use assets, net Identifiable intangible assets.net Goodwill Deferred income taxes and other assets TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Current portion of long term debt Notes payable Accounts payable Current portion of aperating lease abilities Accrued liabilities Income taxes payable Total current liabilities Long-term debt Operating lease liabilities Deferred income taxes and other liabilities Commitments and contingencies (Note 18) Redeemable preferred stock Shareholders' equity Common stock at stated value Class A convertible --- 315 and 315 shares outstanding Class B-1,243 and 1,253 shares outstanding Capital in excess of stated value Accumulated other comprehensive income (loss) Retained eamings (deficit) Total shareholders' equity TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 6 9 2,612 3 5 248 2.248 445 5.184 156 8,284 9,406 2.913 2 684 5,010 229 7,866 3,464 3,347 3 8,299 156) (191) 8,055 31,342 $ 7,163 231 1,643 9,040 23,717 $ NIKE, INC. CONSOLIDATED STATEMENTS OF INCOME S Inim, except per skure data Revenues Cost of sales Gross profit Demand creation expense Operating overhead expense Total selling and administrative expense Interest expense (income), net Other (income) expense, net Income before income taxes Income tax expense NET INCOME Earnings per common share Basic Diluted Weighted average common shares outstanding. Basic Diluted YEAR ENDED MAY 31, 2020 2019 37 403 5 39.117 5 21.162 21.643 16,241 17,474 3.592 3.753 9.534 8.949 13.126 12.702 89 139 (78) 2.887 4.801 348 772 2,539 $ 4,029 $ 2018 36.397 20.441 15.956 3.577 7.934 11,511 54 86 4.325 2.392 1.933 $ s $ 1.63 $ 1.60 $ 2.55 S 2.49 $ 1.19 1.17 1.558.8 1,591.6 1,579.7 1,618,4 1,623.8 1.659.1 The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement Under Armour, Inc. and Subsidiaries Consolidated Statements of Operations (In thousands, except per share amounts) Net revenues Cost of goods sold Gross profit Selling general and administrative expenses Restructuring and impairment charges Income (loss) from operations Interest expense, net Other expense, net Income (loss) before income taxes Income tax expense (benefit) Income (loss) from equity method investment Net income (loss) Year Ended December 31, 2019 2018 2017 5,267,132 $ 5,193,185 $ 4,989,244 2,796,599 2,852,714 2,737,830 2,470,533 2,340,471 2,251,414 2,233.763 2,182,339 2,099,522 183,149 124.049 236,770 (25,017) 27,843 (21,240) (33,568) (34,538) (5.688) (9.203) (3.614) 209,842 (67,788) (10,309) 70,024 (20,552) 37.951 (47,679) 934 92,139 $ (46,302) $ (48,260) Basic net income (loss) per share of Class A, B and C common stock Diluted net income (loss) per share of Class A, B and C common stock 0.20 0.20 $ $ (0.10) $ (0.10) $ (0.11) (0.11) Weighted average common shares outstanding Class A, B and C common stock Basic Diluted See accompanying notes. 450.964 454,274 445,815 445,815 440.729 440,729 NIKE, INC. CONSOLIDATED BALANCE SHEETS MAY 31, 2020 2019 $ 8.348 439 2.749 7.367 1,653 20.556 4.805 3,097 274 223 2.328 31,342 6 4,466 197 4,272 5,622 1,968 16,525 4,744 283 154 2,011 23,717 $ $ ASSETS Current assets Cash and equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Property, plant and equipment, net Operating lease right of use assets, net Identifiable intangible assets.net Goodwill Deferred income taxes and other assets TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Current portion of long term debt Notes payable Accounts payable Current portion of aperating lease abilities Accrued liabilities Income taxes payable Total current liabilities Long-term debt Operating lease liabilities Deferred income taxes and other liabilities Commitments and contingencies (Note 18) Redeemable preferred stock Shareholders' equity Common stock at stated value Class A convertible --- 315 and 315 shares outstanding Class B-1,243 and 1,253 shares outstanding Capital in excess of stated value Accumulated other comprehensive income (loss) Retained eamings (deficit) Total shareholders' equity TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 6 9 2,612 3 5 248 2.248 445 5.184 156 8,284 9,406 2.913 2 684 5,010 229 7,866 3,464 3,347 3 8,299 156) (191) 8,055 31,342 $ 7,163 231 1,643 9,040 23,717 $ NIKE, INC. CONSOLIDATED STATEMENTS OF INCOME S Inim, except per skure data Revenues Cost of sales Gross profit Demand creation expense Operating overhead expense Total selling and administrative expense Interest expense (income), net Other (income) expense, net Income before income taxes Income tax expense NET INCOME Earnings per common share Basic Diluted Weighted average common shares outstanding. Basic Diluted YEAR ENDED MAY 31, 2020 2019 37 403 5 39.117 5 21.162 21.643 16,241 17,474 3.592 3.753 9.534 8.949 13.126 12.702 89 139 (78) 2.887 4.801 348 772 2,539 $ 4,029 $ 2018 36.397 20.441 15.956 3.577 7.934 11,511 54 86 4.325 2.392 1.933 $ s $ 1.63 $ 1.60 $ 2.55 S 2.49 $ 1.19 1.17 1.558.8 1,591.6 1,579.7 1,618,4 1,623.8 1.659.1 The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement Under Armour, Inc. and Subsidiaries Consolidated Statements of Operations (In thousands, except per share amounts) Net revenues Cost of goods sold Gross profit Selling general and administrative expenses Restructuring and impairment charges Income (loss) from operations Interest expense, net Other expense, net Income (loss) before income taxes Income tax expense (benefit) Income (loss) from equity method investment Net income (loss) Year Ended December 31, 2019 2018 2017 5,267,132 $ 5,193,185 $ 4,989,244 2,796,599 2,852,714 2,737,830 2,470,533 2,340,471 2,251,414 2,233.763 2,182,339 2,099,522 183,149 124.049 236,770 (25,017) 27,843 (21,240) (33,568) (34,538) (5.688) (9.203) (3.614) 209,842 (67,788) (10,309) 70,024 (20,552) 37.951 (47,679) 934 92,139 $ (46,302) $ (48,260) Basic net income (loss) per share of Class A, B and C common stock Diluted net income (loss) per share of Class A, B and C common stock 0.20 0.20 $ $ (0.10) $ (0.10) $ (0.11) (0.11) Weighted average common shares outstanding Class A, B and C common stock Basic Diluted See accompanying notes. 450.964 454,274 445,815 445,815 440.729 440,729