Question

You are the CFO of Brutus Co. and expect your firm to generate FCFs of $450,000 per year (starting next year) for 10 years.

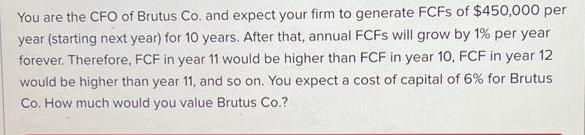

You are the CFO of Brutus Co. and expect your firm to generate FCFs of $450,000 per year (starting next year) for 10 years. After that, annual FCFS will grow by 1% per year forever. Therefore, FCF in year 11 would be higher than FCF in year 10, FCF in year 12 would be higher than year 11, and so on. You expect a cost of capital of 6% for Brutus Co. How much would you value Brutus Co.?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To value Brutus Co we can use the discounted cash flow DCF method by calculating the present value o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Microeconomics An Intuitive Approach with Calculus

Authors: Thomas Nechyba

1st edition

538453257, 978-0538453257

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App