Answered step by step

Verified Expert Solution

Question

1 Approved Answer

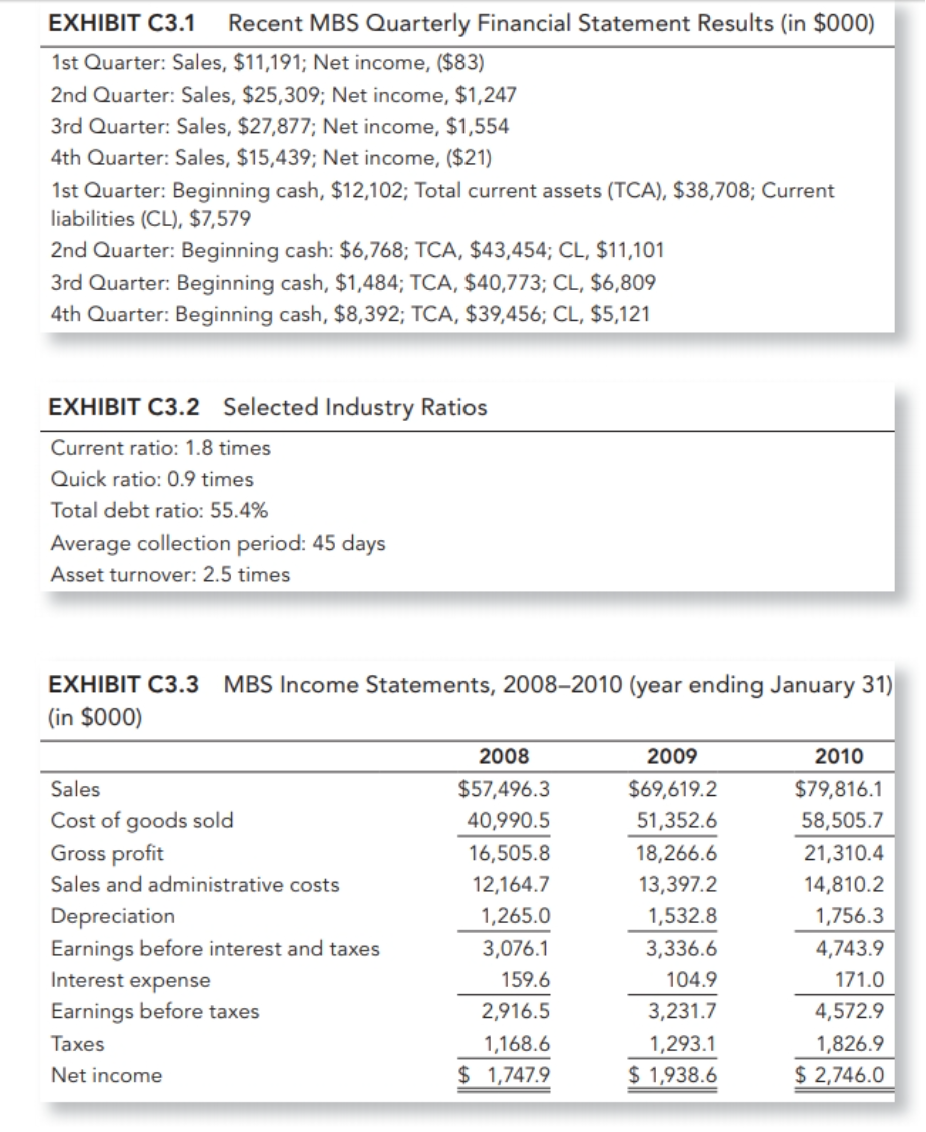

You are the CFO of Miller Building Supplies. Using the financial exhibits to determine the working capital required and actual level for each quarter of

You are the CFO of Miller Building Supplies. Using the financial exhibits to determine the working capital required and actual level for each quarter of the year for the firm, please help with the following questions.

- What challenges does Miller Building Supplies face in establishing a monthly cash budget?

- What would a cash budget provide Miller Building Supplies, if completed successfully?

- What are some working capital options that might improve the firm's cash position and profit?

- How might the company's accounts receivable choices impact the company?

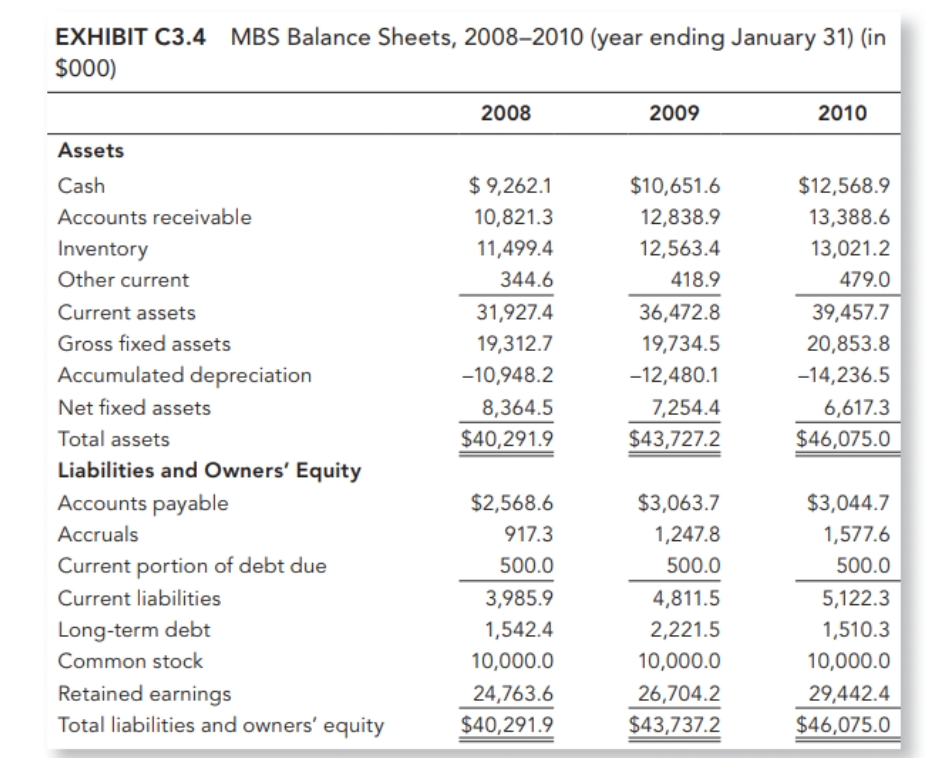

EXHIBIT C3.1 Recent MBS Quarterly Financial Statement Results (in \$000) 1st Quarter: Sales, \$11,191; Net income, (\$83) 2nd Quarter: Sales, \$25,309; Net income, \$1,247 3rd Quarter: Sales, \$27,877; Net income, \$1,554 4th Quarter: Sales, \$15,439; Net income, (\$21) 1st Quarter: Beginning cash, \$12,102; Total current assets (TCA), \$38,708; Current liabilities (CL), \$7,579 2nd Quarter: Beginning cash: \$6,768; TCA, \$43,454; CL, \$11,101 3rd Quarter: Beginning cash, $1,484; TCA, $40,773;CL,$6,809 4th Quarter: Beginning cash, $8,392; TCA, $39,456; CL, $5,121 EXHIBIT C3.2 Selected Industry Ratios Current ratio: 1.8 times Quick ratio: 0.9 times Total debt ratio: 55.4% Average collection period: 45 days Asset turnover: 2.5 times EXHIBIT C3.3 MBS Income Statements, 2008-2010 (year ending January 31) (in \$000) \begin{tabular}{|c|c|c|c|} \hline & 2008 & 2009 & 2010 \\ \hline Sales & $57,496.3 & $69,619.2 & $79,816.1 \\ \hline Cost of goods sold & 40,990.5 & 51,352.6 & 58,505.7 \\ \hline Gross profit & 16,505.8 & 18,266.6 & 21,310.4 \\ \hline Sales and administrative costs & 12,164.7 & 13,397.2 & 14,810.2 \\ \hline Depreciation & 1,265.0 & 1,532.8 & 1,756.3 \\ \hline Earnings before interest and taxes & 3,076.1 & 3,336.6 & 4,743.9 \\ \hline Interest expense & 159.6 & 104.9 & 171.0 \\ \hline Earnings before taxes & 2,916.5 & 3,231.7 & 4,572.9 \\ \hline Taxes & 1,168.6 & 1,293.1 & 1,826.9 \\ \hline Net income & $1,747.9 & $1,938.6 & $2,746.0 \\ \hline \end{tabular} EXHIBIT C3.4 MBS Balance Sheets. 2008-2010 (vear ending .lanuarv 31) (in

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started