Answered step by step

Verified Expert Solution

Question

1 Approved Answer

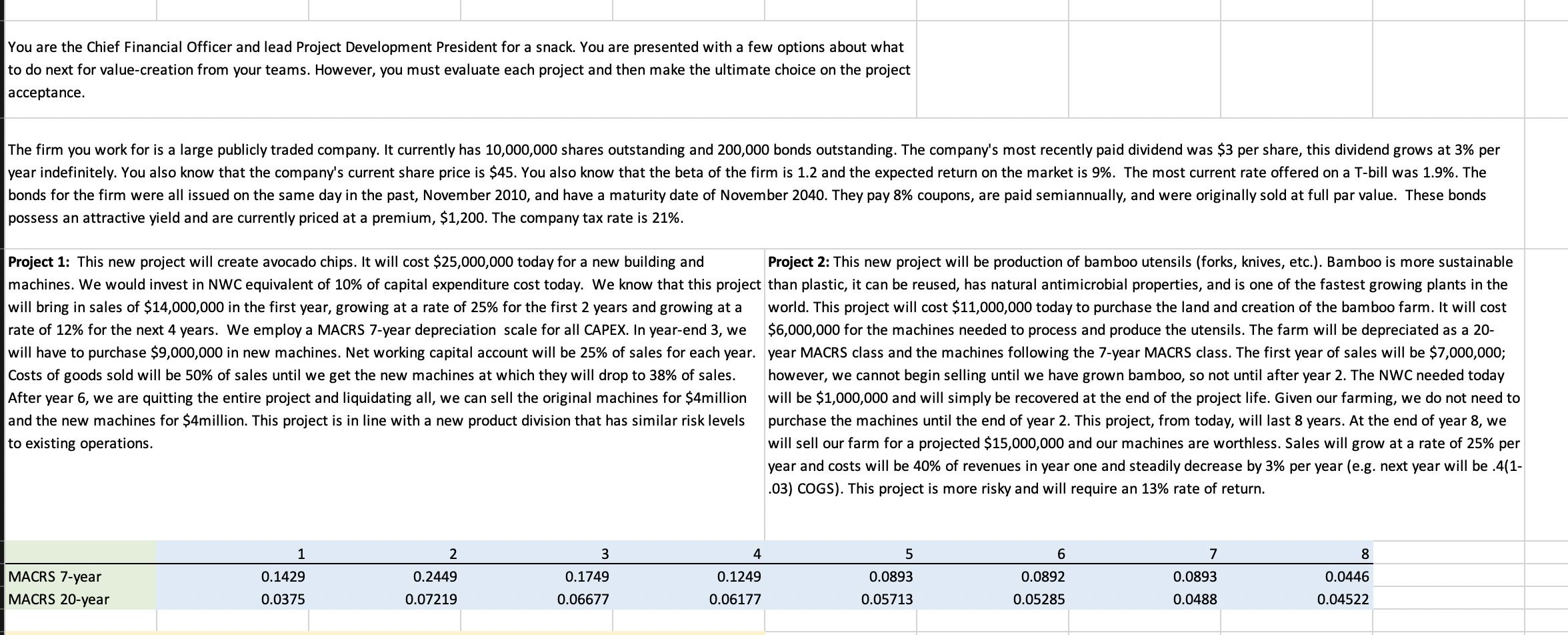

You are the Chief Financial Officer and lead Project Development President for a snack. You are presented with a few options about what to

You are the Chief Financial Officer and lead Project Development President for a snack. You are presented with a few options about what to do next for value-creation from your teams. However, you must evaluate each project and then make the ultimate choice on the project acceptance. The firm you work for is a large publicly traded company. It currently has 10,000,000 shares outstanding and 200,000 bonds outstanding. The company's most recently paid dividend was $3 per share, this dividend grows at 3% per year indefinitely. You also know that the company's current share price is $45. You also know that the beta of the firm is 1.2 and the expected return on the market is 9%. The most current rate offered on a T-bill was 1.9%. The bonds for the firm were all issued on the same day in the past, November 2010, and have a maturity date of November 2040. They pay 8% coupons, are paid semiannually, and were originally sold at full par value. These bonds possess an attractive yield and are currently priced at a premium, $1,200. The company tax rate is 21%. Project 1: This new project will create avocado chips. It will cost $25,000,000 today for a new building and machines. We would invest in NWC equivalent of 10% of capital expenditure cost today. We know that this project will bring in sales of $14,000,000 in the first year, at a rate of 25% for the first 2 years and growing at a rate of 12% for the next 4 years. We employ a MACRS 7-year depreciation scale for all CAPEX. In year-end 3, we will have to purchase $9,000,000 in new machines. Net working capital account will be 25% of sales for each year. Costs of goods sold will be 50% of sales until we get the new machines at which they will drop to 38% of sales. After year 6, we are quitting the entire project and liquidating all, we can sell the original machines for $4million and the new machines for $4million. This project is in line with a new product division that has similar risk levels to existing operations. MACRS 7-year MACRS 20-year 1 0.1429 0.0375 2 0.2449 0.07219 3 0.1749 0.06677 4 0.1249 0.06177 Project 2: This new project will be production of bamboo utensils (forks, knives, etc.). Bamboo is more sustainable than plastic, it can be reused, has natural antimicrobial properties, and is one of the fastest growing plants in the world. This project will cost $11,000,000 today to purchase the land and creation of the bamboo farm. It will cost $6,000,000 for the machines needed to process and produce the utensils. The farm will be depreciated as a 20- year MACRS class and the machines following the 7-year MACRS class. The first year of sales will be $7,000,000; however, we cannot begin selling until we have grown bamboo, so not until after year 2. The NWC needed today will be $1,000,000 and will simply be recovered at the end of the project life. Given our farming, we do not need to purchase the machines until the end of year 2. This project, from today, will last 8 years. At the end of year 8, we will sell our farm for a projected $15,000,000 and our machines are worthless. Sales will grow at a rate of 25% per year and costs will be 40% of revenues in year one and steadily decrease by 3% per year (e.g. next year will be .4(1- .03) COGS). This project is more risky and will require an 13% rate of return. 5 0.0893 0.05713 6 0.0892 0.05285 7 0.0893 0.0488 8 0.0446 0.04522 Which Project would you choose and why?

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations for Project 2 1 Calculate NPV for each period usin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started