Question

You are the chief financial officer (CFO) of Rich Man Company Inc. The company has performed well over the past year. After setting aside money

You are the chief financial officer (CFO) of Rich Man Company Inc. The company has performed well over the past year. After setting aside money for dividends for the shareholders you have 10,000,000 Riyals in cash. You need to decide what to do with all the money you made. A meeting with the heads of the finance departments is called and you asked them for their recommendations. You tell them that although the current year has been good, you dont know how the next year is going to be. You also explain that according to the companys current expansion plans, you will need 1,000,000 Riyals every year for the next ten years. When you asked for their opinions everything goes crazy and as expected, they cant agree about anything. From their presentations, you understand that the current market conditions are as follows:

- Evaluate each of the bonds provided in the case. Provide the expected price for each of the bonds in addition to the current yields

ignore the first long paragraph

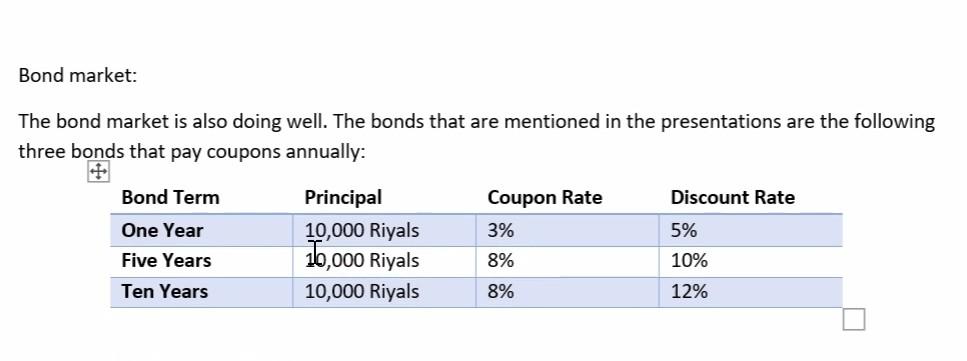

Bond market: The bond market is also doing well. The bonds that are mentioned in the presentations are the following three bonds that pay coupons annuallyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started