Answered step by step

Verified Expert Solution

Question

1 Approved Answer

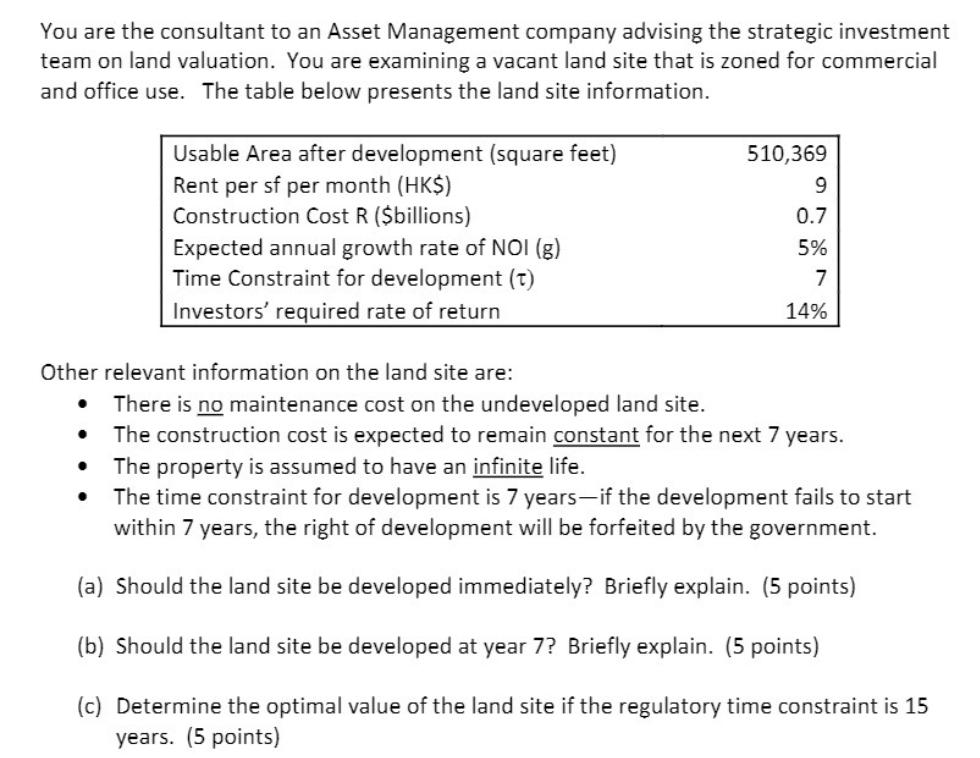

You are the consultant to an Asset Management company advising the strategic investment team on land valuation. You are examining a vacant land site

You are the consultant to an Asset Management company advising the strategic investment team on land valuation. You are examining a vacant land site that is zoned for commercial and office use. The table below presents the land site information. Other relevant information on the land site are: Usable Area after development (square feet) Rent per sf per month (HK$) Construction Cost R ($billions) Expected annual growth rate of NOI (g) Time Constraint for development (t) Investors' required rate of return 510,369 0.7 5% 7 14% There is no maintenance cost on the undeveloped land site. The construction cost is expected to remain constant for the next 7 years. The property is assumed to have an infinite life. The time constraint for development is 7 years-if the development fails to start within 7 years, the right of development will be forfeited by the government. (a) Should the land site be developed immediately? Briefly explain. (5 points) (b) Should the land site be developed at year 7? Briefly explain. (5 points) (c) Determine the optimal value of the land site if the regulatory time constraint is 15 years. (5 points)

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a No the land site should not be developed immediately The expected return on investment ROI o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started