Answered step by step

Verified Expert Solution

Question

1 Approved Answer

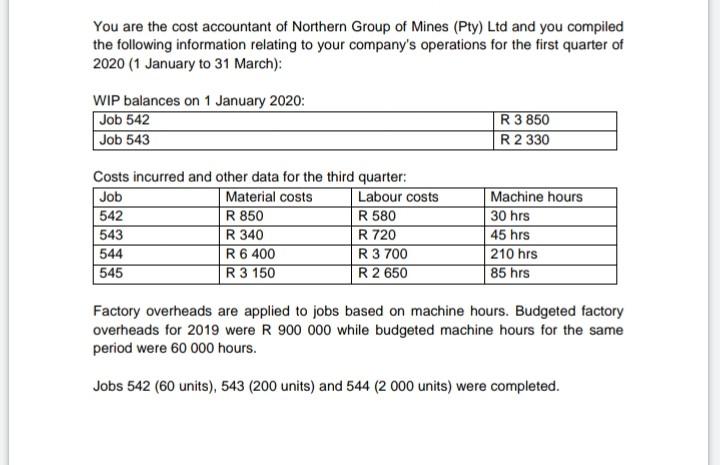

You are the cost accountant of Northern Group of Mines (Pty) Ltd and you compiled the following information relating to your company's operations for the

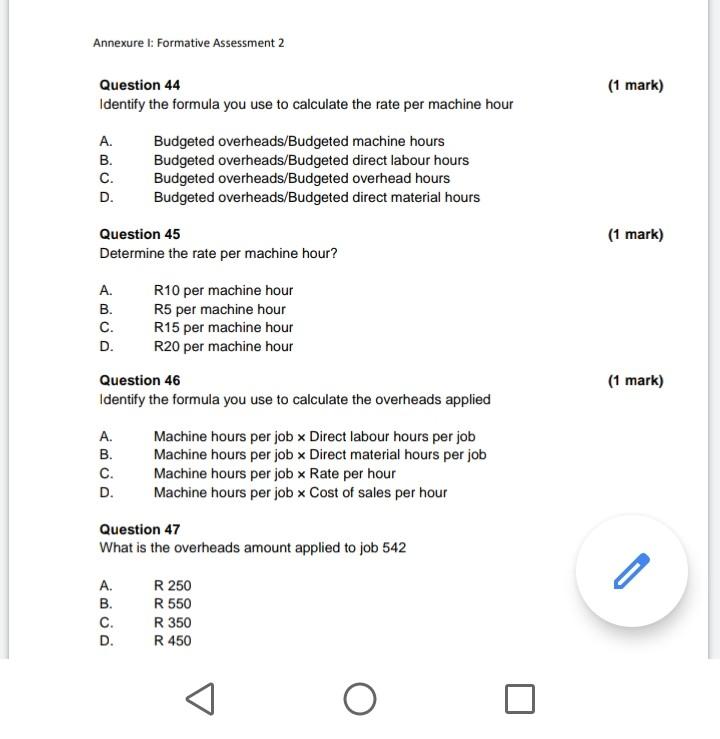

You are the cost accountant of Northern Group of Mines (Pty) Ltd and you compiled the following information relating to your company's operations for the first quarter of 2020 (1 January to 31 March): WIP balances on 1 January 2020: Job 542 Job 543 R 3 850 R2 330 Costs incurred and other data for the third quarter: Job Material costs Labour costs 542 R 850 R 580 543 R 340 R 720 544 R 6 400 R 3 700 545 R3 150 R2 650 Machine hours 30 hrs 45 hrs 210 hrs 85 hrs Factory overheads are applied to jobs based on machine hours. Budgeted factory overheads for 2019 were R 900 000 while budgeted machine hours for the same period were 60 000 hours. Jobs 542 (60 units), 543 (200 units) and 544 (2 000 units) were completed. Annexure : Formative Assessment 2 (1 mark) Question 44 Identify the formula you use to calculate the rate per machine hour A. Budgeted overheads/Budgeted machine hours B. Budgeted overheads/Budgeted direct labour hours C. Budgeted overheads/Budgeted overhead hours D. Budgeted overheads/Budgeted direct material hours Question 45 Determine the rate per machine hour? (1 mark) oe A. R10 per machine hour B. R5 per machine hour C. R15 per machine hour R20 per machine hour Question 46 Identify the formula you use to calculate the overheads applied D. (1 mark) A. B. C. Machine hours per job Direct labour hours per job Machine hours per job ~ Direct material hours per job Machine hours per job Rate per hour Machine hours per job Cost of sales per hour D. Question 47 What is the overheads amount applied to job 542 A. R 250 B. R 550 C. R 350 D. R 450 O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started