Answered step by step

Verified Expert Solution

Question

1 Approved Answer

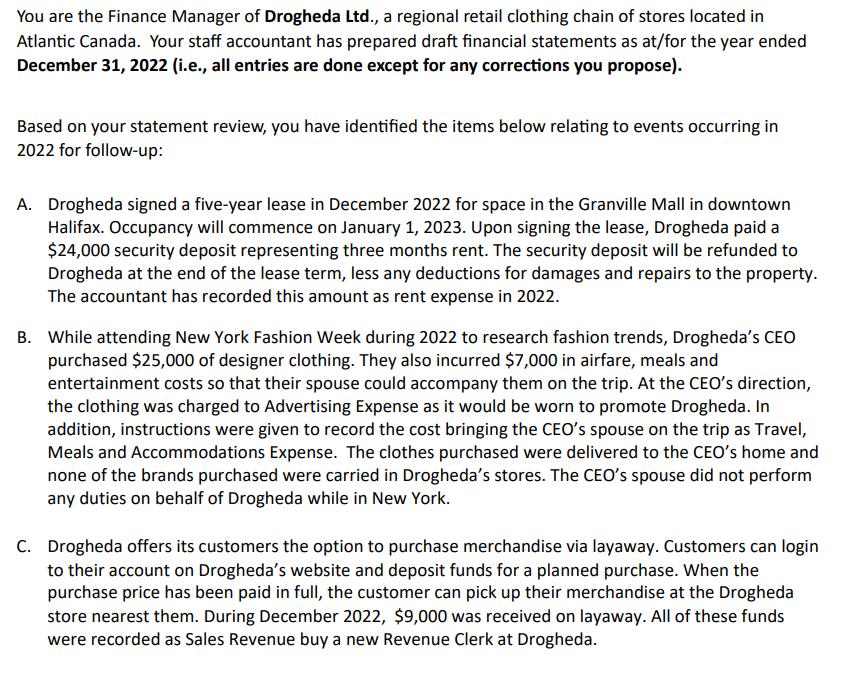

You are the Finance Manager of Drogheda Ltd., a regional retail clothing chain of stores located in Atlantic Canada. Your staff accountant has prepared

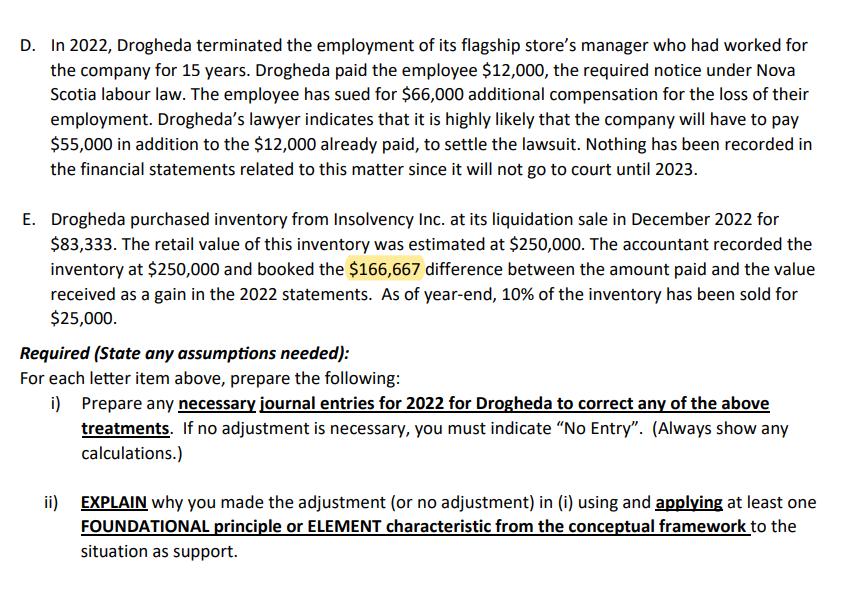

You are the Finance Manager of Drogheda Ltd., a regional retail clothing chain of stores located in Atlantic Canada. Your staff accountant has prepared draft financial statements as at/for the year ended December 31, 2022 (i.e., all entries are done except for any corrections you propose). Based on your statement review, you have identified the items below relating to events occurring in 2022 for follow-up: A. Drogheda signed a five-year lease in December 2022 for space in the Granville Mall in downtown Halifax. Occupancy will commence on January 1, 2023. Upon signing the lease, Drogheda paid a $24,000 security deposit representing three months rent. The security deposit will be refunded to Drogheda at the end of the lease term, less any deductions for damages and repairs to the property. The accountant has recorded this amount as rent expense in 2022. B. While attending New York Fashion Week during 2022 to research fashion trends, Drogheda's CEO purchased $25,000 of designer clothing. They also incurred $7,000 in airfare, meals and entertainment costs so that their spouse could accompany them on the trip. At the CEO's direction, the clothing was charged to Advertising Expense as it would be worn to promote Drogheda. In addition, instructions were given to record the cost bringing the CEO's spouse on the trip as Travel, Meals and Accommodations Expense. The clothes purchased were delivered to the CEO's home and none of the brands purchased were carried in Drogheda's stores. The CEO's spouse did not perform any duties on behalf of Drogheda while in New York. C. Drogheda offers its customers the option to purchase merchandise via layaway. Customers can login to their account on Drogheda's website and deposit funds for a planned purchase. When the purchase price has been paid in full, the customer can pick up their merchandise at the Drogheda store nearest them. During December 2022, $9,000 was received on layaway. All of these funds were recorded as Sales Revenue buy a new Revenue Clerk at Drogheda. D. In 2022, Drogheda terminated the employment of its flagship store's manager who had worked for the company for 15 years. Drogheda paid the employee $12,000, the required notice under Nova Scotia labour law. The employee has sued for $66,000 additional compensation for the loss of their employment. Drogheda's lawyer indicates that it is highly likely that the company will have to pay $55,000 in addition to the $12,000 already paid, to settle the lawsuit. Nothing has been recorded in the financial statements related to this matter since it will not go to court until 2023. E. Drogheda purchased inventory from Insolvency Inc. at its liquidation sale in December 2022 for $83,333. The retail value of this inventory was estimated at $250,000. The accountant recorded the inventory at $250,000 and booked the $166,667 difference between the amount paid and the value received as a gain in the 2022 statements. As of year-end, 10% of the inventory has been sold for $25,000. Required (State any assumptions needed): For each letter item above, prepare the following: i) Prepare any necessary journal entries for 2022 for Drogheda to correct any of the above treatments. If no adjustment is necessary, you must indicate "No Entry". (Always show any calculations.) ii) EXPLAIN why you made the adjustment (or no adjustment) in (i) using and applying at least one FOUNDATIONAL principle or ELEMENT characteristic from the conceptual framework to the situation as support.

Step by Step Solution

★★★★★

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

i Journal Entries A Lease Security Deposit Date December 31 2022 Debit Prepaid Rent Asset 24000 Credit Cash 24000 To record the prepaid rent security ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started