Question

You are the financial manager at Alpha Corporation. You have an outstanding interest rate swap with Beta Co. Your counterpart at Beta has indicated they

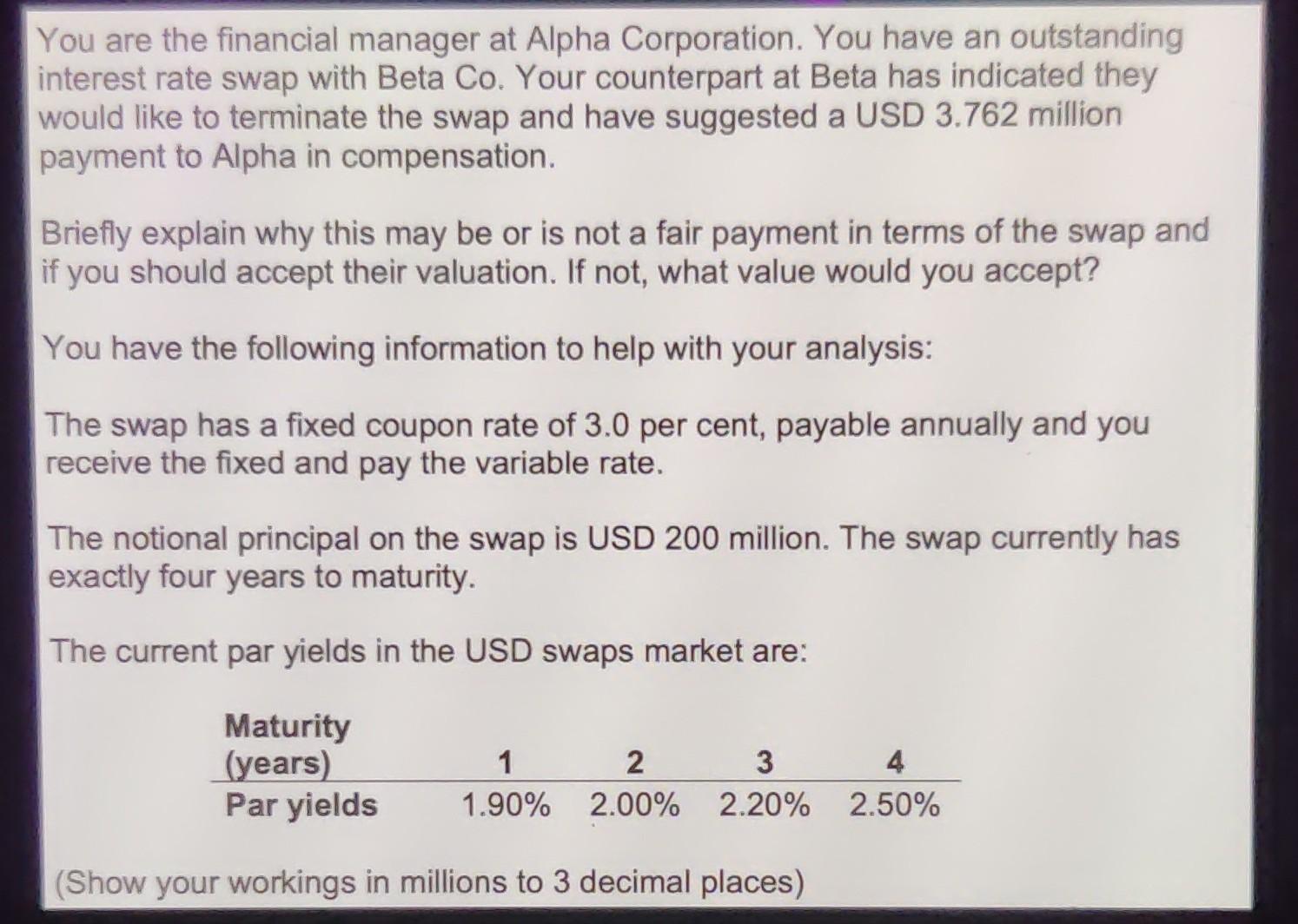

You are the financial manager at Alpha Corporation. You have an outstanding interest rate swap with Beta Co. Your counterpart at Beta has indicated they would like to terminate the swap and have suggested a USD 3.762 million payment to Alpha in compensation. Briefly explain why this may be or is not a fair payment in terms of the swap and if you should accept their valuation. If not, what value would you accept? You have the following information to help with your analysis: The swap has a fixed coupon rate of 3.0 per cent, payable annually and you receive the fixed and pay the variable rate. The notional principal on the swap is USD 200 million. The swap currently has exactly four years to maturity. The current par yields in the USD swaps market are: Maturity (years) Par yields (Show your workings in millions to 3 decimal places) 1 2 3 1.90% 2.00% 2.20% 2.50%

You are the financial manager at Alpha Corporation. You have an outstanding interest rate swap with Beta Co. Your counterpart at Beta has indicated they would like to terminate the swap and have suggested a USD 3.762 million payment to Alpha in compensation. Briefly explain why this may be or is not a fair payment in terms of the swap and if you should accept their valuation. If not, what value would you accept? You have the following information to help with your analysis: The swap has a fixed coupon rate of 3.0 per cent, payable annually and you receive the fixed and pay the variable rate. The notional principal on the swap is USD 200 million. The swap currently has exactly four years to maturity. The current par yields in the USD swaps market are: (Show your workings in millions to 3 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started