Question

You are the financial manager for SBP Inc. Three engineers come to you with projects. Adams project is expected to generate an IRR of 8.75%

You are the financial manager for SBP Inc. Three engineers come to you with projects. Adams project is expected to generate an IRR of 8.75% and costs $10,000,000. Barbaras project is expected to generate an IRR of 10% and costs $20,000,000. Chris project is expected to generate an IRR of 8.25% and costs $30,000,000. Which of the projects should you accept according to the IRR decision method? Hint: Try ranking the projects and plotting the MCC schedule.

A) You should accept Barbara's project and Adam's project

B) You should accept Barbaras project and Chris' project

C) You should accept Adam's project and Chris' project

D) You should accept all of the projects

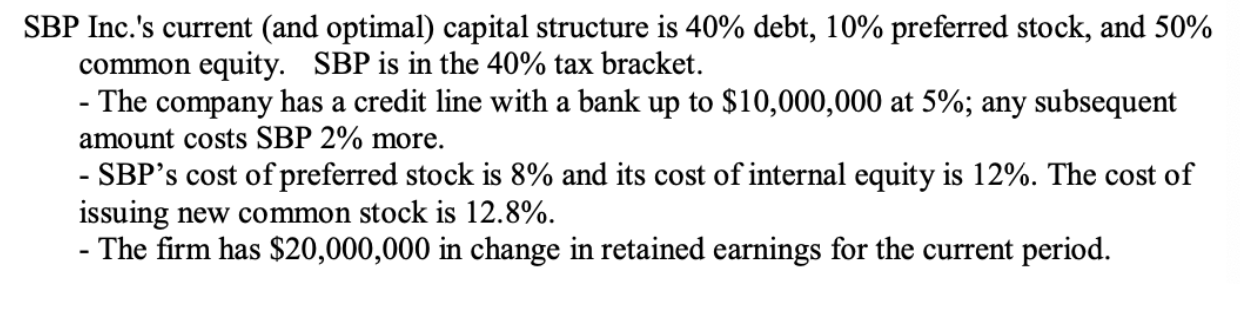

SBP Inc.'s current (and optimal) capital structure is 40% debt, 10% preferred stock, and 50% common equity. SBP is in the 40% tax bracket. - The company has a credit line with a bank up to $10,000,000 at 5%; any subsequent amount costs SBP 2% more. - SBP's cost of preferred stock is 8% and its cost of internal equity is 12%. The cost of issuing new common stock is 12.8%. - The firm has $20,000,000 in change in retained earnings for the current periodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started