Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the Financial Manager of a mid sized insurance company and have the responsibility to determine which projects your company will fund. In

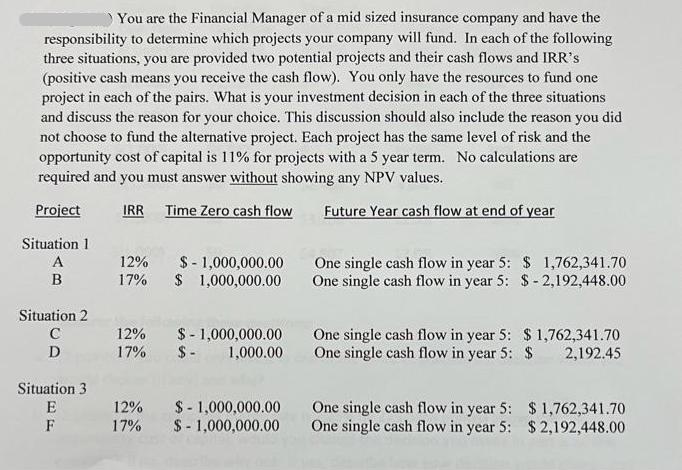

You are the Financial Manager of a mid sized insurance company and have the responsibility to determine which projects your company will fund. In each of the following three situations, you are provided two potential projects and their cash flows and IRR's (positive cash means you receive the cash flow). You only have the resources to fund one project in each of the pairs. What is your investment decision in each of the three situations and discuss the reason for your choice. This discussion should also include the reason you did not choose to fund the alternative project. Each project has the same level of risk and the opportunity cost of capital is 11% for projects with a 5 year term. No calculations are required and you must answer without showing any NPV values. Project IRR Time Zero cash flow Future Year cash flow at end of year Situation 1 A B Situation 2 C D Situation 3 E F 12% 17% 12% 17% 12% 17% $1,000,000.00 $1,000,000.00 $1,000,000.00 $- 1,000.00 $ - 1,000,000.00 $1,000,000.00 One single cash flow in year 5: $ 1,762,341.70 One single cash flow in year 5: $-2,192,448.00 One single cash flow in year 5: One single cash flow in year 5: One single cash flow in year 5: One single cash flow in year 5: $1,762,341.70 $ 2,192.45 $1,762,341.70 $2,192,448.00

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below In each situation the choice of project ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started