Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the financial manager of a recently built, 18-hole, golf course. The course was originally designed for people to walk around. Green fees

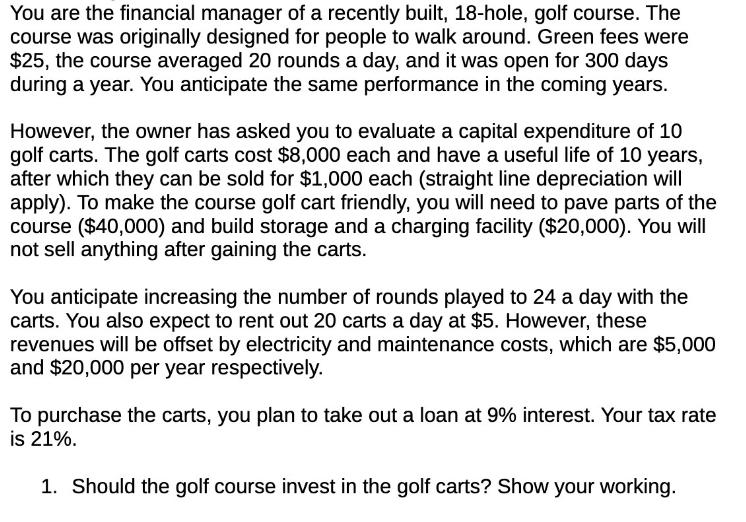

You are the financial manager of a recently built, 18-hole, golf course. The course was originally designed for people to walk around. Green fees were $25, the course averaged 20 rounds a day, and it was open for 300 days during a year. You anticipate the same performance in the coming years. However, the owner has asked you to evaluate a capital expenditure of 10 golf carts. The golf carts cost $8,000 each and have a useful life of 10 years, after which they can be sold for $1,000 each (straight line depreciation will apply). To make the course golf cart friendly, you will need to pave parts of the course ($40,000) and build storage and a charging facility ($20,000). You will not sell anything after gaining the carts. You anticipate increasing the number of rounds played to 24 a day with the carts. You also expect to rent out 20 carts a day at $5. However, these revenues will be offset by electricity and maintenance costs, which are $5,000 and $20,000 per year respectively. To purchase the carts, you plan to take out a loan at 9% interest. Your tax rate is 21%. 1. Should the golf course invest in the golf carts? Show your working.

Step by Step Solution

★★★★★

3.32 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether the golf course should invest in the golf carts we need to calculate the net pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started