Question

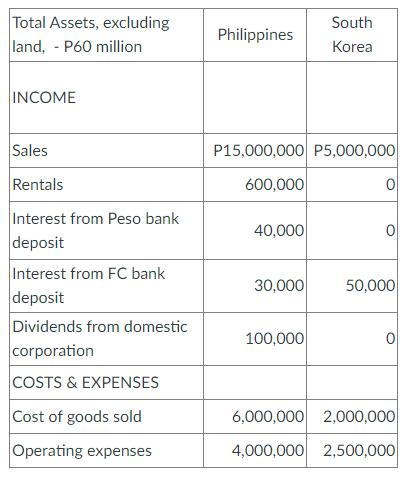

The taxpayer had the following data at the end of its 10th year of operations: Assuming that the taxpayer is a domestic corporation claiming itemized

The taxpayer had the following data at the end of its 10th year of operations:

Assuming that the taxpayer is a domestic corporation claiming itemized deductions, how much is the income tax due for the year?

choices

P741,400

P1,230.000

P1,537,500

P1,525,000

Total Assets, excluding land, P60 million INCOME Sales Rentals Interest from Peso bank deposit Interest from FC bank deposit Dividends from domestic corporation COSTS & EXPENSES Cost of goods sold Operating expenses Philippines P15,000,000 P5,000,000 600,000 40,000 30,000 South Korea 100,000 0 0 50,000 6,000,000 2,000,000 4,000,000 2,500,000

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Sales PH 15000000 Less Cost of Goods Sold PH 6000000 Sales South Korea ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Economics and Business Strategy

Authors: Michael Baye, Jeff Prince

8th edition

9780077802615, 73523224, 77802616, 978-0073523224

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App