Answered step by step

Verified Expert Solution

Question

1 Approved Answer

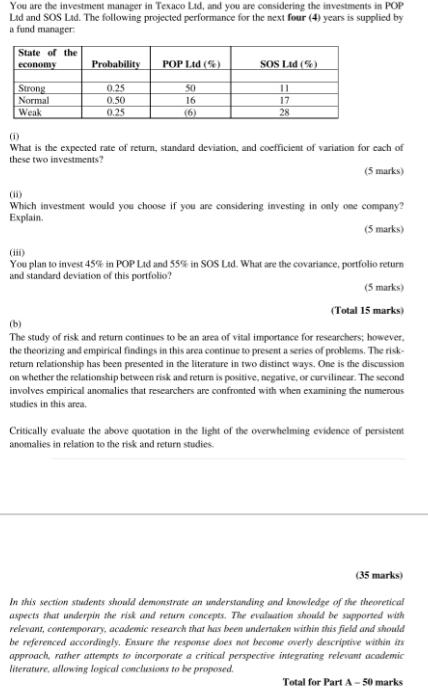

You are the investment manager in Texaco Ltd, and you are considering the investments in POP Lid and SOS Lad. The following projected performance

You are the investment manager in Texaco Ltd, and you are considering the investments in POP Lid and SOS Lad. The following projected performance for the next four (4) years is supplied by a fund manager: State of the economy Strong Normal Weak Probability 0.25 0.50 0.25 POP Ltd (5) 50 16 (6) SOS Ltd (%) 17 28 What is the expected rate of return, standard deviation, and coefficient of variation for each of these two investments? (5 marks) (16) Which investment would you choose if you are considering investing in only one company? Explain. (5 marks) You plan to invest 45% in POP Ltd and 55% in SOS Ltd. What are the covariance, portfolio return and standard deviation of this portfolio? (5 marks) (Total 15 marks) (b) The study of risk and return continues to be an area of vital importance for researchers; however, the theorizing and empirical findings in this area continue to present a series of problems. The risk- return relationship has been presented in the literature in two distinct ways. One is the discussion on whether the relationship between risk and return is positive, negative, or curvilinear. The second involves empirical anomalies that researchers are confronted with when examining the numerous studies in this area. Critically evaluate the above quotation in the light of the overwhelming evidence of persistent anomalies in relation to the risk and return studies. (35 marks) In this section students should demonstrate an understanding and knowledge of the theoretical aspects that underpin the risk and return concepts. The evaluation should be supported with relevant, contemporary, academic research that has been undertaken within this field and should be referenced accordingly. Ensure the se does not become overly descriptive within its approach, rather attempts to incorporate a critical perspective integrating relevant academic literature, allowing logical conclusions to be proposed. Total for Part A-50 marks

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The image youve presented appears to contain a question from an exam or assignment related to finance specifically about investments in two companies named POP Ltd and SOS Ltd The question has three p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started