Answered step by step

Verified Expert Solution

Question

1 Approved Answer

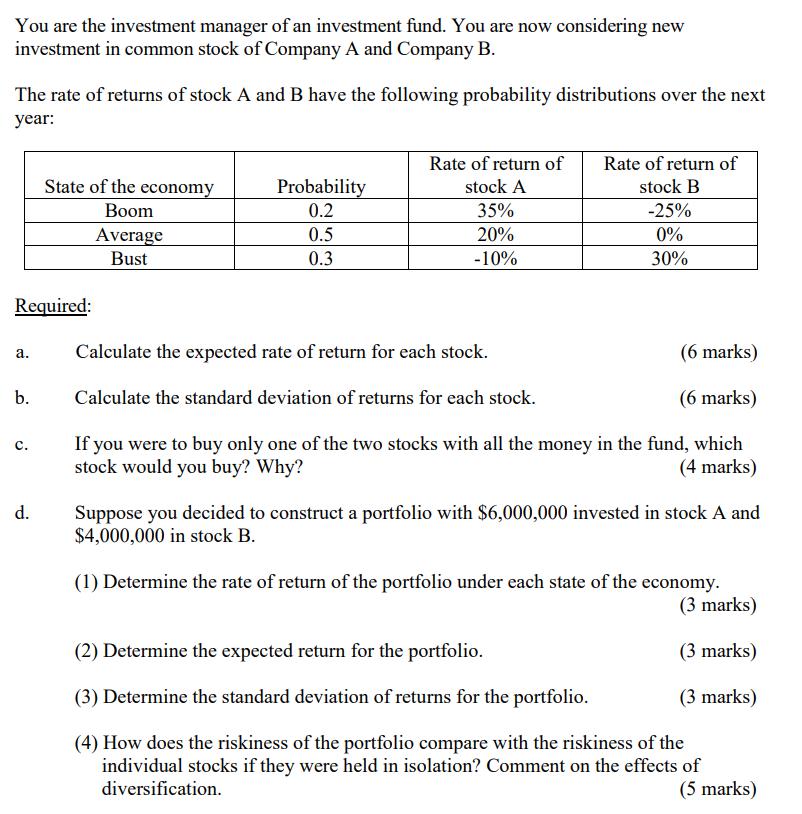

You are the investment manager of an investment fund. You are now considering new investment in common stock of Company A and Company B.

You are the investment manager of an investment fund. You are now considering new investment in common stock of Company A and Company B. The rate of returns of stock A and B have the following probability distributions over the next year: Rate of return of Rate of return of State of the economy Boom Probability stock A stock B 0.2 35% -25% Average 0.5 20% 0% Bust 0.3 -10% 30% Required: a. Calculate the expected rate of return for each stock. b. Calculate the standard deviation of returns for each stock. (6 marks) (6 marks) C. d. If you were to buy only one of the two stocks with all the money in the fund, which stock would you buy? Why? (4 marks) Suppose you decided to construct a portfolio with $6,000,000 invested in stock A and $4,000,000 in stock B. (1) Determine the rate of return of the portfolio under each state of the economy. (3 marks) (2) Determine the expected return for the portfolio. (3 marks) (3) Determine the standard deviation of returns for the portfolio. (3 marks) (4) How does the riskiness of the portfolio compare with the riskiness of the individual stocks if they were held in isolation? Comment on the effects of diversification. (5 marks)

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the expected rate of return for each stock we multiply the rate of return for each state of the economy by its corresponding probability and sum them up For Stock A Expected Rate of Ret...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started