Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the manager of a pension fund, BU Rocks Pension Plan (BRPP). BRPP's financial situation is: Assets = 10 million Duration of assets

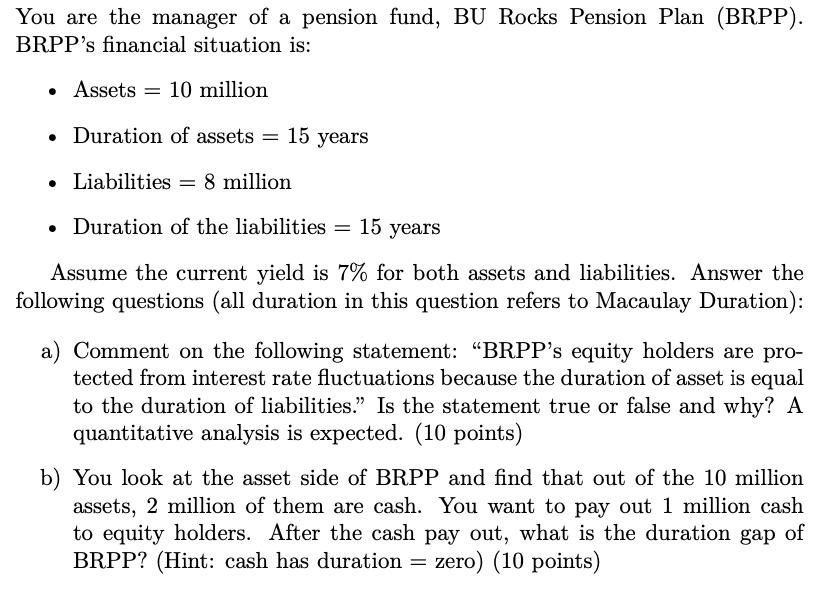

You are the manager of a pension fund, BU Rocks Pension Plan (BRPP). BRPP's financial situation is: Assets = 10 million Duration of assets = 15 years Liabilities = 8 million Duration of the liabilities = 15 years Assume the current yield is 7% for both assets and liabilities. Answer the following questions (all duration in this question refers to Macaulay Duration): a) Comment on the following statement: "BRPP's equity holders are pro- tected from interest rate fluctuations because the duration of asset is equal to the duration of liabilities." Is the statement true or false and why? A quantitative analysis is expected. (10 points) b) You look at the asset side of BRPP and find that out of the 10 million assets, 2 million of them are cash. You want to pay out 1 million cash to equity holders. After the cash pay out, what is the duration gap of BRPP? (Hint: cash has duration = zero) (10 points)

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

A The Macaulay duration is the weighted average term to maturity of the cash flows from the bond ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started