Answered step by step

Verified Expert Solution

Question

1 Approved Answer

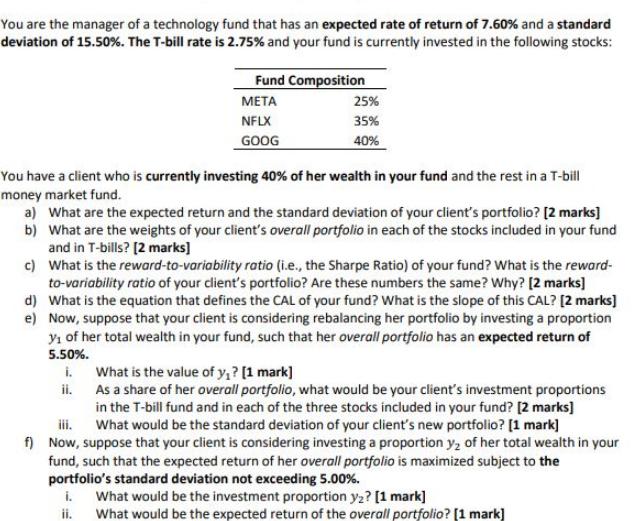

You are the manager of a technology fund that has an expected rate of return of 7.60% and a standard deviation of 15.50%. The

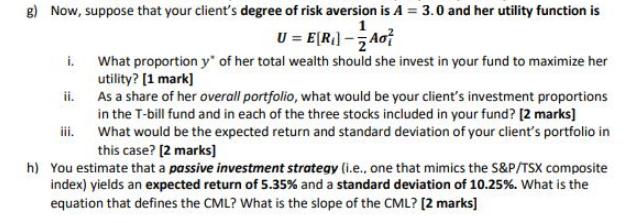

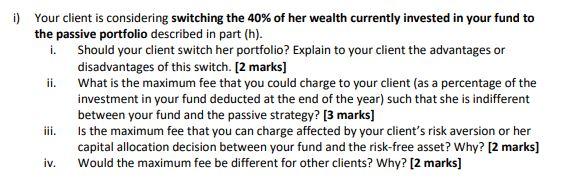

You are the manager of a technology fund that has an expected rate of return of 7.60% and a standard deviation of 15.50%. The T-bill rate is 2.75% and your fund is currently invested in the following stocks: Fund Composition i. ii. META NFLX GOOG 25% 35% 40% You have a client who is currently investing 40% of her wealth in your fund and the rest in a T-bill money market fund. a) what are the expected return and the standard deviation of your client's portfolio? [2 marks] What are the weights of your client's overall portfolio in each of the stocks included in your fund and in T-bills? [2 marks] b) c) What is the reward-to-variability ratio (i.e., the Sharpe Ratio) of your fund? What is the reward- to-variability ratio of your client's portfolio? Are these numbers the same? Why? [2 marks] d) What is the equation that defines the CAL of your fund? What is the slope of this CAL? [2 marks] e) Now, suppose that your client is considering rebalancing her portfolio by investing a proportion y of her total wealth in your fund, such that her overall portfolio has an expected return of 5.50%. What is the value of y? [1 mark] As a share of her overall portfolio, what would be your client's investment proportions in the T-bill fund and in each of the three stocks included in your fund? [2 marks] What would be the standard deviation of your client's new portfolio? [1 mark] iii. f) Now, suppose that your client is considering investing a proportion y of her total wealth in your fund, such that the expected return of her overall portfolio is maximized subject to the portfolio's standard deviation not exceeding 5.00%. i. What would be the investment proportion y? [1 mark] ii. What would be the expected return of the overall portfolio? [1 mark] g) Now, suppose that your client's degree of risk aversion is A = 3.0 and her utility function is 1 U = E(R] - Ao What proportion y" of her total wealth should she invest in your fund to maximize her utility? [1 mark] As a share of her overall portfolio, what would be your client's investment proportions in the T-bill fund and in each of the three stocks included in your fund? [2 marks] What would be the expected return and standard deviation of your client's portfolio in this case? [2 marks] h) You estimate that a passive investment strategy (i.e.. one that mimics the S&P/TSX composite index) yields an expected return of 5.35% and a standard deviation of 10.25%. What is the equation that defines the CML? What is the slope of the CML? [2 marks] i. ii. i) Your client is considering switching the 40% of her wealth currently invested in your fund to the passive portfolio described in part (h). i. Should your client switch her portfolio? Explain to your client the advantages or disadvantages of this switch. [2 marks] What is the maximum fee that you could charge to your client (as a percentage of the investment in your fund deducted at the end of the year) such that she is indifferent between your fund and the passive strategy? [3 marks] Is the maximum fee that you can charge affected by your client's risk aversion or her capital allocation decision between your fund and the risk-free asset? Why? [2 marks] Would the maximum fee be different for other clients? Why? [2 marks] ii. iii. iv.

Step by Step Solution

★★★★★

3.34 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Solution a The expected return and standard deviation of your clients portfolio are calculated as follows Expected return 040 760 060 275 550 Standard deviation sqrt0402 15502 0602 02 1550 b The weigh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started