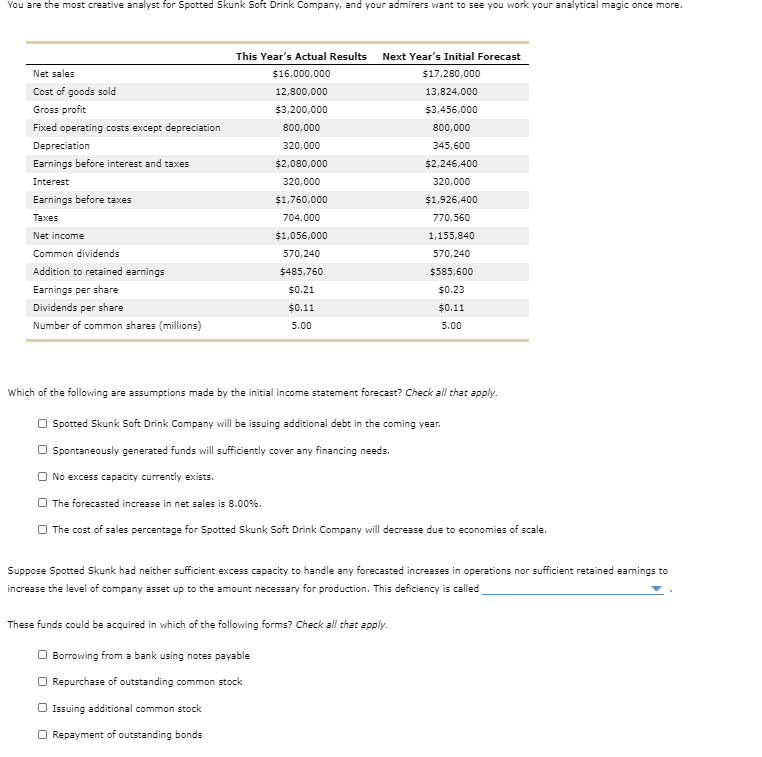

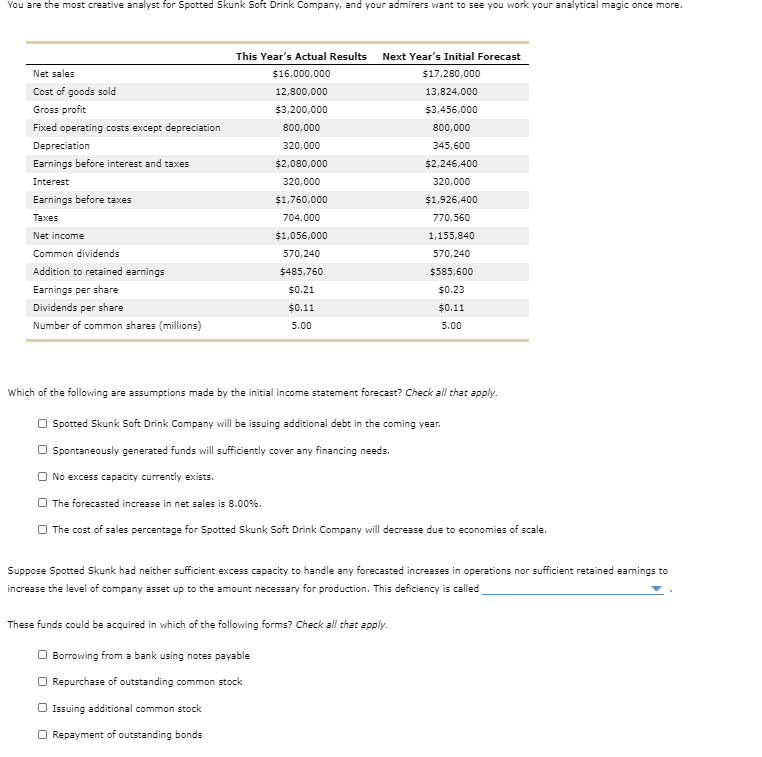

You are the most creative analyst for Spotted Skunk Soft Drink Company, and your admirers want to see you work your analytical magic once more. Next Year's Initial Forecast $17,280,000 This Year's Actual Results $16,000,000 12,800,000 $3,200,000 800,000 13,824,000 $3,456,000 800,000 345,600 320,000 $2,080,000 320,000 Net sales Cost of goods sold Gross profit Fixed operating costs except depreciation Depreciation Earnings before interest and taxes Interest Earnings before taxes Taxes Net income Common dividends Addition to retained earnings Earnings per share Dividends per share Number of common shares (millions) $1,760,000 704,000 $1,056,000 570,240 $2.246,400 320,000 $1.926,400 770,560 1,155,840 570,240 $485,760 $585,600 $0.23 $0.21 $0.11 5.00 $0.11 5.00 Which of the following are assumptions made by the initial income statement forecast? Check all that apply. Spotted Skunk Soft Drink Company will be issuing additional debt in the coming year. Spontaneously generated funds will sufficiently cover any financing needs. No excess capacity currently exists. The forecasted increase in net sales is 8.00%. The cost of sales percentage for Spotted Skunk Soft Drink Company will decrease due to economies of scale. Suppose Spotted Skunk had neither sufficient excess capacity to handle any forecasted increases in operations nor sufficient retained earnings to increase the level of company asset up to the amount necessary for production. This deficiency is called These funds could be acquired in which of the following forms? Check all that apply. Borrowing from a bank using notes payable Repurchase of outstanding common stock Issuing additional common stock Repayment of outstanding bonds You are the most creative analyst for Spotted Skunk Soft Drink Company, and your admirers want to see you work your analytical magic once more. Next Year's Initial Forecast $17,280,000 This Year's Actual Results $16,000,000 12,800,000 $3,200,000 800,000 13,824,000 $3,456,000 800,000 345,600 320,000 $2,080,000 320,000 Net sales Cost of goods sold Gross profit Fixed operating costs except depreciation Depreciation Earnings before interest and taxes Interest Earnings before taxes Taxes Net income Common dividends Addition to retained earnings Earnings per share Dividends per share Number of common shares (millions) $1,760,000 704,000 $1,056,000 570,240 $2.246,400 320,000 $1.926,400 770,560 1,155,840 570,240 $485,760 $585,600 $0.23 $0.21 $0.11 5.00 $0.11 5.00 Which of the following are assumptions made by the initial income statement forecast? Check all that apply. Spotted Skunk Soft Drink Company will be issuing additional debt in the coming year. Spontaneously generated funds will sufficiently cover any financing needs. No excess capacity currently exists. The forecasted increase in net sales is 8.00%. The cost of sales percentage for Spotted Skunk Soft Drink Company will decrease due to economies of scale. Suppose Spotted Skunk had neither sufficient excess capacity to handle any forecasted increases in operations nor sufficient retained earnings to increase the level of company asset up to the amount necessary for production. This deficiency is called These funds could be acquired in which of the following forms? Check all that apply. Borrowing from a bank using notes payable Repurchase of outstanding common stock Issuing additional common stock Repayment of outstanding bonds