Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the new general manager of Les Cuisines Elavie, inc, A newly formed company specializing in the manufacture and installation of High-end kitchen

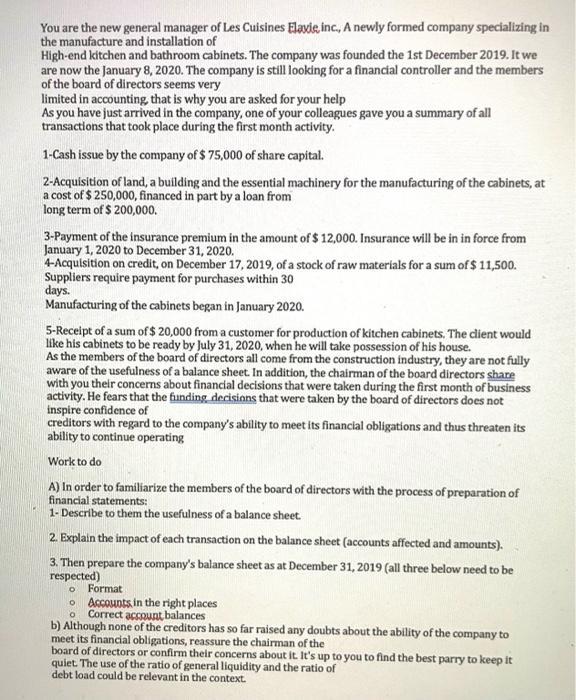

You are the new general manager of Les Cuisines Elavie, inc, A newly formed company specializing in the manufacture and installation of High-end kitchen and bathroom cabinets. The company was founded the 1st December 2019. It we are now the January 8, 2020. The company is still looking for a financial controller and the members of the board of directors seems very limited in accounting that is why you are asked for your help As you have just arrived in the company, one of your colleagues gave you a summary of all transactions that took place during the first month activity. 1-Cash issue by the company of $ 75,000 of share capital. 2-Acquisition of land, a building and the essential machinery for the manufacturing of the cabinets, at a cost of $ 250,000, financed in part by a loan from long term of $ 200,000. 3-Payment of the insurance premium in the amount of $ 12,000. Insurance will be in in force from January 1, 2020 to December 31, 2020. 4-Acquisition on credit, on December 17, 2019, of a stock of raw materials for a sum of $ 11,500. Suppliers require payment for purchases within 30 days. Manufacturing of the cabinets began in January 2020. 5-Recelpt of a sum of $ 20,000 from a customer for production of kitchen cabinets. The dient would like his cabinets to be ready by July 31, 2020, when he will take possession of his house. As the members of the board of directors all come from the construction industry, they are not fully aware of the usefulness of a balance sheet. In addition, the chairman of the board directors share with you their concerns about financial decisions that were taken during the first month of business activity. He fears that the funding decisions that were taken by the board of directors does not inspire confidence of creditors with regard to the company's ability to meet its financial obligations and thus threaten its ability to continue operating Work to do A) In order to familiarize the members of the board of directors with the process of preparation of financial statements: 1- Describe to them the usefulness of a balance sheet. 2. Explain the impact of each transaction on the balance sheet (accounts affected and amounts). 3. Then prepare the company's balance sheet as at December 31, 2019 (all three below need to be respected) Format o Accounts in the right places Correct account balances b) Although none of the creditors has so far raised any doubts about the ability of the company to meet its financial obligations, reassure the chairman of the board of directors or confirm their concerns about it. It's up to you to find the best parry to keep it quiet. The use of the ratio of general liquidity and the ratio of debt load could be relevant in the context. of

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 The value of a balance sheet Simply said a balancesheet is a statement that shows a companys finan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started