Answered step by step

Verified Expert Solution

Question

1 Approved Answer

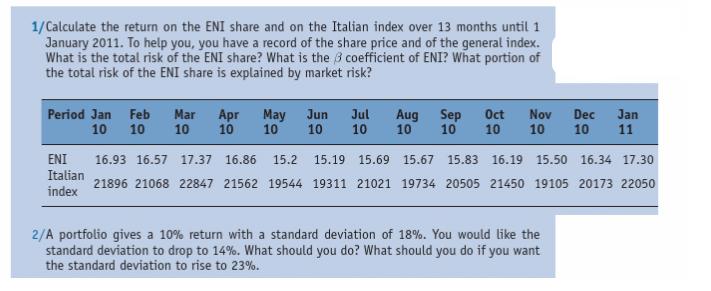

1/Calculate the return on the ENI share and on the Italian index over 13 months until 1 January 2011. To help you, you have

1/Calculate the return on the ENI share and on the Italian index over 13 months until 1 January 2011. To help you, you have a record of the share price and of the general index. What is the total risk of the ENI share? What is the 3 coefficient of ENI? What portion of the total risk of the ENI share is explained by market risk? Period Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan 10 10 10 10 10 10 10 10 10 10 10 10 11 ENI Italian index 16.93 16.57 17.37 16.86 15.2 15.19 15.69 15.67 15.83 16.19 15.50 16.34 17.30 21896 21068 22847 21562 19544 19311 21021 19734 20505 21450 19105 20173 22050 2/A portfolio gives a 10% return with a standard deviation of 18%. You would like the standard deviation to drop to 14%. What should you do? What should you do if you want the standard deviation to rise to 23%.

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the returns on the ENI share and the Italian index over the 13month period until January 1 2011 well follow the provided formula Return Ending Price Beginning Price Beginning Price 100 Fi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started