Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the newly appointed financial analyst at a small business called ABC Electronics. Your first task is to analyze a series of transactions

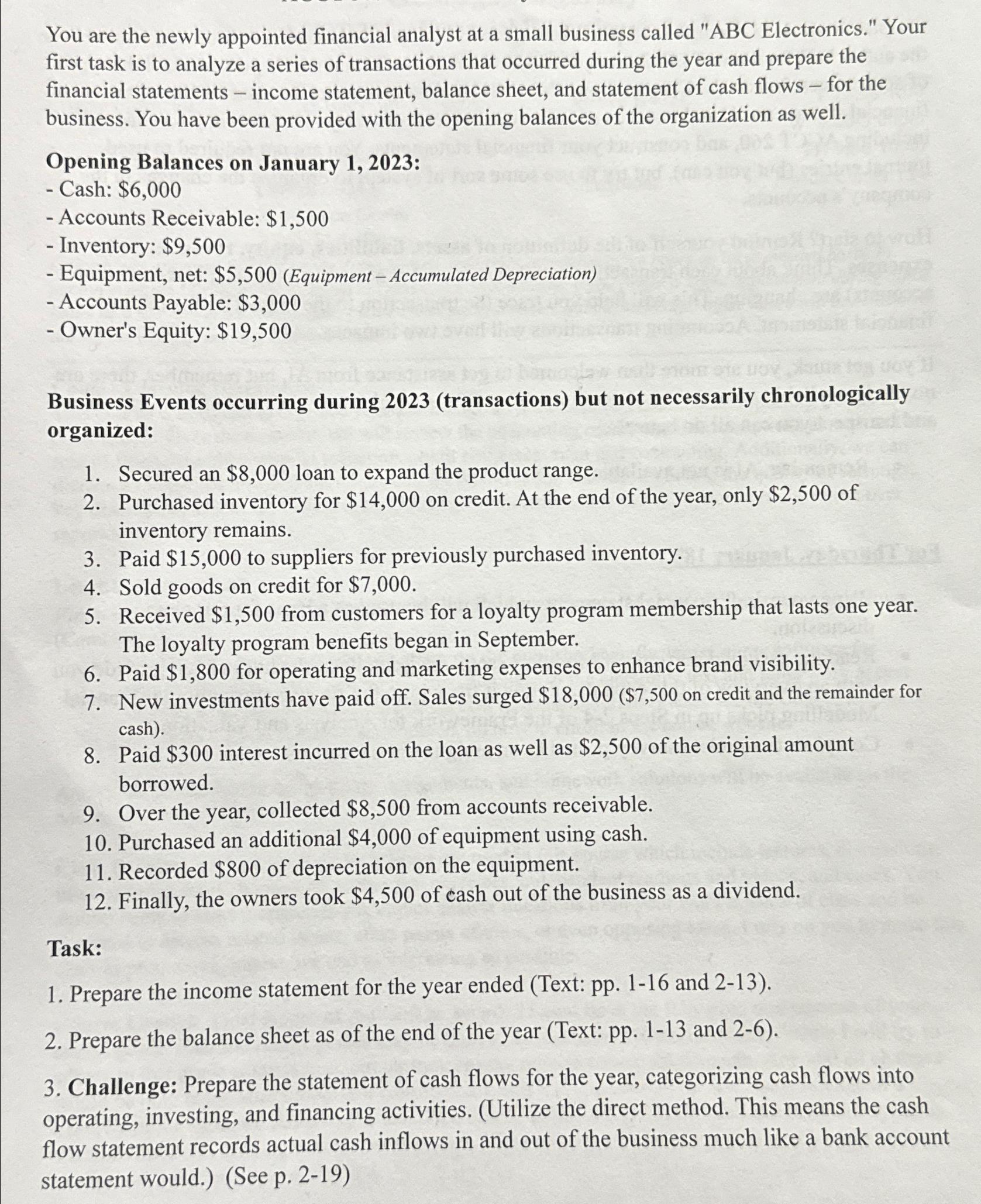

You are the newly appointed financial analyst at a small business called "ABC Electronics." Your first task is to analyze a series of transactions that occurred during the year and prepare the financial statements - income statement, balance sheet, and statement of cash flows for the business. You have been provided with the opening balances of the organization as well. Opening Balances on January 1, 2023: - Cash: $6,000 - Accounts Receivable: $1,500 - Inventory: $9,500 - Equipment, net: $5,500 (Equipment - Accumulated Depreciation) - Accounts Payable: $3,000 - Owner's Equity: $19,500 1 Business Events occurring during 2023 (transactions) but not necessarily chronologically organized: 1. Secured an $8,000 loan to expand the product range. 2. Purchased inventory for $14,000 on credit. At the end of the year, only $2,500 of inventory remains. 3. Paid $15,000 to suppliers for previously purchased inventory. 4. Sold goods on credit for $7,000. 5. Received $1,500 from customers for a loyalty program membership that lasts one year. The loyalty program benefits began in September. 6. Paid $1,800 for operating and marketing expenses to enhance brand visibility. 7. New investments have paid off. Sales surged $18,000 ($7,500 on credit and the remainder for cash). 8. Paid $300 interest incurred on the loan as well as $2,500 of the original amount borrowed. 9. Over the year, collected $8,500 from accounts receivable. 10. Purchased an additional $4,000 of equipment using cash. 11. Recorded $800 of depreciation on the equipment. 12. Finally, the owners took $4,500 of cash out of the business as a dividend. Task: 1. Prepare the income statement for the year ended (Text: pp. 1-16 and 2-13). 2. Prepare the balance sheet as of the end of the year (Text: pp. 1-13 and 2-6). 3. Challenge: Prepare the statement of cash flows for the year, categorizing cash flows into operating, investing, and financing activities. (Utilize the direct method. This means the cash flow statement records actual cash inflows in and out of the business much like a bank account statement would.) (See p. 2-19)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER Income Statement for the Year Ended December 31 2023 Revenue Sales 25500 Expenses Cost of Goo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started