Answered step by step

Verified Expert Solution

Question

1 Approved Answer

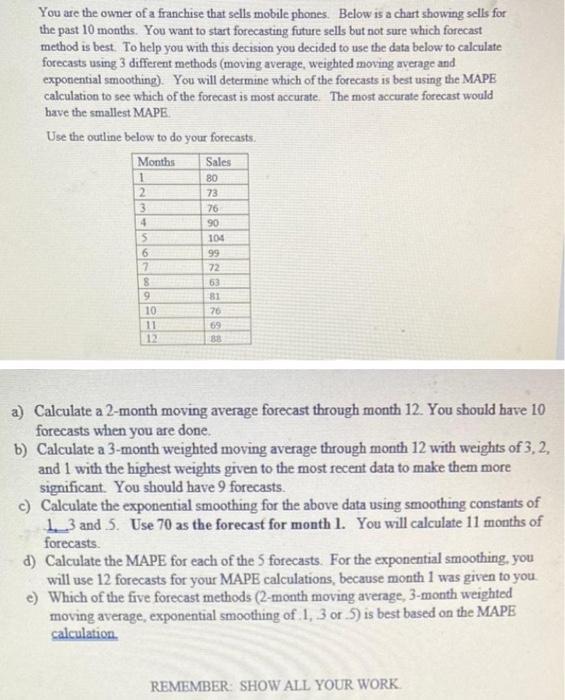

You are the owner of a franchise that sells mobile phones. Below is a chart showing sells for the past 10 months. You want

You are the owner of a franchise that sells mobile phones. Below is a chart showing sells for the past 10 months. You want to start forecasting future sells but not sure which forecast method is best To help you with this decision you decided to use the data below to calculate forecasts using 3 different methods (moving average, weighted moving average and exponential smoothing). You will determine which of the forecasts is best using the MAPE calculation to see which of the forecast is most accurate. The most accurate forecast would have the smallest MAPE. Use the outline below to do your forecasts. Months Sales 80 2. 73 3. 76 4 90 104 99 72 63 9. 81 10 76 1 12 69 88 a) Calculate a 2-month moving average forecast through month 12. You should have 10 forecasts when you are done. b) Calculate a 3-month weighted moving average through month 12 with weights of 3, 2, and 1 with the highest weights given to the most recent data to make them more significant. You should have 9 forecasts. c) Calculate the exponential smoothing for the above data using smoothing constants of 1 3 and 5. Use 70 as the forecast for month 1. You will calculate 11 months of forecasts. d) Calculate the MAPE for each of the 5 forecasts. For the exponential smoothing, you will use 12 forecasts for your MAPE calculations, because month 1 was given to you. e) Which of the five forecast methods (2-month moving average, 3-month weighted moving average, exponential smoothing of 1, 3 or 5) is best based on the MAPE calculation. REMEMBER: SHOW ALL YOUR WORK

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Year Mileage A 2week moving avg F Forecast Error Actual Value Forecast Percentage Error Forecast ErrorActual AFA Absolute Value of Percentage Error 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started