Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the owner of a full-service bookkeeping and auditing firm. A client contacts you about preparing financial statements and explaining the purpose of each

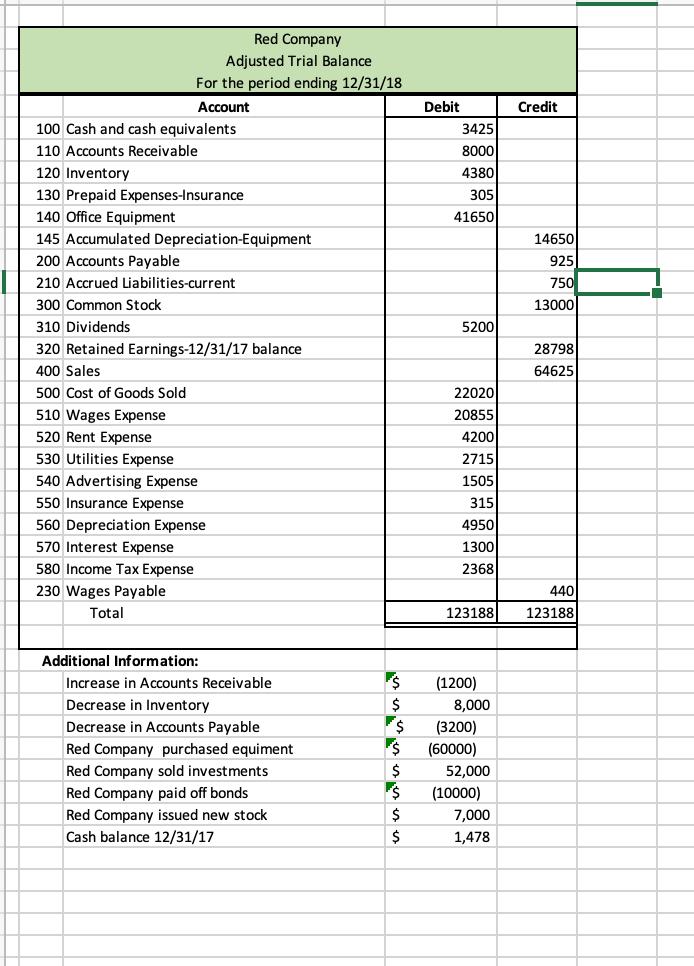

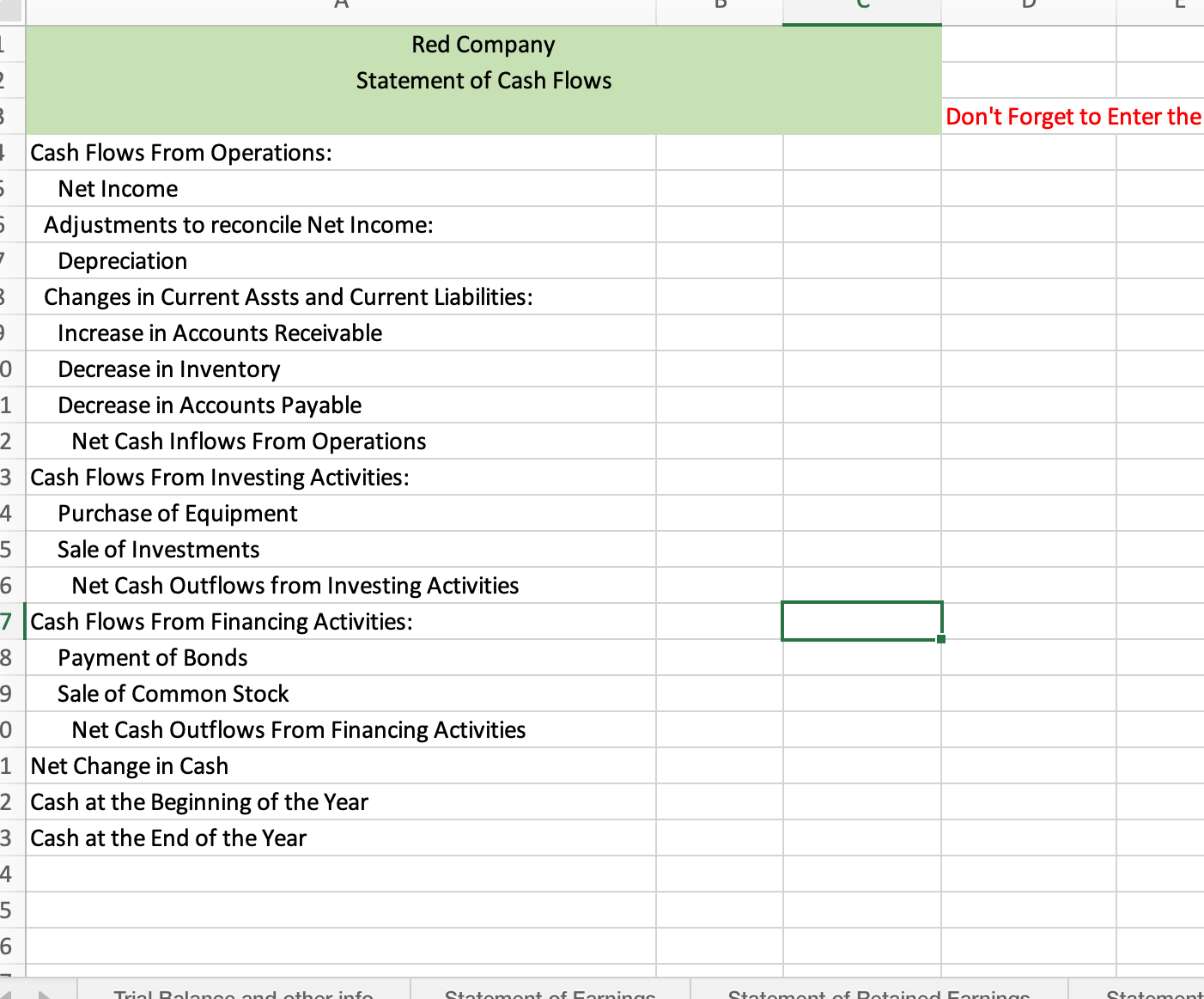

You are the owner of a full-service bookkeeping and auditing firm. A client contacts you about preparing financial statements and explaining the purpose of each statement. The client is endeavoring to attract investors and has to make several presentations of her financials and explanations of the meaning behind the numbers. From printouts of the computerized accounting system, the client has put together the following Excel spreadsheet.

- Complete each of the four statements requested using the attached spreadsheet and professional presentation techniques along with Excel formulas and submit the completed spreadsheet. Be sure to pay particular attention to the grading rubric.

- Prepare a properly formatted Statement of Earnings.

- Prepare a properly formatted Statement of Retained Earnings.

- Prepare a properly formatted Statement of Financial Position. Prepare a properly formatted Statement of Cash Flows

For the period ending 12/31/18 Account 100 Cash and cash equivalents 110 Accounts Receivable 120 Inventory 130 Prepaid Expenses-Insurance 140 Office Equipment 145 Accumulated Depreciation-Equipment 200 Accounts Payable Red Company Adjusted Trial Balance 210 Accrued Liabilities-current 300 Common Stock 310 Dividends 320 Retained Earnings-12/31/17 balance 400 Sales 500 Cost of Goods Sold 510 Wages Expense 520 Rent Expense 530 Utilities Expense 540 Advertising Expense 550 Insurance Expense 560 Depreciation Expense 570 Interest Expense 580 Income Tax Expense 230 Wages Payable Total Additional Information: Increase in Accounts Receivable Decrease in Inventory Decrease in Accounts Payable Red Company purchased equiment Red Company sold investments Red Company paid off bonds Red Company issued new stock Cash balance 12/31/17 $ $ $ $ $ $ $ $ Debit 3425 8000 4380 305 41650 5200 22020 20855 4200 2715 1505 315 4950 1300 2368 123188 (1200) 8,000 (3200) (60000) 52,000 (10000) 7,000 1,478 Credit 14650 925 750 13000 28798 64625 440 123188 18

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To prepare the financial statements lets start by organizing the provided information Based on the data we can create the following tables 1 Adjusted Trial Balance Account Debit Credit 100 Ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started