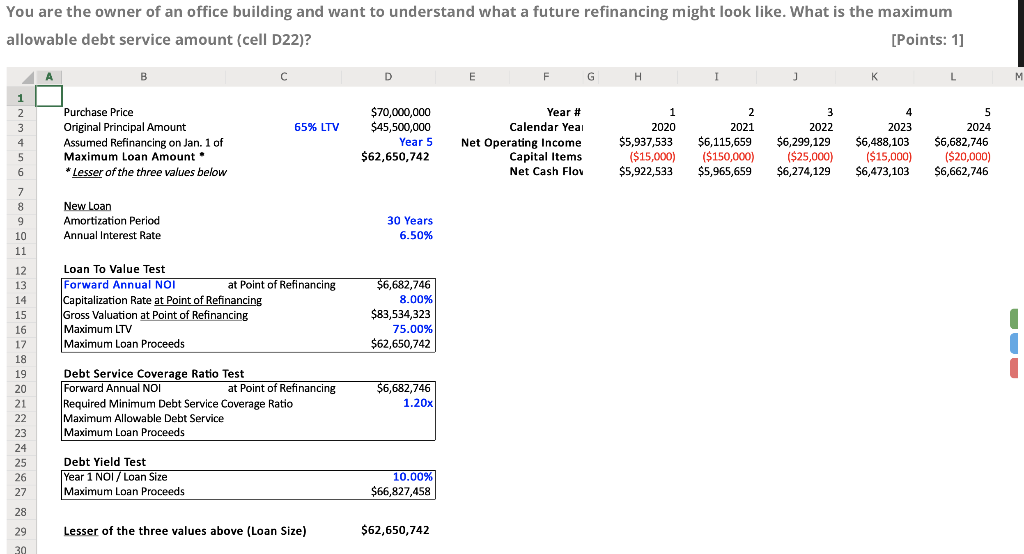

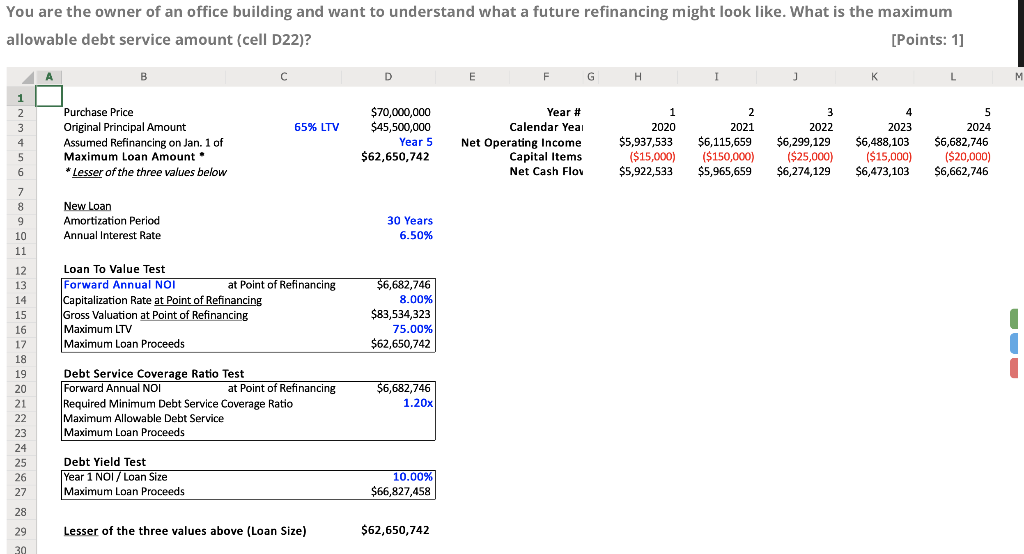

You are the owner of an office building and want to understand what a future refinancing might look like. What is the maximum Points: 1] allowable debt service amount (cell D22)? $70,000,000 $45,500,000 Purchase Price Year # Original Principal Amount Assumed Refinancing on Jan. 1 of Maximum Loan Amount Calendar Yea 65% LTV 2020 2021 2022 2024 $5,937,533 $6,115,659 $6,299,129 $6,488,103 $6,682,746 15,000 150,000) $5,922,533 $5,965,659 $6,274,129 $6,473,103 $6,662,746 Year 5 Net Operating Income Capital Items $62,650,742 ($25,000 ($15,000) $20,000) Lesser of the three values below Net Cash Flov Amortization Period 30 Years Annual Interest Rate 6.50% Loan To Value Test 12 Forward Annual NOI at Point of Refinancing 682,746 13 8.00% apitalization Rate at Point of Refinancing Gross Valuation at Point of Refinancing $83,534,323 15 Maximum LTV 75.00% $62,650,742 Maximum Loan Proceeds Debt Service Coverage Ratio Test 19 at Point of Refinancing 682,746 Forward Annual NOI 20 1.20x 21 Required Minimum Debt Service Coverage Ratio Maximum Allowable Debt Service Maximum Loan Proceeds 23 Debt Yield Test 25 Year 1 NOI Loan Size 10.00% 26 $66,827,458 Maximum Loan Proceeds 27 28 $62,650,742 Lesser of the three values above (Loan Size) 29 You are the owner of an office building and want to understand what a future refinancing might look like. What is the maximum Points: 1] allowable debt service amount (cell D22)? $70,000,000 $45,500,000 Purchase Price Year # Original Principal Amount Assumed Refinancing on Jan. 1 of Maximum Loan Amount Calendar Yea 65% LTV 2020 2021 2022 2024 $5,937,533 $6,115,659 $6,299,129 $6,488,103 $6,682,746 15,000 150,000) $5,922,533 $5,965,659 $6,274,129 $6,473,103 $6,662,746 Year 5 Net Operating Income Capital Items $62,650,742 ($25,000 ($15,000) $20,000) Lesser of the three values below Net Cash Flov Amortization Period 30 Years Annual Interest Rate 6.50% Loan To Value Test 12 Forward Annual NOI at Point of Refinancing 682,746 13 8.00% apitalization Rate at Point of Refinancing Gross Valuation at Point of Refinancing $83,534,323 15 Maximum LTV 75.00% $62,650,742 Maximum Loan Proceeds Debt Service Coverage Ratio Test 19 at Point of Refinancing 682,746 Forward Annual NOI 20 1.20x 21 Required Minimum Debt Service Coverage Ratio Maximum Allowable Debt Service Maximum Loan Proceeds 23 Debt Yield Test 25 Year 1 NOI Loan Size 10.00% 26 $66,827,458 Maximum Loan Proceeds 27 28 $62,650,742 Lesser of the three values above (Loan Size) 29